The dollar-yen pair remains near critical levels as traders weigh policy divergences between the Fed and BOJ amid rising intervention risks and record Japanese budget approval.

Key Market Statistics:

- Current price: 157.55

- Highest in 2024: 158.08 (December)

- Weekly variation: +0.8%

- Performance since the start of the year: +10%

- Key level: 160 (intervention risk zone)

- Range after OBJ meeting: 153.34-158.08

Dynamics of BOJ policy

Recent notices from the BOJ meeting reveal mixed views on the timing of the rate hike, with some members saying conditions are ripe for a near-term move, while others advocate patience given the uncertainties surrounding the policies of future President Trump. New central bank profit estimates show potential losses of up to $13 billion under a 2% rate scenario, highlighting the challenges of policy normalization.

Political and fiscal landscape

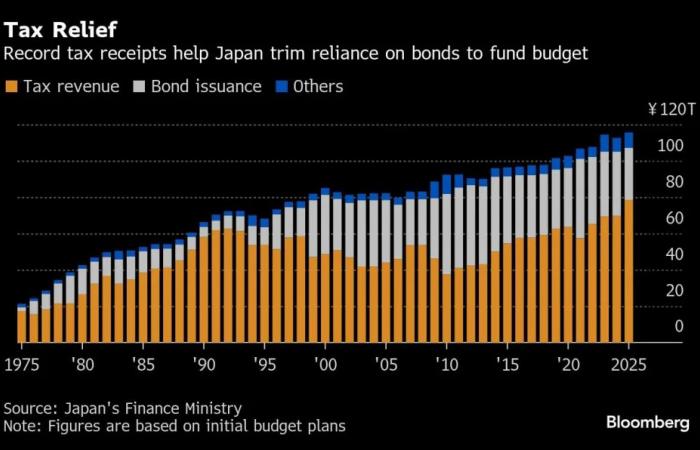

The approval of Japan’s record 115.5 trillion yen budget for fiscal 2025 poses a key test for Prime Minister Ishiba’s minority government. The 2.6% increase in spending, combined with a reduction in bond issuance, reflects fiscal consolidation efforts. However, political uncertainty related to the adoption of the budget could influence the BOJ’s decision on interest rates in January.

Source: Bloomberg

Risk of intervention

Finance Minister Kato’s new warnings against excessive currency movements have heightened speculation of intervention as the USD/JPY parity approaches 160. The recent surge to five-month highs has prompted increased official rhetoric, although the actual intervention thresholds remain uncertain.

Outlook for 2025

While the markets currently assess the probability of an increase in the Bank of Japan’s key rate at 42% in January and at 72% in March, this trajectory remains highly dependent on the evolution of wages and the clarity of American politics. The interplay between monetary normalization, political stability and currency market dynamics portends continued volatility, with 160 as the key psychological risk and intervention level.

USDJPY (Intervals D1)

The USDJPY pair is approaching the highs of 157-158 reached in late April, a level that has already led to intervention in the foreign exchange market. Following this intervention, USDJPY pulled back to the 50-day EMA, suggesting that for bears the target could be around 153.167.

Bulls, on the other hand, could aim for a retest of all-time highs in the 160-161 zone. The RSI is consolidating near the overbought zone, which has always been a sign of further upside before a potential correction. Furthermore, the MACD continues to advance but is narrowing, indicating that momentum may be fading. Source: xStation

“This content is a marketing communication within the meaning of Article 24(3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/ 92/EC and Directive 2011/61/EU (MiFID II) The marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy. within the meaning of Regulation (EU) No. 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (Market Abuse Regulation) and repealing Directive 2003/6 / EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Delegated Regulation (EU) 2016/958 of the Commission of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council as regards regulatory technical standards relating to technical arrangements for the objective presentation of investment recommendations or ‘other information recommending or suggesting an investment strategy and for the disclosure of special interests or indications of conflicts of interest or any other advice, including in the field of investment advice, within the meaning of Article L321-1 of the Monetary and Financial Code. All information, analyzes and training provided are provided for informational purposes only and should not be interpreted as advice, a recommendation, a solicitation for investment or an inducement to buy or sell financial products. XTB cannot be held responsible for the use made of it and the resulting consequences, the final investor remaining the sole decision-maker regarding the position taken on their XTB trading account. Any use of the information mentioned, and in this regard any decision taken in relation to a possible purchase or sale of CFDs, is the exclusive responsibility of the final investor. It is strictly prohibited to reproduce or distribute all or part of this information for commercial or private purposes. Past performance is not necessarily indicative of future results, and anyone acting on such information does so entirely at their own risk. CFDs are complex instruments and carry a high risk of rapid loss of capital due to leverage. 74% of retail investor accounts lose money when trading CFDs with this provider. You need to make sure that you understand how CFDs work and that you can afford to take the likely risk of losing your money. With the Limited Risk Account, the risk of losses is limited to the capital invested.”

Belgium