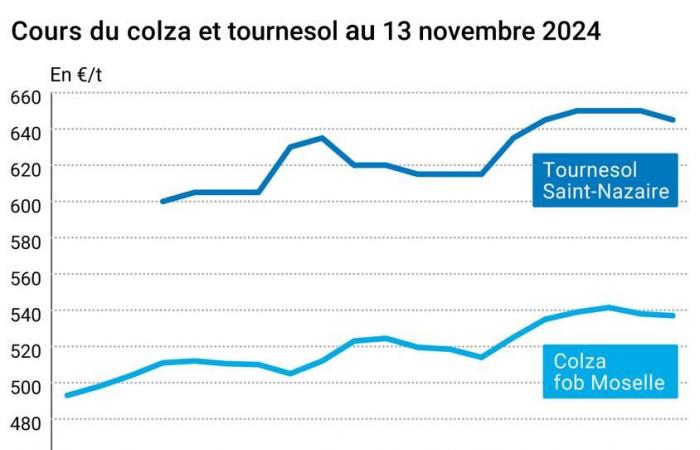

THE prix of rapeseed European markets closed almost stable between November 12 and 13, despite a strong volatility in session. The courses of the main vegetable oils have in fact lost ground in the wake of the palm Malaysiaweighing on the quotations of oilseeds. On the walk French physics, rapeseed prices fell slightly from one day to the next.

To find out everything about agricultural market news, click here

In Kuala Lumpur, theoil of palms ended the session lower, under the pressure of technical sales in view of the high levels of the last few days, and in the wake of other Chinese vegetable oils on Dalian. The slight increase in oil prices in New York and London was not enough to reverse the trend.

The drop was particularly felt on the complex military American, mainly in oil, but also in crab. Seed prices experienced more contrasting developments depending on the maturity date. The trend that is emerging with the future appointment of the Trump administration at the head of the federal environmental agency continues to worry the markets regarding the use ofvegetable oil for the biofuels. We could also expect a decline in imports of used cooking oil, with a drop in demand for biofuels coupled with the implementation of taxes on trade between Chine and the UNITED STATES. Fears are also beginning to arise regarding the Chinese request in soya which could decline somewhat. The public company Cofco has thus revised downwards its soybean import forecast for China for the 2024-2025 campaign, while the figure from the local Ministry of Agriculture is a little below Cofco's forecast. This would be motivated by the state of the Chinese economy. The increase in dollar compared to competing currencies also pushed soybean prices downward, making the US origin less competitive.

On the other hand, the weather report favorable in South America also weighed on soybean prices. In Argentine in particular, the arrival of dry weather after the precipitation recent results should make it possible to maintain the pace of soybean plantings. The Rosario Mercantile Exchange and that of Buenos Aires forecast a soybean sole of between 17.7 and 18.6 Mt. Brazilthe rhythm ofexportation oilcake was sustained through 2024 and the year's total is expected to surpass that of 2023, Reuters reports, citing figures from the National Grain Exporters Association (Anec).

The drop in oil and soybean meal as well as that of palm oil weighed on the prices of canola Canadian, which lost 10 dollars per ton from one session to the next, due to technical sales of investment fundbut also sales from farmers. There is also concern about the possible implementation of import taxes on canola by UNITED STATES after the arrival of Donald Trump in power.

In Bulgaria and in Romaniathe content of sunflower oil is down compared to that observed last year, report Bulgarian analysts from AgroPortal. This poses a risk for the Bulgarian industry triturationthe harvest being low this year throughout the area Black Seaand the country seeing its imports coming fromUkraine drastically reduced due to lack of availability. The crushing capacity in fact amounts to 4 Mt, for a Bulgarian harvest expected at 1.5 Mt, again according to AgroPortal.

The courses of sunflower oleic yields fell €5/t in Saint-Nazaire, while the January-March deadline was not processed in Bordeaux.

To find out everything about the latest news from professionals in the grain sector, click here

Fundamentals:

- Argentina, soy, surface : 17.7 Mha (source: Rosario Mercantile Exchange);

- Argentina, soy, surface : 18.6 Mha (source: Buenos Aires Stock Exchange);

- Argentina, soy, production : 52 to 53 Mt (source: Rosario Stock Exchange);

Commerce international :

- China, soy, imports : 94.5 Mt over 2024-2025 (source: Chinese Ministry of Agriculture);

- China, soy, imports : 98.8 Mt over 2024-2025 (source: Cofco);

- Brazil, soybean meal, exports : 21.12 Mt from January to November 2024 compared to 22.35 Mt in the total for the year 2023 (source: National Association of Cereal Exporters).

European import as of November 10:

(source: European Commission)

| in tonnes | Cumulative 2024/25 | S19 2024/25 | Cumulative 2023/24 | S19 2023/24 |

| Rapeseed (import) | 2 222 119 | 47 727 | 1 926 635 | 150 041 |

French physical markets from November 13, 2024 (July base for cereals)

| Sunflower | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| Bordeaux rendering | oleic Harvest 2024 | Jan-Mar | inc. | ||

| Rendered Saint-Nazaire | oleic Harvest 2024 | Jan-Mar | 645,00 | T | -5,00 |

| Rapeseed | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| Rendering Rouen | Harvest 2024 | Jan-Mar | 535,00 | T | |

| Fob Moselle | Harvest 2024 | Jan-Mar | 537,00 | T | -1,00 |

| Soybean meals | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| Departure Montoir | 48% pellets Brazil | nov. | 372,00 | V | |

| 48% pellets Brazil | dec. | 373,00 | V |

| Then | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| Departure from Marne | forage Harvest 2024 | Nov.-Dec. | 290,00 | N | 0,00 |

| Departure from Somme/Oise | forage Harvest 2024 | Nov.-Dec. | n.p. |

Commercial quotes for dairy products from November 7, 2024

| Milk powder | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| NBPL departure at 30 days 5% H BT bulk | available. | 2420,00 | N |

| Whey powder | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| NBPL departure at 30 days, BILA pH 6 bulk | available. | 855,00 | N |

Evolution dollar / euro du 13 novembre 2024

| Devise | Closing value |

|---|---|

| 1 dollar US | 0,9408 euro |

| 1 euro | 1,0629 dollar |

Chicago Futures Market Closes November 13, 2024

| Raw materials | Fence | Chicago |

|---|---|---|

| Military | 1004,25 | cents/wood. |

| Soybean meals | 291,60 | $/t |

| Soybean oil | 45,18 | cts/livre |

Closing of the Euronext futures market on November 13, 2024

| Colza (Euronext) | |

|---|---|

| Echéance | Fence |

| Feb. 2025 | 535,00 |

| May 2025 | 529,25 |

| August 2025 | 492,50 |

| Volume | 32427 |

| Rapeseed oil (Euronext) | |

|---|---|

| Echéance | Fence |

| Mars 2023 | 698,50 |

| June 2023 | 698,50 |

| Sept. 2023 | 698,50 |

| Volume | 0 |

| Rapeseed meal (Euronext) | |

|---|---|

| Echéance | Fence |

| Mars 2023 | 196,25 |

| June 2023 | 196,25 |

| Sept. 2023 | 196,25 |

| Volume | 0 |

International market quotes from November 13, 2024

| Energy | Echéance | Closing value |

|---|---|---|

| Oil (Nymex) | Dec. 2024 | 68,43 $ |

| Ocean freight indices | from November 13 | Variation |

|---|---|---|

| Baltic Dry Index (BDI) | 1630 | -4,00 |

| Baltic Panamax Index (BPI) | 1208 | 14,00 |

| Baltic Capesize Index (BCI) | 2746 | -7,00 |

| Baltic Supramax Index (BSI) | 1036 | -15,00 |

| Baltic Handysize Index (BHSI) | 693 | -4,00 |