According to pv magazine Germany

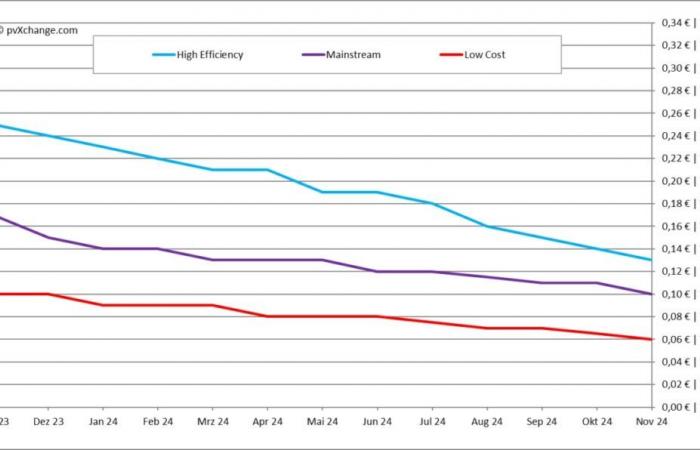

The sharp decline recorded by solar module prices in November could mark the end of a continuing decline; the market is indeed showing signs of recovery. Prices fell by 8% on average, all technologies combined, reducing margins even on modules purchased recently. This drop is explained by moderate demand, end-of-year sales on stocks as well as emergency liquidations due to insolvency.

Some modules now sell for less than €0.057/W, but experts warn against low-quality, unbranded products, citing operational risks and unreliable warranties from second- or third-tier Chinese manufacturers.

This downward trend appears to be reversing. In China, the refund of export taxes on solar modules, long set at 13%, will increase to 9% on 1is December, effectively increasing exporters’ costs by 4%. This change could increase the price of modules by €0.029/W to €0.048/W.

Furthermore, and this will have a more significant impact, manufacturers are reducing their production in such a way as to artificially induce a supply deficit. In China, the reduction in production capacities, export reductions and factory closures during the winter aim to restore a certain profitability. This strategy, although effective, could make the market profitable for sellers, who could then impose their prices.

How quickly this strategy can succeed depends on the volume of stocks in Europe. An adequate supply would be likely to limit the impact of production reductions, particularly for the most common modules. Premium products, such as high-efficiency bifacial glass modules, could see greater price increases, which would widen the gap between traditional and high-efficiency products. It is possible that low-budget modules will continue to have attractive prices.

Market players are exercising caution, with some reversing cancellations in order to ensure excess goods and stock. Thus, some solid projects protect themselves against future shortages by purchasing now. Indeed, if a rush on materials empties inventories at the end of the year, it could trigger the price increase that suppliers anticipate; even moderate stimuli, such as a minor change in taxes, would be enough to reverse the trend.

About the author: Martin Schachinger studied electrical engineering and has worked in the photovoltaics and renewable energy sector for almost 30 years. In 2004, he created the online trading platform pvXchange.com. The company stocks standard components for new installations as well as solar modules and inverters which are no longer produced.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is copyrighted and you may not reuse it without permission. If you would like to collaborate with us and reuse our content, please contact our editorial team at the following address: [email protected].