The S&P 500 (^GSPC 0.24%) shows an increase of 28% this year, a figure close to triple of its average annual gain since 1957. This trend follows a particularly robust year 2023, during which the index increased by 26%.

These gains propelled the S&P to a relatively expensive valuation, with a price-to-earnings (P/E) ratio of 27.8, far exceeding its historical average of 18.1. This makes the search for values in this market particularly complex.

Currently, technology stocks are leading the way, with a predominance of companies investing in the field of artificial intelligence (AI), which are showing particularly convincing results. This trend is likely to continue in 2025, as some of the world’s largest technology companies plan record spending to build out their AI infrastructure.

Although AI company stocks are among the most expensive on the market, some of them retain potential to outperform the S&P 500 in 2025.

Source de l’image : Getty Images.

There’s still value in big tech

Last year, a Wall Street analyst described a group of large-cap technology stocks, dubbed the “Magnificent Seven,” that propelled the market higher. This group includes Nvidia, Microsoft, Apple, Amazon, Tesla, Alphabet (GOOG -0.01%) (GOOGL 0.05%)et Meta Platforms (META 0.79%).

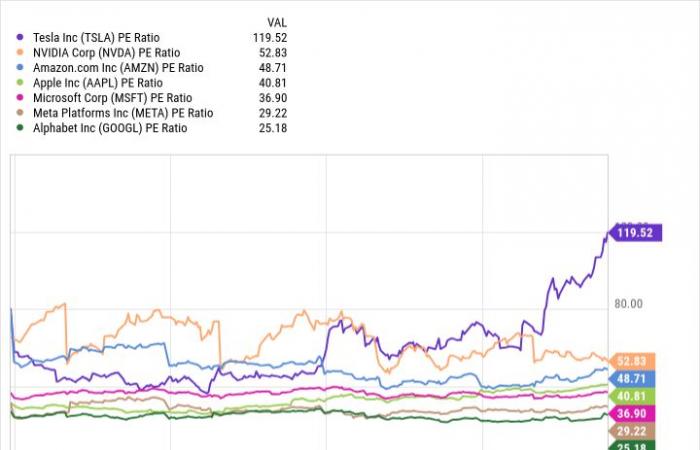

All of these companies are involved in the AI race in one way or another. However, when it comes to value, Alphabet and Meta Platforms stand out for their relatively low P/E ratios:

P/E ratio data provided by YCharts

Here’s why Alphabet and Meta have the potential to outperform the S&P 500 in 2025.

The case of Alphabet

Alphabet, the parent company of Google and YouTube, as well as self-driving car company Waymo, has developed its own line of language models called Gemini, which support an AI chatbot of the same name. These models also power several new AI features in Google Search.

The majority of Alphabet’s revenue comes from advertising on Google Search, which holds 90% of the search engine market. However, its dominance is being challenged by third-party AI chatbots like OpenAI’s ChatGPT, which are transforming the way users access information online.

The Gemini chatbot is Alphabet’s response to these challenges, which also needs to rethink the user experience on Google Search. The company launched “AI Overviews” earlier this year, AI-generated answers that appear at the top of traditional search results. These previews may include text, images and links to third-party sites to provide quick access to information. This feature is currently deployed in 100 countries, reaching one billion monthly users.

These links receive more clicks than in traditional search results, which could become a significant revenue driver for Alphabet. Monetization is expected to be an area of development in 2025, with investors seeking to recoup the billions invested by companies like Alphabet in the development of AI.

However, a dark cloud hangs over Alphabet: the United States Department of Justice (DOJ) won a major court case this year, ruling that the company practices monopolistic methods to maintain its dominant position in the search industry Internet.

The decision on Alphabet’s sanction will be made in mid-2025. The DOJ is asking the company to sell its Chrome browser, and perhaps even its Android operating system, in order to diminish the distribution channels used to maintain Google Search’s market share. These measures may harm Alphabet, but it is possible that the company will only receive a fine.

Many analysts believe this case could remain in court for years while Alphabet appeals. In the meantime, it appears that the company will continue operations as normal, much to the benefit of investors who may focus on its initiatives in the AI sector.

Wall Street forecasts (published by Yahoo) suggest that Alphabet will reach record revenues and profits in 2025. I am not claiming that its stock will align with the average P/E ratio of the “Great Seven”, which is 50.4, but even if it comes close to the Nasdaq-100’s 34.9, that would imply a potential upside of 38% from its current level, which would probably be enough to outperform the S&P 500 in 2025.

The case of Meta Platforms

Shares of Meta Platforms have surged nearly 80% this year, but they remain less expensive than most of the actions of the Magnificent Seven. I think the company will continue this momentum in 2025, particularly thanks to its AI efforts.

Content feeds on Meta’s social networks, Facebook and Instagram, are increasingly powered by AI. Users typically spend more time on these platforms if Meta can show them more posts they like, which translates into more ads and more revenue for the company. In Q3 2024, CEO Mark Zuckerberg reported that AI-based recommendations led to an 8% increase in user time on Facebook and a 6% increase on Instagram.

Meta also launched an assistant called Meta AI last year, which is now available in all of the company’s apps. This assistant can answer complex questions, generate images, suggest ideas for fun activities with friends, and even resolve debates in group chats. Currently, it has over 500 million monthly active users, and although it is free, monetization opportunities could emerge in the future. For example, businesses could pay to include a product link in Meta AI’s answers to relevant questions.

Meta AI is based on Llama, a family of language models developed in-house. Being open source, a multitude of developers can review the code, allowing for rapid identification of bugs and improvements. To date, Llama has been downloaded more than 600 million times, making it the most popular family of open source LLMs in the world.

Meta plans to launch Llama 4 next year, which Zuckerberg hopes will become the most powerful in the industry. The company plans to invest up to $40 billion in AI data center infrastructure this year to develop enough computing capacity to make Llama 4 operational. Simply put, larger LLMs equal better AI software, and Meta hopes these investments will pay off in the long term through new revenue opportunities thanks to features like Meta AI.

Despite Meta’s stock’s strong performance this year, its price still needs to increase by 19.5% for its current P/E ratio of 29.2 to reach that of 34.9 seen for the Nasdaq-100. Wall Street also expects Meta’s earnings per share to grow 12% in 2025, which could create further upside prospects for its stock value. Thus, it appears to be a prime candidate to outperform the S&P 500 next year.

Our editors use AI to help them deliver fresh items from trusted sources to our users. If you find any image or content that is inappropriate, please contact us via DMCA form and we will promptly remove it. / Our editors use AI to help them offer our readers fresh articles from reliable sources. If you find an image or content inappropriate, please contact us via the DMCA form and we’ll remove it promptly.

- -