Texas is considering creating a strategic Bitcoin reserve, backed by a bill guaranteeing its holding for at least five years to boost innovation and financial security. More and more entities (States, companies) are turning to Bitcoin. Adoption is being felt, particularly on spot Bitcoin ETFs. In fact, BTC does much better than gold on these investment products, and this could allow the price of Bitcoin to continue to increase in value. Here is the newsletter for December 14!

BTC ETFs chain 11 positive days

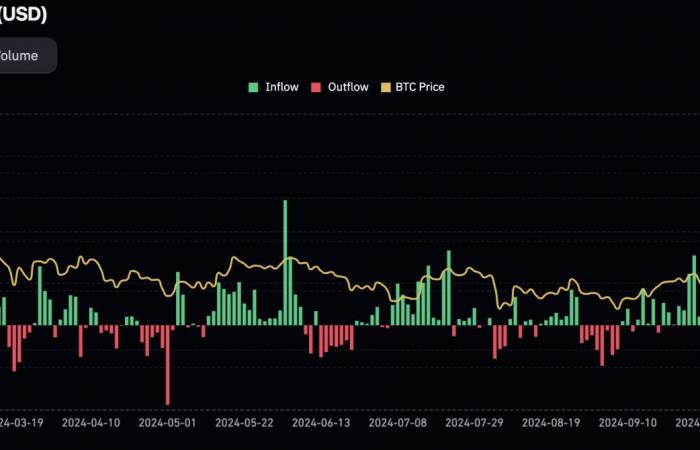

The price of Bitcoin has dropped from 13% on December 5and he still can’t clearly get out of $100,000. And yet, spot Bitcoin ETFs remain on a crazy dynamic since November 27. Indeed, ETFs continue 11 days in the positive and record entries of almost 5 billion dollars :

November was already extremely positive with a total of more than 6 billion dollars in entries. There are therefore approximately two weeks left for the operators to do better than in November. The enthusiasm for ETFs has been significant for several months, and the trend still not weakening as the end of the year approaches.

ETF adoption is much faster on Bitcoin than on gold

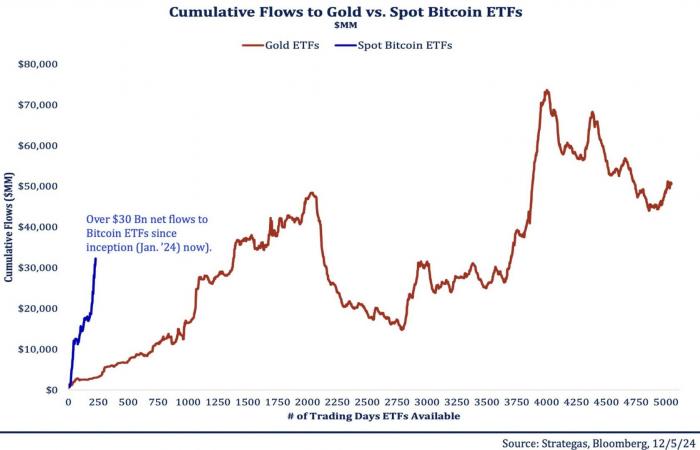

As we have just seen, ETFs record many entries for several weeks, even several months now. And even if the entries were much more mixed between March and September, the launch of ETFs is still exceptional. Moreover, according to Bloomberg data, there were more $30 billion in net inflows since the beginning of the year:

Such figures can be difficult to conceptualize, and the comparison between gold and Bitcoin allows us to understand to what extent this launch is amazing. It took approximately 250 trading days to reach $30 billion on Bitcoin ETFs in cash. Gold, at the time, had taken more than 1,250 trading days to achieve a similar amount. The curve therefore shows a real FOMO from operators who invest in these Bitcoin-related investment vehicles.

Bitcoin Retains Strong Momentum Beyond Bullish Institutional Bias

Since August, these are the buyers who clearly have control over the price. First, the course has broken the bearish trendline and the resistance at $70,000. Then, the course reaches $100,000. On its way, BTC has built a support around $93,000 :

Until today, all returns at the level of institutional bias (EMA 9/EMA 18) bullish allow rebounds. And at trend continues in the days and weeks to come, the price could fly towards $110,000. It will be necessary to keep the support at $93,000 to avoid experiencing a correction. The RSI recorded a bearish divergencebut an excess of 83 would allow maintain upward momentum on a daily basis.

Demand on spot Bitcoin ETFs is extremely high. It far exceeds that known for gold in its early days. From a technical point of view, the price is still bullish, and as long as $93,000 is held, a new upward phase seems possible. After the bullish explosion of BTC, is it Ethereum’s turn? Some experts believe that ETH could go for $5,000.

BITCOIN NEWS THAT COUNTS

- The price of Bitcoin is following the 2021 cycle. It could therefore reach $150,000 according to an on-chain indicator.