The older we get, the more wealth we have. It's logical and this phenomenon corresponds to the cycles of life. But the figures have evolved significantly over the last few decades. We are not getting rich at the same rate or at the same ages as twenty or thirty years ago.

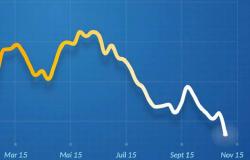

Published in October, the latest INSEE report on the income and assets of the French recalls that household assets reached their maximum at age 55 in 1998 and subsequently decreased. Naturally with sudden increases over the years, when the household bought its main residence, for example, or when it received a donation. Twelve years later, in 2010, the wealth peak was no longer reached at 55 but at 60, before decreasing more rapidly than before. And this gap has further accentuated in 2021 since household wealth only begins to decrease from the age of 75. There are several reasons for this phenomenon…

The standard of living of retirees and the elderly was rather modest in the 70s and 80s. They therefore drew on their savings to cover their daily expenses. With the increase in pensions, the poverty rate is now lower among retirees than among workers. They can therefore preserve their assets until a later age.

Another factor linked to the increase in lifespan: households today inherit later than in previous decades. The level of heritage is therefore well preserved thanks to the transmission of wealth. Inheritances that have a real impact on the standard of living and heritage of the French. According to the INSEE report, households that have inherited have, on average, almost twice as much gross wealth as households that have never inherited.

Conversely, 75 years is also an average age from which, in general, high expenses linked to dependency emerge which affect many retirees. We are thinking in particular of accommodation costs in nursing homes, which can gradually erode the savings and assets of elderly people over the years. As for seniors who continue to live at home, they often have to bear other costs, such as those for housing adaptation work or home help for meals, cleaning, toileting, etc.

Schematically, we can therefore say that in the past, household wealth began to decrease from the age of 50, whereas today it is stable from 50 to 75 years of age, and then decreases. Sometimes quickly due to the significant costs generated by dependency fees.

In this context, it is therefore better to take this data into account in long-term asset management, particularly through estate planning. Families must therefore anticipate not only the transmission of their heritage, but also the issues of intergenerational solidarity. With a trade-off to be made – well before the age of 75 – between the need to help one's descendants and the prevention of future dependence.