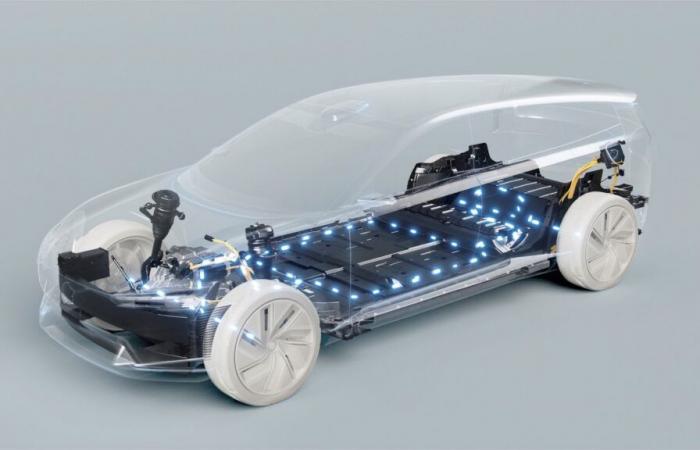

In recent months, the financial difficulties of automobile equipment manufacturers have unfortunately materialized in numerous bankruptcy filings and bankruptcies. Among them, At the beginning of October, we learned that the Swedish electric battery giant Northvolt had filed for bankruptcy of its subsidiary responsible for the development of its giant factory in Skelleftea, Sweden. And barely more than a month after announcing several thousand job cuts. It must be said that BMW canceled a large contract last June relating to battery cells worth 2 billion euros. And, unfortunately, above the one that represented one of the most important hopes in an electric vehicle battery market largely dominated by China, the sky is only getting darker every day.

First a CEO who steps down…

Thus, this Thursday, November 21, the Swede placed itself under the American bankruptcy protection regime, the famous “Chapter 11”, while the company’s debt is abysmal: $5.84 billion, the equivalent of approximately 5.58 billion euros. By entering into receivership, the company retains the hope of raising its head and perhaps being able to receive new financing. But if the company made it clear right away that this was not a “bankruptcy procedure”, but rather a “reorganization”, everything seems to be going from bad to worse. With, the day after this procedure, on November 22, CEO Peter Carlsson resigned. If the man who co-founded Northvolt remains a member of the board of directors, he explained to journalists a few days ago that, to reestablish the activity, Northvolt must now raise between 1 and 1.2 billion dollars. Good luck to the successor – CFO Pia Aaltonen-Forsell.

…and now the largest shareholder(s)

And we didn’t have to wait long to see that the Northvolt house of cards collapsed further. Indeed, we learned that the main shareholder of the Scandinavian start-up, which is none other than Volkswagen, with up to 21% of the shares, has drastically reduced its stake. Which has nothing to do with the recent problems of the automobile giant, since this has happened gradually over the last two years. From 1.4 billion euros in 2022, it would have fallen to 693 million in 2023. A value which fell in 2024, according to sources close to the matter cited by Reuters. And the other investors are withdrawing one after the other. According to the Financial Times, citing letters sent to investors, funds managed by Goldman Sachs, Northvolt’s second largest investor (19.2%), would reduce their stake of $900 million in the company to zero. here at the end of the year. Several investment funds (the Swedish AMF and the Scottish Billie Gifford) had also reduced their participation.

Bad signal for electrical

When we think that not so long ago, an IPO of Northvolt had been considered, and thata valuation of around 20 billion dollars was planned, we better realize the collapse of the start-up. And above all to what extent investors could be increasingly cautious about financing projects linked to the energy transition. Enough to put a little more lead in the wing of electric, whose sales are still struggling to take off.