Growing interest in BTC – The cryptocurrency market appears to be in a bull run with Bitcoin continuing to rise above $90,000. Moreover, the recent rise in Bitcoin has generated unprecedented enthusiasm since the end of the 2021 bull run according to Google Trends data.

At the same time, the price of Bitcoin also recorded a new ATH against gold. Is the king of cryptocurrencies ready to go much higher? For this to happen, the dollar would have to weaken. Let’s go to the Macro Point!

Bitcoin Price Could Fall Towards Bullish Institutional Bias At $85,000

End of the bullish madness on the price of Bitcoin? This week, the king of cryptocurrencies began a retracement. BTC records a drop of around 9% from top local beyond $99,000. Note that the collapse caused numerous liquidations buyers. But if red is never a pleasure to see, the decline remains almost imperceptible on the time unit 3 days. Taking a step back, the fall is far from catastrophic.

If the decline has only just begun, the price could return to the level of institutional bias (EMA 9/EMA 18) bullish. The moving averages are located around the 85 000 $ Currently. They could act as dynamic support to go get the 100 00 $. If this is not the case, the course could tumble more sharply towards $70,000.

The RSI momentum indicator continues toevolve upwards et without indicating shortness of breath. Momentum is with the bulls at the moment.

Risk off: Bitcoin outperforms gold, but the dollar does not weaken

The strength of the dollar could worry cryptocurrencies

The dollar index (DXY) is moving upwards since the end of September. While the course was in a put away for several monthsthe election of Donald Trump as the new president of the United States has boosted the dollar. And the course is currently trying to break the row :

If the trend continues and the range is indeed brokenthe DXY could continue to climbing towards the final highs of 2022. However, seeing such a powerful DXY is clearly not not positive for the cryptocurrency sector. When the DXY is powerful, cryptocurrencies have more difficulty expressing themselves. This is why the price would have to fall and it would back in the range. Recall that when the DXY began its ascension in 2022cryptocurrencies came into bear market.

RSI attempts break of the bearish trendline in place since 2022. Here again, it would be necessary to weakening of the RSI with a return below the trendline.

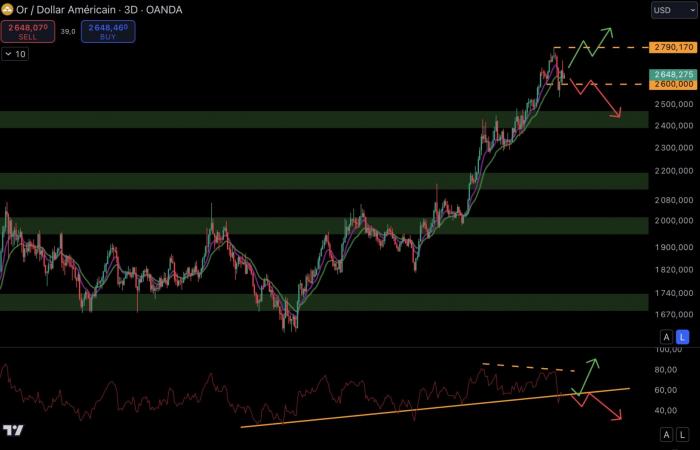

Local top on gold?

Gold is a popular asset for investors looking to limit their exposure to risk. Since the beginning of the year, the course has offered increase of around 35%. But the price of gold could pausewith a course that has struggling to exceed $2,800 :

In fact, the course sent a bearish signal with the drop below $2,600. It will be necessary to fence beyond the 2 790 $ to be able to find a dynamic with rising lows and highs. For this, the course must bounce back from the bullish institutional bias. Otherwise, the course could correct towards the next strong support at $2,400. The RSI has validated a bearish divergencewhich indicates a certain running out of steam on the part of buyers. A loss of bullish trendline could show that the sellers regain momentum.

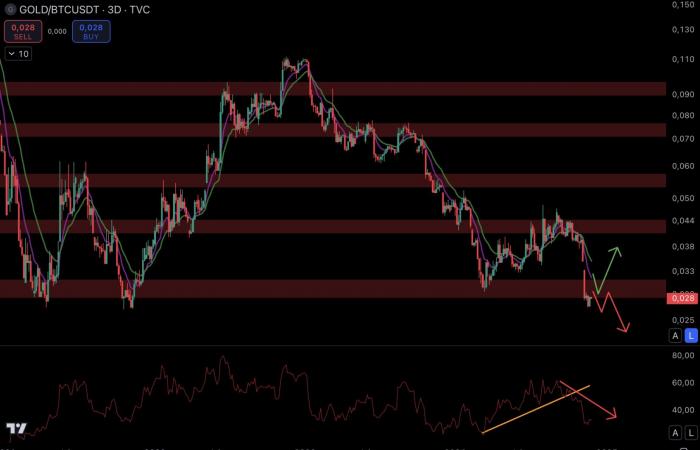

As we said in the introduction to this article, the Bitcoin recorded an ATH against gold. But we can also say that thegold validates a historic low against Bitcoin :

Since the end of 2022, the Bitcoin surperforme l’ordespite an exceptional year for the global store of value. This shows even more to what extent the Bitcoin is strong currently. For the trend to continue, the price will have to be throw back on the resistance in the coming days. At the same time, the momentum is bearish.

US indices remain strong

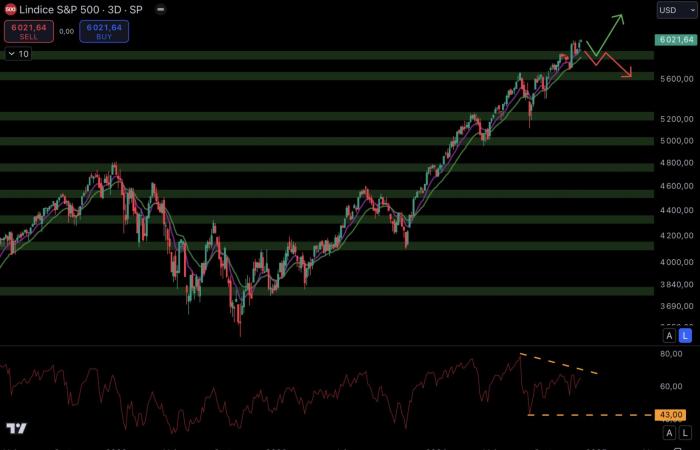

The S&P 500 continues its rise by bouncing off the support at $5,850

The course of S&P 500 is clearly bullish since the end of 2022, as it has a series of ascending troughs and peaks. Recently, the course has bounced back on bullish institutional bias and on the support at $5,850. He also recorded a new all-time high against the dollar :

As long as the support is preservedthe probabilities are oriented towards a new increase on the side of the S&P 500. On the other hand, if the price slides under the supporthe could find the support at $5,650. THE buyers have control over the price until proven otherwise.

For its part, the RSI is in the process of divergebut validation will only be done in the event of close below last low at 43. In this case, the momentum would be less strong. To maintain a a solid momentit will be necessary surpass the last peak.

NASDAQ bounces off support at $20,300

Like the S&P 500, the NASDAQ sets new highs since the end of 2022. The price is clearly bullish, and the bounce off support at $20,300 allowed the course to once again record a all-time high :

As long as the price moves beyond the 20 300 $ and moving averages 9 and 18 bullishit has the possibility of recording new ATHs. On the other hand, in the case where the course loses supporthe could end up on the next support located at around $18,300. The momentum is still bullish with an RSI beyond the bullish trendline. However, a fall below the trendline could validate a bearish divergence.

Key elements to remember

Despite the slight decline recorded over the past few days, the price of Bitcoin is still bullish. A telling sign of BTC’s current strength is its ability to continue to outperform gold. Despite everything, we note that the dollar is still not weakening. If the dollar does not weaken in the coming days or weeks, cryptocurrencies could end up showing difficulties. The stock market is doing relatively well with the NASDAQ and the S&P 500 continuing to move upwards and hitting a series of historic highs.

Will the strength of Bitcoin allow the artificial intelligence (AI) sector to take off? The sector has been trending significantly upwards since the end of October.