A 60% US tariff could reduce Chinese GDP growth by 1.5 percentage points in the first 12 months.

China’s domestic economic landscape has changed significantly since the first US-China trade war in 2018. Former President Donald Trump proposed 60% tariffs on the country if he won. China’s economy is slowing due to a combination of growing global trade protectionism, internal economic pressures and persistent deflationary trends. Despite recent stimulus measures from the People’s Bank of China (PBoC), we believe China is much more vulnerable to high tariffs than it was six years ago. Here, we’ll look at some of the key factors shaping its economy and the potential impact of additional tariffs.

Trade tensions and risks for the export sector

First, let’s look at the historical context of the 2018 trade war. From early 2018 to 2020, the Trump administration sharply increased U.S. tariffs on Chinese goods from 3% to 21% (Source: https:/ /www.piie.com/research/piie-charts/2019/us-china-trade-war-tariffs-date-chart). At the time, strong domestic consumption, a robust real estate market, healthy local finances and an absence of persistent deflationary pressures allowed China to weather the first trade tensions with less severe economic repercussions than many had expected. anticipated.

The prolonged crisis in China’s real estate market is perhaps the biggest change in the economy since 2018.

Today, the economic landscape in China is markedly different. The export sector is now the only bright spot in the Chinese economy, and even that is in danger. Recent US and EU tariff hikes and the threat of further increases cloud the future. Many companies have started moving production out of China to avoid the tariffs, and some Chinese companies have invested overseas to secure their supply chains and diversify their production. Even if the tariff threat subsides, some economic damage seems inevitable, in our view.

The real estate market crisis

The prolonged crisis in China’s real estate market, which began with the default of real estate developer Evergrande in July 2021, is perhaps the biggest change in the economy since 2018. This crisis represents the first prolonged period of significant decline in prices since China established its private real estate market in the late 1990s. With sharply reduced cash flow and profits for property developers, companies are aggressively scaling back construction to cut costs. New housing construction starts are only a third of those in 2019 (Source: National Bureau of Statistics). Given that real estate accounts for around 60% of urban household assets, the decline of China’s real estate market has led to a significant erosion of household wealth, with significant implications for consumer confidence and spending.

Consumer and labor market challenges

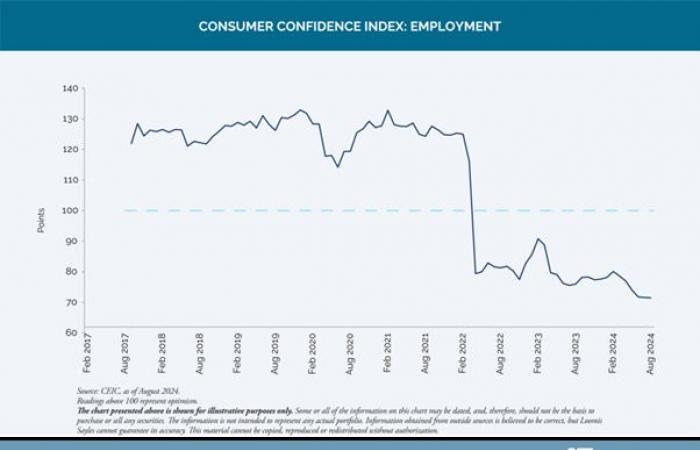

Weakness in the property market has rippled through the Chinese economy, contributing to challenges in consumption and the labor market. Unlike 2018, when consumer confidence was high, China now faces weak labor market conditions and slow growth in household incomes. The PBoC Quarterly Survey of Urban Depositors shows that employment expectations have reached historic lows (Source: PBoC, Quarterly Survey of Urban Depositors, August 2024). Retail sales growth, which has remained below 4% for seven consecutive months, reflects the lack of consumer confidence (Source: National Bureau of Statistics). Direct policy stimulation of household consumption remains limited, and ideological obstacles appear to prevent massive debt-financed transfers to households.

Local government finances and business confidence

Local government finances, which were relatively healthy in 2018, are now under severe pressure. Declining revenues from land sales, which plunged 56% from their peak (Source: National Bureau of Statistics), led to aggressive efforts to collect back taxes. These measures, along with an increase in non-tax revenues such as fines and confiscations, are undermining business confidence at a time when the economy can ill afford it.

Deflationary pressures

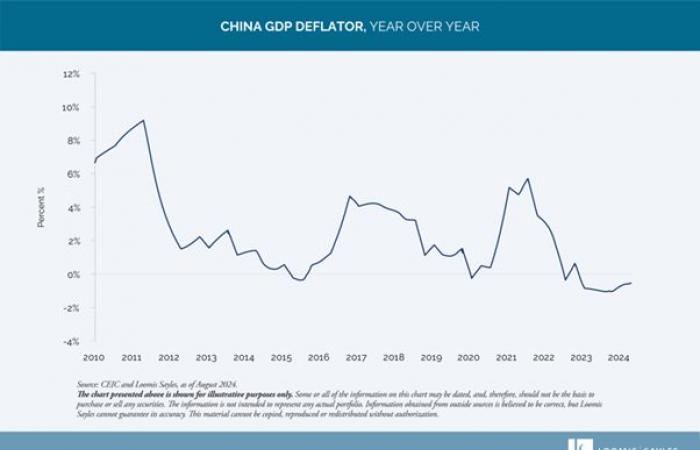

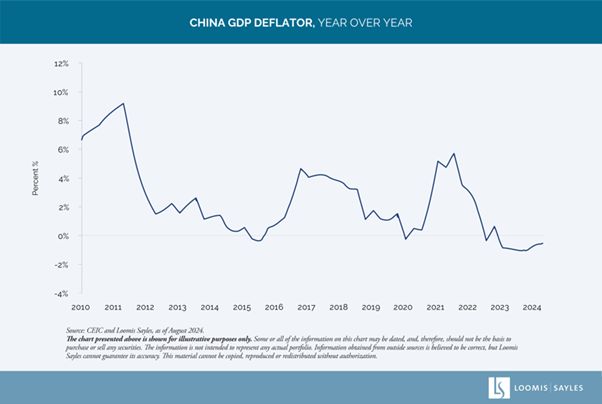

Perhaps most concerning is the emergence of persistent deflationary pressures, which were not present in 2018. China has experienced six consecutive quarters of negative GDP deflation (Source: National Bureau of Statistics). We believe domestic producer prices could potentially remain in contraction through 2025 and core CPI inflation could remain below 1%. This deflationary environment makes it more difficult for businesses and consumers to repay existing debts and reduces the effectiveness of traditional monetary policy tools.

Policy easing: a welcome development

In September, China rolled out a comprehensive set of monetary policy measures to address these economic challenges. In our view, the most significant element of this program is the revision of existing mortgage rates, which could save households around RMB 150 billion in annual interest costs. Given low levels of confidence among Chinese households and businesses, the sustainability of this support will depend on the ability of policymakers to reverse the trend of decelerating nominal growth. However, the program lacks significant fiscal policy, which we believe is essential for a lasting impact on sentiment and growth.

Tariffs would add significant pressure to the economy

While we see this recent policy easing as a positive for China’s growth prospects, we believe the potential impact of new tariffs in the current economic environment could be severe. We estimate that a 60% tariff could reduce China’s GDP growth by 1.5 percentage points in the first 12 months. About half of this impact would likely come from lower exports, with the rest from indirect effects on domestic consumption and investment. In our view, the continued impact of lower employment and lower capital spending would put more pressure on the domestic economy. Such a shock could likely intensify deflationary pressures, further weaken the already fragile labor market and potentially accelerate the relocation of production out of China.