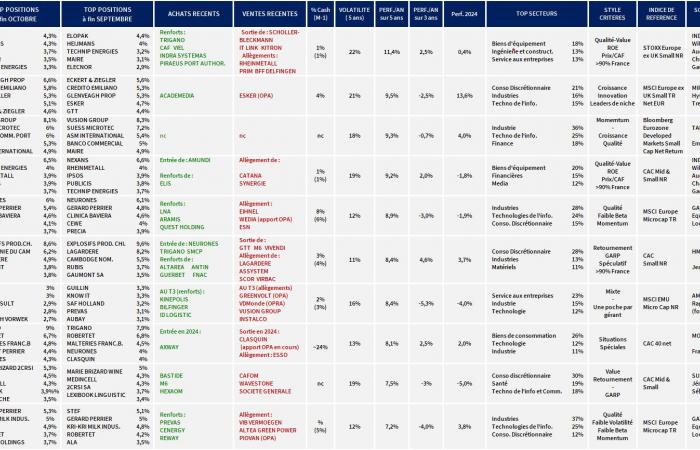

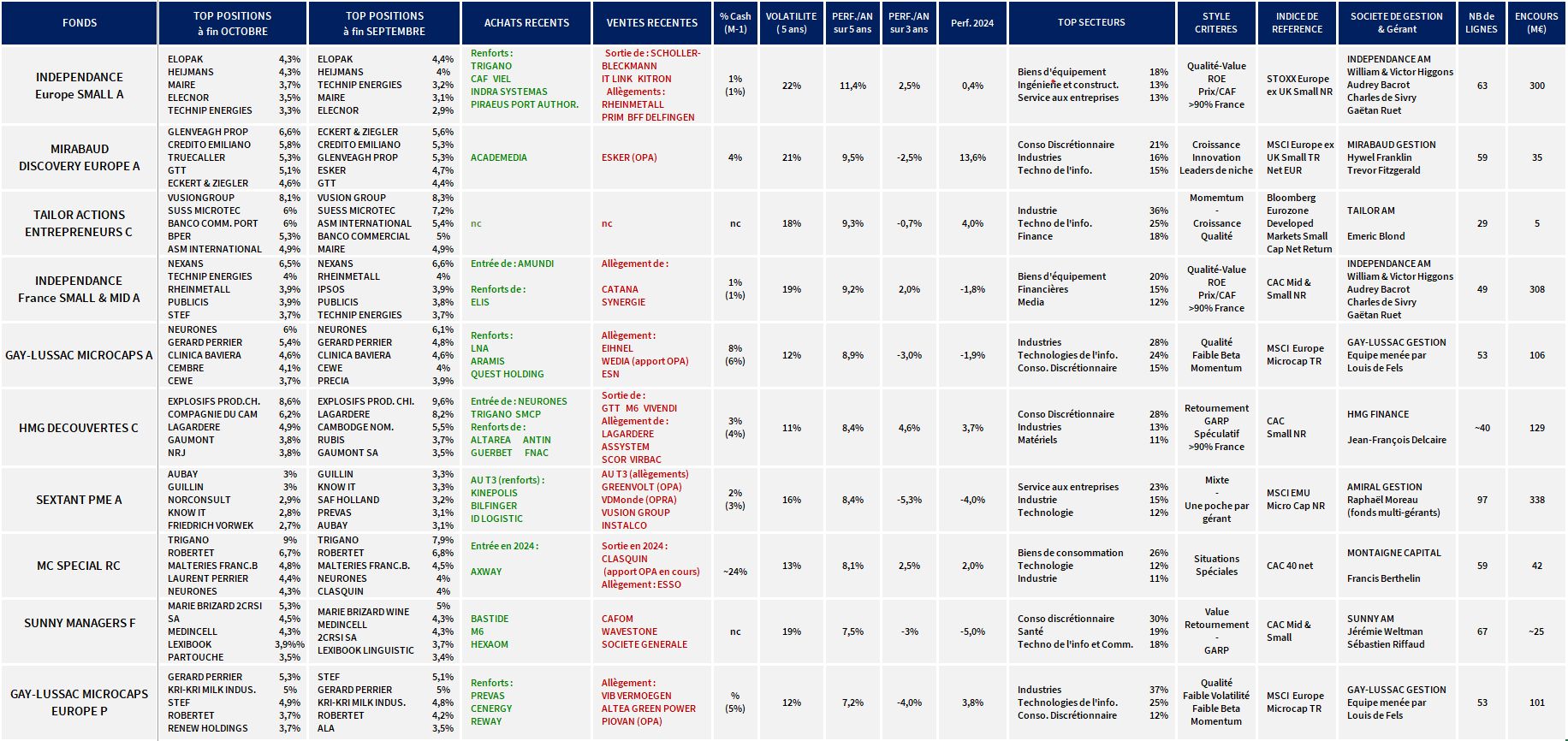

Each month, we examine the monthly activity reports of European small-cap funds (UCIs) and summarize for you in the form of a summary table the latest choices of the best managers. The objective: to help you better select them, better understand their performance, and allow you to easily follow the latest decisions of the best French stock-pickers. And why not take inspiration from it in your own choices of values.

The other decline of small European stocks

Since the beginning of October, the European markets have been poorly oriented, unlike the American market where the results are less mixed and where the prospect and then the election of Donald Trump have excited the business world.

The feeling of economic stalling is particularly strong in France and Germany, while activity is doing better in Southern Europe. In Northern Europe, some signs of recovery were observed in certain sectors such as real estate, against a backdrop of monetary easing. The managers of Amiral Gestion note that “the general level of caution towards the German and French quotes sometimes contaminates certain share prices of companies little affected by the local economy, which can be a source of stockpicking opportunities”.

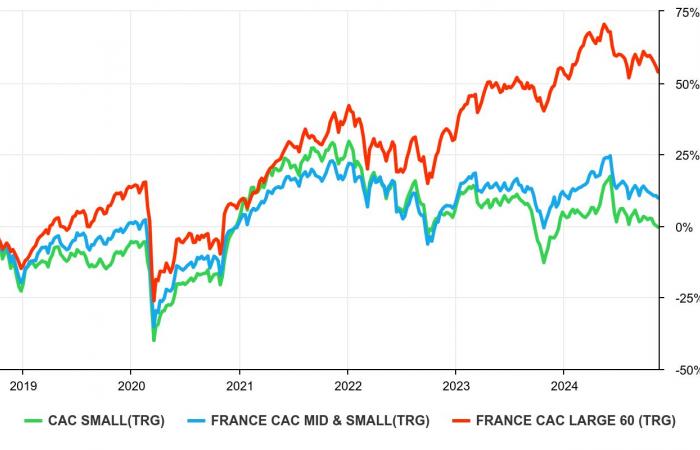

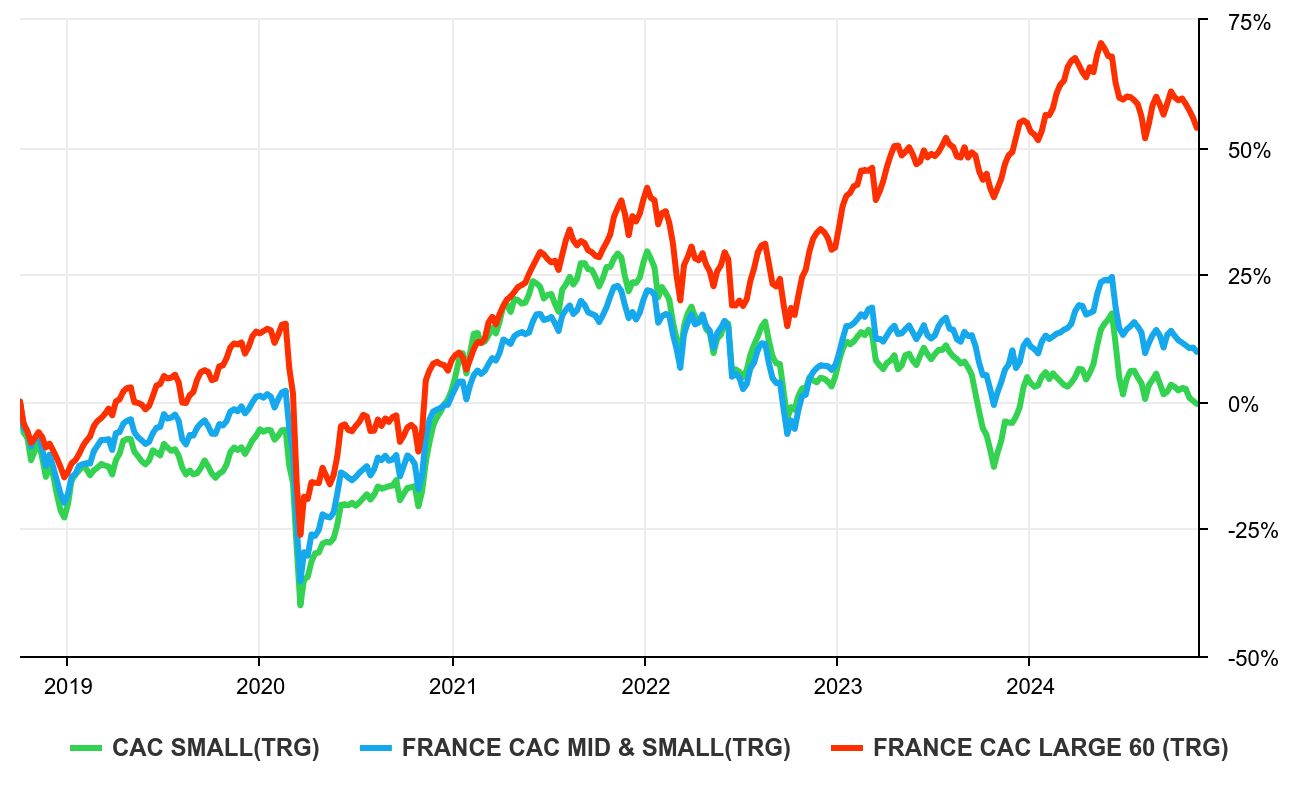

Evolution, dividends included, of French stock indices by capitalization size since 1is October 2024

If small French stocks no longer underperform compared to large stocks, it is a shift away from small American stocks that has taken over. Indeed, the election of Donald Trump caused a surge in the Russell 2000 index representing the valuation of the 2000 capitalizations following the 1000 largest American capitalizations. This index is thus returning to the vicinity of its historic highs and will increase by almost 20% in 2024 while the smallest French capitalizations decline by 5 to 15% depending on the indices used.

In blue, the Russell 2000 index has largely outpaced the CAC Mid 60 index for 3 months

It must be said that in addition to the differentials in economic growth between Europe and the United States, the differences in dynamics in terms of economic and fiscal policy are clearly to America's advantage. Be careful, however, not to throw the baby out with the bathwater: even after revisions to 2024 earnings per share expectations of more than 15% since the start of the year for small French stocks, their median PER on the current year remains around 12x, compared to nearly 30x for the Russell 2000 values…

It turns out that we learned this morning in a press release from the CDC of the launch of a CDC Croissance Selection PME fund with €500 million in order to “support the highly weakened asset class” that constitutes SMEs. Listed ETIs. This fund of funds “will invest selectively in small & mid cap funds in France and the Eurozone”. Around 25 funds will be selected “on the basis of predefined criteria: fund size of around €100-200M, experienced management teams based in France, positive long-term track record, ability to raise funds, etc. A Ultimately, the fund will have indirect exposure to French listed SMEs and mid-caps of around 60 to 80%. An interesting initiative as long as it is carried out intelligently and economically in order to create value at all levels, including the taxpayer.

In terms of financial operations, three more operations have been noted since last month: OPRA on OVH (15% spot premium), OPR on Alpha Mos (19% premium) and on 1000mercis (29%). Note that OPR projects in the Bolloré galaxy face the revocation of the appointment of the independent expert chosen by the initiator. Unprecedented, the AMF therefore listened to the protests of minority shareholders who revealed the existence of a conflict of interest between the initiator and the expert. A new expert will be appointed. Some hope that this will result in an increase in the terms of this operation, which remains to be proven. In the meantime, the prices of the bid targets are trading above the offer prices.

Let's end with this graph of the evolution of French indices according to capitalization size which shows that including dividends, the underperformance of the asset class for 5 years.

Evolution, dividends included, of French stock indices by capitalization size over the past five years

General remarks

(Source: Quantalys, monthly report from management companies)

Generally speaking, we notice that:

- A renewal of the selection with the entry last month of MC Special and this month of Gay-Lussac Microcaps Europe as well as Mirabaud Discovery Europe in place of MCA Entreprendre PME and Idam Small Euro (two funds rich in French microcaps logically impacted by this positioning).

- The funds in the selection showed an average increase of 1.5% at the end of September. However, if we exclude the Mirabaud Discovery Europe fund (+13.6% in 2024), poorly positioned in France and micro-caps, the average performance of the selection is zero.

- Among the files held closely by our selection of funds, we note in particular GTT, Hexaom, Medincell, Vusion Group, Fountaine Pajot, Wavestone, Sword, Aubay, Neurones, Robertet, Trigano, Guillin, Precia, Mersen, Maire Tecnimont, Clinica Baviera, Theon International and Stef.

The latest arbitrations from the pros

- Independence Europe Small a “sold its investments in Schoeller-Bleckmann, IT Link and Kitron. The fund also reduced its positions in Rheinmetall, Prim, BFF and Delfingen. Conversely, Europe Small strengthened its positions in Trigano, Viel, CAF, Indra Sistemas and Piraeus Port Authority. For his part, Independence France Small & Mid “was lighter in Catana, the yachting sector experiencing a sharp slowdown and in Synergie, the absence of dividends is a challenge. It strengthened in Elis, the planned acquisition of Vestis having led to a sharp drop in prices and has formed a new line in Amundi, the valuation is attractive.”

- Gay-Lussac Microcaps evokes a “context still marked by political uncertainty in France and a mixed quarterly publication period. Quest Holdings announced that it had reached an agreement to sell 20% of its mail stake, ACS, to GLS, for the sum of 74M € with a definitive purchase option for 100% of the capital maturing in 2025 and 2026. This sale values ACS at €370M, or more than 60% of the market capitalization of Quest Holdings, for an asset representing only 20% of the group's operating profit. We took advantage of the non-reaction of the stock price following the announcement to strengthen our position. Our visit to an institute. rehabilitation and an EHPAD operated by LNA Santé has reinforced our conviction in this value Beyond its undemanding valuation, we appreciate the group's family governance and its pure operating model. who weighed on the sector in recent years will create external growth opportunities for the group. Regarding Aramis Auto, we believe that the stock is at an inflection point, and that the market is underestimating the potential for significant improvement in profitability and cash generation. On the sales side, we therefore took some profits on some of our ESNs which have performed very well for 1.5 months. We believe that investors have over-reacted to a more optimistic speech on the banking sector, which, in our opinion, does not yet offer sufficient guarantee to fully re-expose themselves to the sector, given the more structural challenges that the latter must face. face. We have slightly trimmed our Einhell line, which has performed well since our initiation and whose outlook appears slightly conservative at this stage. However, the sluggishness of the industry, particularly in Germany, encourages us to slightly reduce our exposure. Finally, we contributed our securities to the offer in Wedia, judging that there is more potential in other heavily discounted names on the French coast.”

- HMG Discoveries fell by 4% in October. We can notably note strengthening of positions in “Altarea (real estate company and developer), in Antin Partners (management of infrastructure funds), in Fnac or in Guerbet to take advantage of the prices that we consider attractive. No less than three new lines have this month joins the portfolio: two stocks that we previously held in HMG Découvertes, Neurones, dare we say it, in our opinion the finest IT consulting company whose positioning allows it to systematically outperform the growth of its market, and Trigano (motorhomes) which reassured about the health of its sector, while its valuation has rarely been so modest. In a slightly more upsetting register, a position was also initiated in SMCP, creator of the brands. of “accessible luxury”: Sandro, Maje, Claudie Pierlot and Fursac, while its activity could rebound and the visibility of its shareholding should soon improve, which would facilitate a change of control, at a price certainly much higher than current prices. In addition to Assystem, reductions were made in Scor (reinsurance), Lagardère, as well as in Virbac (veterinary products), while many lines were sold: in GTT, in Vivendi and M6, and in Française des Jeux now that its dispute is resolved, but that new taxes could penalize its activity.

- Note the integration in the selection of the fund Gay-Lussac Microcaps Europe now that the fund has a 5-year performance history (+7.2%/year). Slightly less efficient than its French equivalent (+8.9%/year) already present in the selection, this fund of small European values invested in France at 22.6% already weighs €101M (vs. €106M for Microcaps) and displays a volatility of 5 years just as low despite a high proportion of industrial stocks (37%). Another sign of Europeanization of the selection: the integration of the fund Mirabaud Discovery Europe A managed from Geneva by Mirabaud AM.

NB: the funds have been selected according to their performance over a long period (we have chosen a duration of 5 years, the duration generally used for investment in equity funds), their volatility and their heavy weighting in small French stocks (minimum 20% of the fund).