“The growth story of Marsa Morocco is far from over,” say analysts atAttijari Global Research in their latest research on value. Holding a market share of approximately 40% and operating in 24 terminals spread across the Kingdom’s 10 main ports, the company has established itself as a strategic pillar of the national port vision, strengthening its key role in the economic and logistical development of the Morocco.

Marsa Morocco should benefit from the implementation of the port strategy 2030including the development of new latest generation ports such as Safi Grand Vrac, Nador West Med (2027), Kenitra Atlantique (long term) et Dakhla Atlantic (2034). These infrastructures promise to generate additional flows linked to sectors of the future, in particular logistics, green energies and subcontracting.

The national specialist in port operations continues its internationalization as part of its strategy « Mars 2030 »with concrete progress in Africa. In 2024, the company won a contract to manage Terminals 1 and 5 of the port of Cotonou in Benin and signed a partnership to operate in two major ports in Liberia: Buchanan and Monrovia.

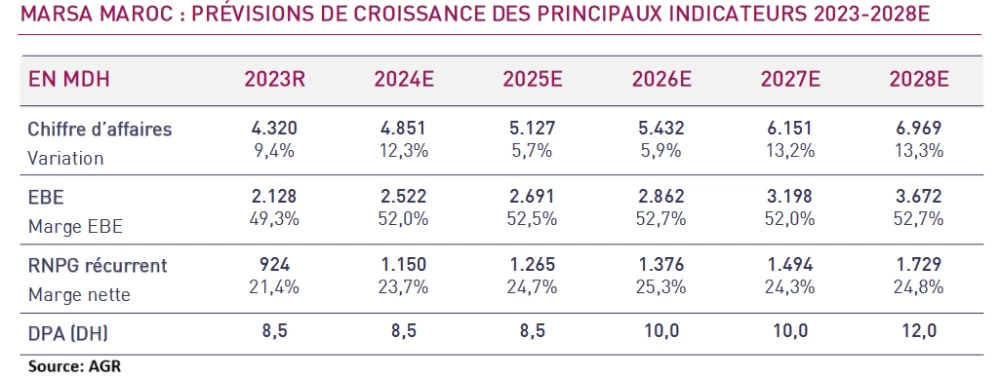

Heading for 1.7 billion dirhams in profits by 2028

AGR forecasts strong momentum for Marsa Morocco over the period 2024-2028, marked by an average annual growth rate (CAGR) of +9.5% of consolidated revenues, reaching 7 billion dirhams in 2028, thanks to the boom in transshipment activity, particularly in Tangier With II et Nador West Medwhich is scheduled to enter service in 2027. Operating profitability is also expected to improve, with gross operating surplus (EBE) estimated at 3.6 billion dirhams in 2028, showing a CAGR of +9.8%. Furthermore, the earning capacity of the group is expected to grow sharply, doubling to reach 1.7 billion dirhams in 2028, compared to 852.2 million in 2023.

Debt under control in the face of large investments

Financing new projects, such as the terminal Nador West Medwill be 70% insured by debt, or around 1 billion dirhams between 2025 and 2027. Despite this, net debt will remain under control at 625 million dirhams on average over the period 2024-2028, with a net gearing of 11, 7% in 2028.

The stock, valued at an earnings multiple (P/E) going from 34.5x in 2024 to 22.9x in 2028, offers attractive potential, reinforced by opportunities not yet integrated into the valuation, such as phase 2 of Nador West Med and future ports like Dakhla Atlantique.

Based on these elements, the research office’s analysts recommend the stock forpurchase for one valuation of 620 DH per sharei.e. a potential increase of 15% compared to the price of November 25, 2024.