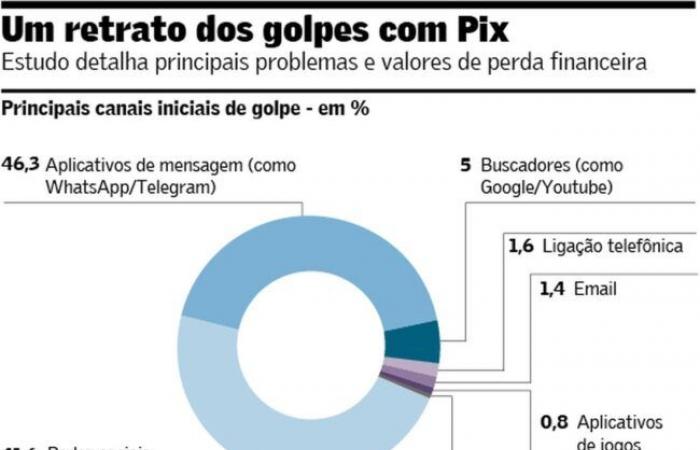

Almost 90% of Pix scams start on messaging apps (WhatsApp or Telegram) or on social networks (such as Instagram and Facebook), while the most frequent scam tactic is offering a product, store service or fake profile ( 44.9% of cases). The data is part of the “Scams with Pix” study, carried out by the digital financial protection company Silverguard based on information from 5,000 reports from victims at the Central SOS Golpe and data from the Central Bank based on the Access to Information Law.

in advance of Valorthe research shows that there are differences in the occurrence of these origins and tactics according to age group and income class, in addition to the average amount lost in the scam.

If on average among people who sought the SOS Golpe service, 46.3% of scams started on messaging apps, this share is 71.7% among those aged 60 and over and 32.6% among those with less age. 18 years old. On the other hand, 56% of fraud reported by young people under the age of 18 started on social networks, for an average of 41.6% in the population and a rate of just 13.3% among the elderly.

Artificial intelligence will be fuel for new scams, every innovation has its dark side”

— Marcia Netto

Founder of Silverguard, Marcia Netto states that fraud is not explained by flaws in the instant payments system, but says that the advancement of digitalization in financial transactions facilitates the occurrence of scams in which the victim themselves transfers the money to the fraudster, driven by some convincing story, so-called social engineering.” In English, they are “authorized push payment fraud” (APP).

“Pix is not the villain. There were already TED and bill scams before. But Pix currently represents 45% of financial transactions and the country has many fintechs and banks”, he says.

Marketing leader at Silverguard, Layla Vallias believes that the effort to reduce fraud should also involve “big tech” and not just financial institutions, as messaging applications and social networks are used in these cases.

“Other countries, such as the United Kingdom, have a more advanced regulatory environment, which forces banks to share the losses. These are initiatives that touch the ecosystem’s pocket,” says Netto.

In the sample of 5 thousand people in the research, the average value of the scams was R$2,100. The higher the income class, the greater the amount lost: in classes AB the amount is R$6,300; followed by R$3,500 in class C and R$1,500 in classes D and E.

In the lower income classes, the most common types of scams are those involving false employment or extra income. In classes AB there are more cases of multiplication of false money/investment; false loan and request for treatment for an acquaintance.

Based on data obtained from the Central Bank, the research shows a 47% increase in the number of requests for the Special Return Mechanism (MED), which went from 1.7 million in 2022 to 2.5 million in 2023. The tool allows request that the amount be blocked in the destination account in case of suspected fraud.

Despite the increase in requests, the mechanism is still little known. Of the fraud victims interviewed in the study, 68% had never heard of MED; 27% knew it existed, but not how it worked; and only 5% knew the tool and how to use it.

The founder of Silverguard attributes part of the lack of knowledge to the lack of disclosure and people's refusal to accept the possibility of falling for scams. Another barrier is the use of language by victims and the lack of adequate training in financial institutions. People often use the word “dispute” but stumble over the fact that they transferred the money.

“The best thing is for the victim to say that they fell for a scam and say that they need the money back to increase the chance of the bank opening the MED”, she says.

Given the creativity of scammers, Netto is already considering possible new fronts of fraud, such as artificial intelligence in the shadows (“dark AI”). Cases of videos of public people are a reality, but she sees a chance for a new wave with personalized images, of relatives or friends.

“Artificial intelligence will be fuel for new scams, every innovation has its dark side. And fraud is always becoming more sophisticated. First it starts with a 'deep fake' of famous people, but we see a path towards more targeted frauds”, he states.