The market is always right, they say. Regarding the American presidential election, investors had clearly bet on Donald Trump, via a series of operations quickly identified as “Trump Trades”. Known for his pro-business policies and economic patriotism, Trump is committed to tirelessly promoting the interests of the United States and its leading businesses. This perspective, aligned with his “America First” vision, was quickly integrated by the markets, testifying to the considerable influence of presidential policies on the global economy.

Elected on the night of November 5 to 6, the markets did not wait for the opening to rise. This general increase in the market is not linked to the fact that the elected candidate is Republican (this is less important than it seems) but is more due to the fact that the situation is known, and therefore predictable. We know that uncertainty is one of the great enemies of the investor. Our clue trio S&P 500, Dow Joneset Nasdaq 100 posted an increase the day following the election of +2.53%, +3.57%, and +2.74% respectively. It should be noted that the Russell 2000often considered a barometer of American domestic stocks, also benefited from this trend by gaining 5.84% post-elections, reinforced by the Fed's rate reduction of 25 basis points which occurred two days after the elections.

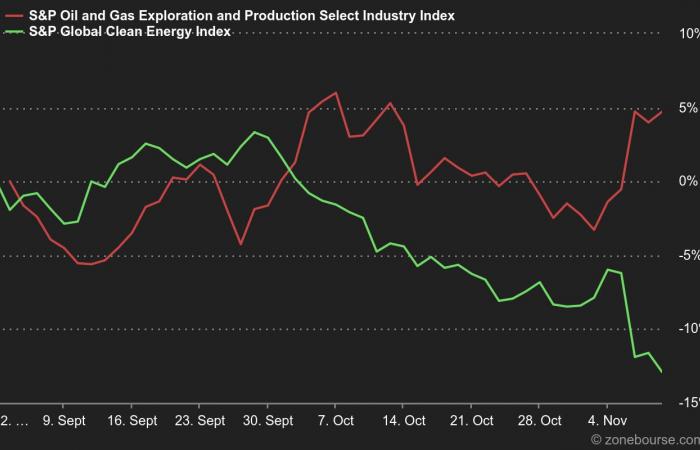

However, the election of Trump really had a very big impact on certain sectors, which tells us a lot about the political agenda of the future American president. Firstly, with its policy of deregulation and reduction of corporate taxes, the Trump administration intends to pave the way for increased exploitation of American soil. This initiative aims to stimulate fossil fuels while green energies, often dependent on state subsidies, are relegated to the background (notably wind power and photovoltaics). Thus, the index S&P Global Clean Energy lost 6.08% post-election where the S&P Oil & Gas Exploration & Production Select Industry gained 5.30%.

The prospects of deregulation for U.S. banks have sparked growing optimism in markets, reminiscent of the upward trend seen after the 2016 election, when bank stocks rose 20%. The anticipation of more lenient regulations, potentially favorable to mergers, is all the more expected as management changes are planned in the main federal regulatory agencies (SEC, FDIC, OCC, CFPB). The repercussions on bank stocks are already perceptible, with notable post-election increases for Citigroup (+8,42 %), Goldman Sachs (+13,10 %), Bank of America (+8,43 %), JPMorgan Chase (+11,54 %) et Morgan Stanley (+11.61%). It took no less for the S&P 500 Banks Index take 10.68%.

The isolationist orientation of the United States, which has strengthened under the Trump presidency, has particular implications for the defense sector. Indeed, President Trump plans to reduce the distribution of weapons and military equipment, especially to Ukraine and Israel. In the context of his re-election, we can still anticipate an increase in military budgets, which would represent an increase in government orders. Additionally, rising tensions with China could also lead to increased investment in cybersecurity and advanced military technology. THE S&P Aerospace & Defense Select Industry grew by 3.84% the day after the elections. Note the performance of Curtiss-Wright (+4.74%) position of our USA portfolio, and Hey there (+3.31%) recently entered Warren Buffet's portfolio.

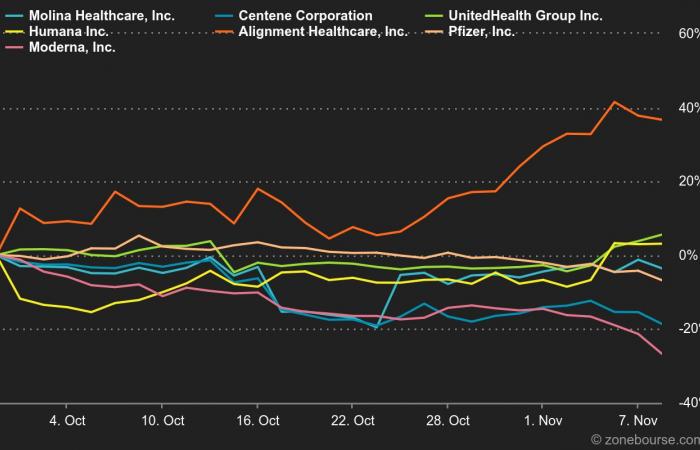

Finally, the healthcare industry is bracing for significant reforms under the Trump administration, with a likely overhaul of Medicaid and an uncertain future for Affordable Care Act (ACA) subsidies, which are not expected to be renewed. These changes could adversely impact businesses linked to these government programs such as Molina Healthcare (-2.16%) or Hundreds (-3.46%). At the same time, this shift towards privatization could increase the need for private coverage. This could benefit health insurers like UnitedHealth Group (+5,23 %), Humana (+10.71%), or Alignment Healthcare (+6.55%). Trump is also considering reforms to federal health agencies like the NIH, following criticism from Republicans over their handling of the pandemic. This could prove negative for Pfizer (-2,25 %) et Modern (-2.78%), who are already involved in legal disputes.

Note that actions in the area of detention and expulsion, such as GEO Group et CoreCivicmade a spectacular jump of 42% and 29% respectively after the elections, followed by a second increase of 13.63% and 25.60% the day after. These stock market movements reflect investors' anticipation of the very strict policy on detention and expulsion.

Finally, how can we not mention Trump Mediathe president's social network, whose price showed an increase of 5.94% after his victory only to be quickly overtaken by reality and lose 22.96% the next day. Elon Musk, Trump's new lieutenant, can boast of seeing Tesla take 14.75% after the elections. Our fervent crypto fans will also be happy to see the Bitcoin jumping 8.86% after the Republican candidate's victory, which made cryptocurrencies a subject of less regulatory concern, suggesting a potentially more favorable environment for their development and integration into the traditional financial system.