Carole Baillargeon, 65 years old, has had her yoga school for 30 years. A world-renowned teacher, she still loves teaching. “But I am very tired of running my school: in fact, I am at the end of my rope,” says the woman who gave us an interview from Bali, where she had been invited to teach yoga for a few weeks.

Posted at 1:28 a.m.

Updated at 8:00 a.m.

She would like to sell her school and continue teaching there, in addition to accepting international contracts. But it’s not easy because her school isn’t really profitable and her teachers have other jobs or are also close to retirement, so they don’t want to buy it.

Carole will not have a large government pension and has no savings, but she has a paid-off condo and two small buildings where she has set up her school which will be paid for in two years. “My pension fund is in real estate,” she said. But I don’t want to sell my school buildings or rent them to anyone and see my business disappear. I am attached to the school and its community. »

She thought about asking her teachers to rent the space. “I should calculate the rental price and talk to them about it, but I am overwhelmed on a daily basis,” she explains.

Selling one of the two buildings is also possible. “But will this be enough for my retirement? I don’t know when I’m going to die! And I’m single with no children, so I have no one to leave what I have to. I don’t know what I should do or where to start. »

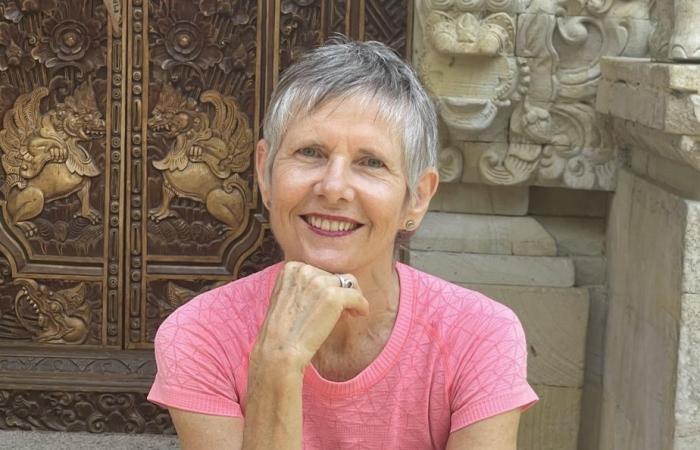

PHOTO PROVIDED BY CAROLE BAILLARGEON

Carole Baillargeon in Bali, where she taught yoga in mid-October.

Draw up a portrait of your situation

In the eyes of Stéphanie Castonguay, senior advisor, Consulting Strategies Team, and financial planner at the National Bank, it is never too late to start taking care of your retirement. The first step for Carole is to draw up a portrait of her situation.

To decide where to go, you have to start by knowing where you are starting from, with figures.

Stéphanie Castonguay, senior advisor, Advisory Strategies Team, and financial planner at the National Bank

Carole would benefit from having her buildings, her condo and her business appraised. Then, you would need to calculate her current annual income, her annual cost of living and see if she has any debts.

“In the process, she will also have every advantage in discussing succession with her team at the yoga school,” says Stéphanie Castonguay. It may also be interesting to look at the competition who might wish to buy your business. »

Carole must also assess her retirement needs, and therefore her basic expenses. “Sometimes, there are things that you don’t think about right away,” says Stéphanie Castonguay, “like renovations that will need to be done to your property, or a car that you will need to buy in a few years. It’s good to discuss your needs with a professional who has a 360 vision.”

Next, Carole will have to name her projects and dreams, then evaluate her retirement income in her current situation. To do this, she will have to check with the Quebec Pension Plan how much she will receive if she applies for her pension now and assess what she will earn as a yoga teacher.

Make a retirement projection

Then comes the moment of truth: the retirement projection. For Simon Préfontaine, financial planner at Lafond Services Financiers, this is a really important step. “Carole has several scenarios in mind, but first she needs to know what will happen if she maintains the status quo. »

Then, she can change different variables, such as selling a building now or in two years. “The results of the different scenarios will help him make his decisions,” says Simon Préfontaine. At the moment, it’s anxiety-inducing because she’s thinking about different unquantified possibilities, therefore without knowing if they are viable. »

He also draws attention to Carole’s wish not to close her school. “I understand that she is attached to it, but if she cannot sell it and her teachers do not want to rent the space, the situation will become untenable,” he says. Their mental and physical health must come first. »

Find cash

Once the future of the school is resolved, Carole will be able to look at the different options to have enough cash flow when she retires.

“We will need to do a personalized analysis to see if, with the income from her teaching, Carole will be able to postpone the application for her government pensions so that they can be improved,” indicates Stéphanie Castonguay. We will also be able to see if she will be eligible for the Guaranteed Income Supplement. This is an important step, because government pensions will be his only guaranteed income for life. »

In addition, Carole will be able to look at reverse mortgage concepts to access the equity in her properties during her lifetime, without selling. Or, she could remortgage a building.

If you don’t have anyone to bequeath your buildings to, it is interesting to look for solutions that allow you to benefit from their value during your lifetime.

Simon Préfontaine, financial planner at Lafond Services Financiers

But one thing is certain, Carole must start by taking some time out to look at her different numerical scenarios and make a decision about her school. “Then,” says Simon Préfontaine, “she will be able to refine her retirement plan. »