Bitcoin (BTC) has had a banner year, recently hitting an all-time high of $108,268. The rise is largely attributed to optimism surrounding more crypto-friendly policy under President Donald Trump, as well as speculation about the possibility of a strategic Bitcoin reserve.

However, the cryptocurrency market remains split, with investors navigating between optimistic institutional interest and less encouraging macroeconomic signals.

These mixed signals have sparked speculation across the market, leaving investors uncertain about where Bitcoin, the world's leading cryptocurrency, might be headed by 2025.

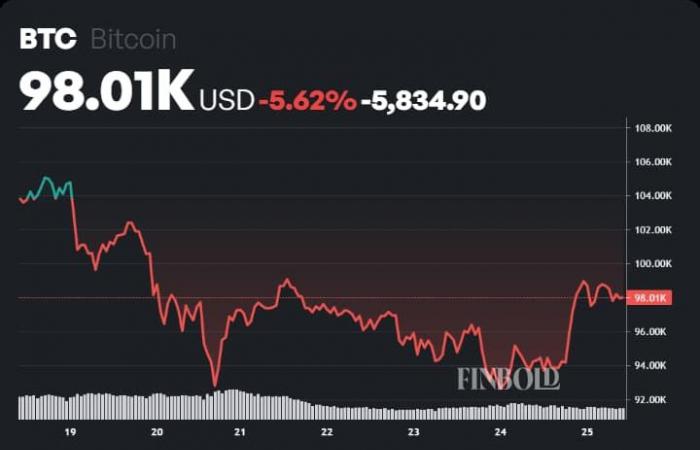

At the time of writing, Bitcoin is trading at $98,015, down 5% over the past week. On a monthly chart, Bitcoin shows a modest gain of 0.05%, highlighting continued market volatility.

Conflicting market signals

Institutional players like MARA Holdings (NASDAQ: MARA) and Riot Platforms continue to expand their Bitcoin holdings, demonstrating long-term confidence in the asset.

For its part, MicroStrategy (NASDAQ: MSTR) made its seventh consecutive week of Bitcoin acquisitions, purchasing 5,262 BTC at an average price of $106,662, for a total investment of $561 million.

Adding to this optimism, billionaire investor Ray Dalio recently described Bitcoin as a hedge against a looming “debt money problem,” solidifying its place as a global financial asset alongside gold.

Despite these positive developments, downward pressures emerged following accommodative statements from the US Federal Reserve, following its decision on December 17 to reduce interest rates by 25 basis points.

Comments from Fed Chairman Jerome Powell regarding Bitcoin reserves also dampened market enthusiasm, briefly pushing Bitcoin below the $100,000 mark. The Fed's forecast of only two rate cuts in 2025, below market expectations for three or four reductions, is also raising concerns among investors.

Institutional demand vs miner production

The gap between institutional demand and limited supply of Bitcoin is becoming increasingly evident. Over the past week, Bitcoin exchange-traded funds (ETFs) saw inflows of $423.6 million, the equivalent of 4,349 BTC.

In contrast, miners only produced 2,250 BTC during the same period. This gap highlights increasingly tight liquidity, with miners struggling to meet growing institutional demand. In December alone, $5.5 billion in inflows were seen into Bitcoin ETFs, bolstering institutional confidence in the cryptocurrency.

On the supply side, the pressure is even more evident. According to data from CryptoQuant, the total amount of Bitcoin available for sale—via exchanges, miners, and OTC desks—has fallen to 3.397 million BTC, a drop of 678,000 BTC since the start of the year.

This level marks the lowest since October 2020. Additionally, the liquidity inventory ratio, which measures the number of months of demand that current sales inventory can support, fell to just 6.6 months, compared to 41 months as of early October, with no signs of a slowdown in demand.

Bitcoin price forecast according to ChatGPT

ChatGPT predicts that Bitcoin could reach $200,000 by 2025, supported by historical trends and current market dynamics.

Key drivers of this forecast include growing institutional adoption, limited supply after the recent halving, and sustained flows into Bitcoin ETFs. These factors are expected to fuel long-term demand despite possible market turbulence.

This projection joins that of Bitwise, which anticipates that Bitcoin will exceed $200,000, and could even reach $500,000, in connection with the possibility of a federal Bitcoin reserve.

Standard Chartered also maintains a target of $200,000, highlighting robust institutional interest, while VanEck offers a slightly more conservative estimate of $180,000, however warning of increased volatility throughout the year.

Although the details differ, the general consensus points towards an optimistic outlook for Bitcoin in 2025, while taking into account a likely pattern of market fluctuations.

Featured image via Shutterstock

It is interesting to note that the cryptocurrency market continues to operate in an uncertain environment. As institutional players show growing confidence, fluctuations in demand and supply raise questions about the sustainability of this trend. How will investors adapt to these challenges in the years to come?

Our editors use AI to help them deliver fresh items from trusted sources to our users. If you find any image or content that is inappropriate, please contact us via DMCA form and we will promptly remove it. / Our editors use AI to help them offer our readers fresh articles from reliable sources. If you find an image or content inappropriate, please contact us via the DMCA form and we’ll remove it promptly.

- -