The two golds. Although they are more complementary as opposites, physical gold and the new digital gold that is Bitcoin (BTC)are both perceived as protections against the continued depreciation of state fiat currencies (such as the dollar and the euro). There valuation of the young reserve asset Bitcoin is progressing however much faster than that of the precious metal.

- The value of a single bitcoin has surpassed 41 ounces of gold, marking a new all-time high against the precious metal.

- Bitcoin spot ETFs have surpassed gold ETFs in terms of assets under management in the United States, despite their much newer existence.

At the end of November 2024, with the upward explosion in the price of Bitcoin following the election of Donald Trump to the presidency of the United States, cryptocurrency had already hits new ATH against gold. The previous record dated back to November 2021that is to say at the top of the previous bull run the Bitcoin.

But this December 17, 2024, it’s happening again: the value of a bitcoin has once again marked a record against the ounce of gold (approximately 31.1 grams of pure metal). A single BTC thus exceeded the 41 onces d’or that day.

It must be said that it was also the day that Bitcoin marked its new ATH against the US Dollarwith a BTC even briefly exceeding $108,000. But it is not only in terms of pure valuation that digital gold has done better than gold metal, as we will see.

Young BTC Spot ETFs Already Beat Gold ETFs

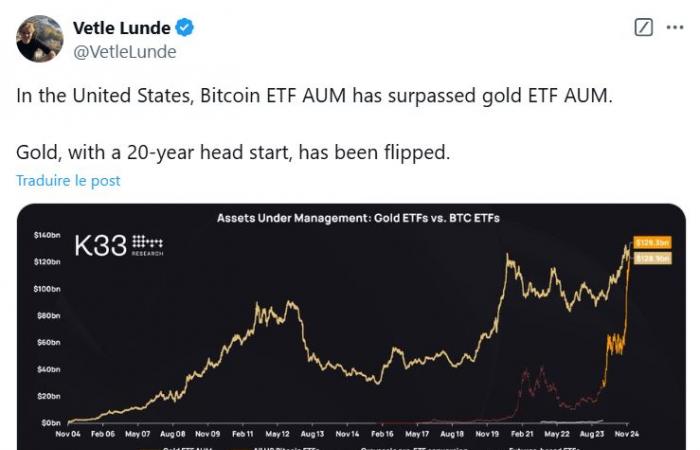

Indeed, according to Vetle Lundethe chief analyst of the Norwegian brokerage company K33despite the 20 years of listing of the XAU ETF (on gold therefore) in the United States, these have just been overtaken by young spot Bitcoin ETFlisted since January 11, 2024 only.

Indeed, the total assets under management (AUM) held by the issuers of the BTC ETFs spot operated a flippening with those based on the precious metal. BlackRock, Fidelity and other issuers of Bitcoin exchange-traded funds thus held $129.3 billion in BTC on the date of the analysis of K33, against $128.9 billion gold for ETFs gold.

“In the United States, assets under management of Bitcoin ETFs have exceeded those of ETFs gold.

Gold, which was 20 years ahead, has been overtaken. »Vetle Lunde

Bitcoin and gold are successful as reserves of valuebecause many investors, like the billionaire Ray Dalio, believe that these two assets will protect against future economic crises. But young digital gold definitely seems to have the more the wind is in its sails than metallic gold, especially since the arrival of BTC ETFs.