Juliette and Nicolas (the first names have been changed at their request), 37 years old, a couple since 2011, opened a joint account in 2019 when they bought their apartment in Hauts-de-Seine. They already had two children. “Until then, we vaguely divided the expenses but it seemed simpler to pay the monthly mortgage payment into a joint account”testifies Juliette.

This communications business manager and her husband, a doctor, fund this account 50-50 through transfers made from their personal account. “This distribution corresponded more or less to our income until recently, but I earned a little less than Nicolas this year, we will have to see how to take this into account”continues Juliette.

This couple explains that they see no difficulty in talking about money. Yet, “the subject is hyper-taboo. Often, we let ourselves live without thinking of putting the situation back on track when both people’s incomes have evolved”deplores Julie Perrin, financial education manager at Crésus.

Interview | Nicole Prieur, family therapist: “You have to dare to talk about money as a couple”

Read later

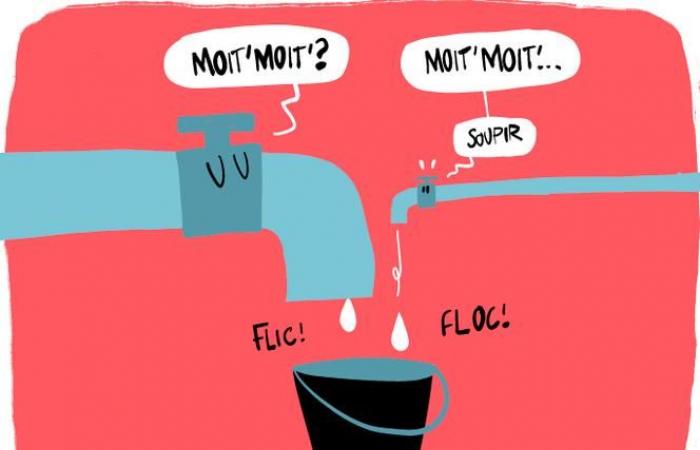

Whether you are married, in a civil partnership or in a common-law union, the joint account makes daily money management easier. “It’s generally when we move in together that the need arises, to pay rent, groceries, pool mobile plans, etc. »notes Anne-Claire Bennevault, founder of the financial education platform SPAK. She advises always keeping a personal account.

You have 74.71% of this article left to read. The rest is reserved for subscribers.

Business

France