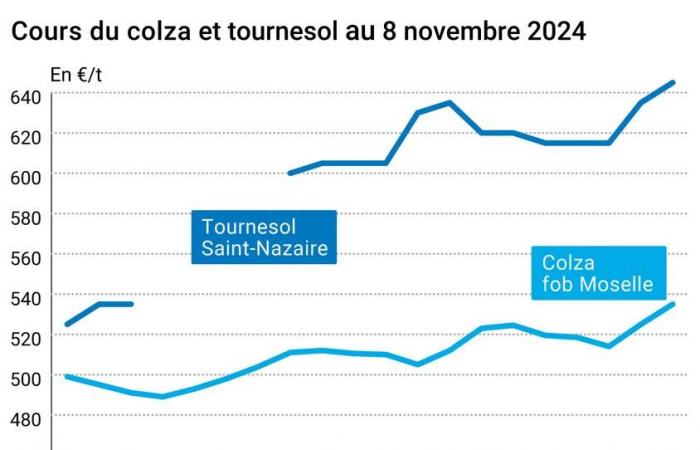

THE prix of rapeseed earned €10/t on Euronext and the walk French physics between November 6 and 7. Rapeseed followed the price movements of the main oilseeds and oils on global trading centers. Note that the prices of oil also progressed, pushing up those of vegetable oils.

To find out everything about agricultural market news, click here

To UNITED STATESthe market expects sustained export activity with the election of Donald Trump as president of the country next January. Uncertainty remains over possible trade tensions with the Chine after his re-election. The appetite of the Middle Kingdom for military is important, and the USDA agricultural attaché in Beijing also expects imports of Chinese soybeans at 104 Mt in the countryside. In the wake of the latest exceptional sales from the United States to China, customs of October show imports of soybeans twice as high as in October 2023. The prospect of Donald Trump’s return to power could also augur taxations on US imports of used cooking oil, stimulating the domestic demand in soybean oil. This remains to be qualified, because the Republican administration could also reduce the use of biofuels.

The prices of canola Canadians also jumped in Winnipeg, in the wake of vegetable oils and others oilseed.

The quotes of theoil of palms continue their rise, while the war in Middle East affects the prices of oil and oils. Furthermore, the phenomenon The Child expected to slow down palm oil production in Southeast Asia. Tensions on other oils (such as sunflower oil following poor harvest in theEuropean Union and in area Black Sea) also support prices, as well as Indian demand. THE stocks of theInde are indeed weaker than usual. But Indian demand may not be sustained in 2024-2025. The Reuters media reports the analysis of SEA India, according to which the imports Indianvegetable oils are expected to decline in 2024-2025. Given the sharp rise in prices, palm oil could even lose market share to the benefit ofsunflower oil. In the United States, the prices ofsoybean oil on the CBOT have also progressed.

The prospects of production for other vegetable oils are however rather positive. The analyst Oléoscope therefore expects a 0.5% increase in global production ofrapeseed oil in 2024-2025 compared to the previous campaign, which should stimulate trade. In Russiathe Tass also predicts a better harvest in rapeseed and soya, partially offsetting the decline in sunflower production. In Romaniathe situation is also complicated in sunflower, and Ukragroconsult expects a 50% decline in exports sunflower, especially towards theEuropean Union.

The prices of sunflower thus followed those of rapeseed on the rise on the French physical markets.

Note that the European regulation on imported deforestation (RDUE) should actually see its application postponed for a year, report our colleagues in Agra. The right group European Parliament would like to postpone its application for two years, and lighten the text.

To find out everything about the latest news from professionals in the grain sector, click here

Fundamentals:

- Russia, rapeseed, production : 4.8 Mt in 2024-2025, compared to 4.2 Mt in 2023-2024 (source: Tass);

- Russia, soy, production : 7 Mt in 2024-2025, compared to 6.8 Mt last year (source: Tass);

- Russia, sunflower, production : 15.85 Mt in 2024-2025, compared to 17.25 Mt in 2023-2024 (source: Tass);

Commerce international :

- China, soy, imports : 104 Mt in 2024-2025 (source: USDA attaché in China);

- China, soy, imports : 8.06 Mt in October 2024 (source: customs);

- United States, soybeans, export sales : 2,037,200 t the week ending October 31 (source: USDA);

- India, vegetable oils, imports : 15 Mt in 2024-2025 (source : SEA India) ;

- India, sunflower oil, imports : 3.5 Mt in 2024-2025, compared to 2.9 Mt in 2023-2024 (source: SEA India);

- World, rapeseed oil, exports : 7.8 Mt in 2024-2025, against 7.4 Mt in 2023-2024 (source: Oléoscope).

French physical markets from November 7, 2024 (July base for cereals)

| Sunflower | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| Bordeaux rendering | oleic Harvest 2024 | Jan-Mar | 645,00 | N | 10,00 |

| Rendered Saint-Nazaire | oleic Harvest 2024 | Jan-Mar | 645,00 | N | 10,00 |

| Rapeseed | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| Rendering Rouen | Harvest 2024 | Jan-Mar | 534,00 | N | 10,00 |

| Fob Moselle | Harvest 2024 | Jan-Mar | 535,00 | N | 10,00 |

| Soybean meals | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| Departure Montoir | 48% pellets Brazil | nov. | 380,00 | V | 4,00 |

| 48% pellets Brazil | dec. | 380,00 | V | 4,00 |

| Then | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| Departure from Marne | forage Harvest 2024 | Nov.-Dec. | 289,00 | N | -1,00 |

| Departure from Somme/Oise | forage Harvest 2024 | Nov.-Dec. | 291,00 | N | -1,00 |

Commercial quotes for dairy products from November 7, 2024

| Milk powder | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| NBPL departure at 30 days 5% H BT bulk | available. | 2420,00 | N |

| Whey powder | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| NBPL departure at 30 days, BILA pH 6 bulk | available. | 855,00 | N |

Evolution dollar / euro du 7 novembre 2024

| Devise | Closing value |

|---|---|

| 1 dollar US | 0,9272 euro |

| 1 euro | 1,0785 dollar |

Chicago Futures Market Closes November 7, 2024

| Raw materials | Fence | Chicago |

|---|---|---|

| Military | 1015,50 | cents/wood. |

| Soybean meals | 298,50 | $/t |

| Soybean oil | 48,32 | cts/livre |

Closing of the Euronext futures market on November 7, 2024

| Colza (Euronext) | |

|---|---|

| Echéance | Fence |

| Feb. 2025 | 532,75 |

| May 2025 | 529,25 |

| August 2025 | 496,00 |

| Volume | 25626 |

| Rapeseed oil (Euronext) | |

|---|---|

| Echéance | Fence |

| Mars 2023 | 698,50 |

| June 2023 | 698,50 |

| Sept. 2023 | 698,50 |

| Volume | 0 |

| Rapeseed meal (Euronext) | |

|---|---|

| Echéance | Fence |

| Mars 2023 | 196,25 |

| June 2023 | 196,25 |

| Sept. 2023 | 196,25 |

| Volume | 0 |

International market quotes from November 7, 2024

| Energy | Echéance | Closing value |

|---|---|---|

| Oil (Nymex) | Dec. 2024 | 72,36 $ |

| Ocean freight indices | from November 6 | Variation |

|---|---|---|

| Baltic Dry Index (BDI) | 1427 | 22,00 |

| Baltic Panamax Index (BPI) | 1185 | -6,00 |

| Baltic Capesize Index (BCI) | 2060 | 93,00 |

| Baltic Supramax Index (BSI) | 1118 | -18,00 |

| Baltic Handysize Index (BHSI) | 707 | -3,00 |