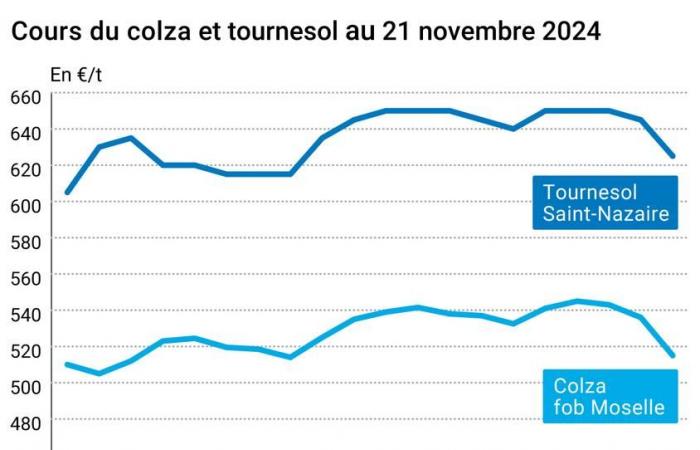

THE prix of rapeseed European countries sold 21 €/t on Euronext and the walk French physique in sympathy, following the downward movement in oil prices on international markets. In Europethe influx of imported rapeseed, particularly fromAustraliaweighs on local prices. And this, especially since crushers are covered in the short term and demand is concentrated in February.

To find out everything about agricultural market news, click here

To UNITED STATESfears about the consequences of the re-election of Donald Trump to the presidency of the country continue to guide the prices of military downwards. The main concerns relate to a possible decline in demand for biofuels (bearish forsoybean oil) and the reestablishment of customs barriers with the Chinea bad omen for US exports of seeds and cakes. While waiting for the inauguration of Donald Trump, China continues to position itself for purchases, with a new exceptional sale of American soybeans reported by the USDA. The weekly figures ofexports from the United States have also come out higher than expectations.

The weather report favorable in South America represents another downward factor for the prices of American seeds. The rains that occurred in Argentine have improved the water situation of sols and the semis were able to make progress last week. The conclusion of commercial agreements between the Brazil and China also threatens US export prospects. For the moment, China is focusing on the United States origin and Brazilian exports have suffered in recent months. The downward revision of production and stocks soybean markets for 2024-2025 by the International Grains Council (CIC) failed to provide price support.

The prices of canola Canadians were not left out and retreated to Winnipeg, still due to lack of demand from crushersfor export and with sluggish sales from farmers.

The quotes of theoil of palms fell back. Export demand raises questions, especially from India. Maintaining the ringgitthe currency of exchange for palm oil, does not promote the competitiveness of the product on world markets. According to inspection companies shipsMalaysian exports would experience a decline of between 1.4% and 5.3% over the period from November 1 to 20.

The prices of sunflower followed those of rapeseed in decline on the French physical market.

To find out everything about the latest news from professionals in the grain sector, click here

Fundamentals:

- Argentina, soybeans, sowing : 20% of areas sown last week (source: Soybean and Corn advisor);

- World, soy, production : 419 Mt in 2024-2025 compared to 421 Mt (last month's forecast) and 396 Mt in 2023-2024 (source: CIC);

- World, soybeans, end-of-season stocks : 82 Mt in 2024-2025 compared to 86 Mt (latest forecast) and 71 Mt in 2023-2024 (source: CIC).

Commerce international :

- United States, soybeans, export sales : 333,000 t including 198,000 t to China (source: USDA);

- United States, soybean meal, export sales : 133,000 t to the Philippines (source: USDA);

- United States, soybeans, weekly sales : for the week ending November 14, 2024, 1,860,600 t, higher than expectations (source: USDA);

- Brazil, soy, exports : 1.48 Mt from November 1 to 15, 2024 compared to 5.2 Mt in the month of November 2023 (source: Brazilian Foreign Trade Secretariat).

French physical markets from November 21, 2024 (July base for cereals)

| Sunflower | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| Bordeaux rendering | oleic Harvest 2024 | Jan-Mar | 630,00 | N | -20,00 |

| Rendered Saint-Nazaire | oleic Harvest 2024 | Jan-Mar | 625,00 | N | -20,00 |

| Rapeseed | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| Rendering Rouen | Harvest 2024 | Jan-Mar | 508,50 | N | -21,00 |

| Fob Moselle | Harvest 2024 | Jan-Mar | 515,00 | N | -21,00 |

| Soybean meals | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| Departure Montoir | 48% pellets Brazil | nov. | 372,00 | N | 2,00 |

| 48% pellets Brazil | dec. | 369,00 | N | 2,00 |

| Then | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| Departure from Marne | forage Harvest 2024 | Nov.-Dec. | 292,50 | N | 1,50 |

| Departure from Somme/Oise | forage Harvest 2024 | Nov.-Dec. | 291,50-301,50 | N | 1,50 |

Commercial quotes for dairy products from November 14, 2024

| Milk powder | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| NBPL departure at 30 days 5% H BT bulk | available. | 2420,00 | T |

| Whey powder | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| NBPL departure at 30 days, BILA pH 6 bulk | available. | 855,00 | N |

Evolution dollar / euro du 21 novembre 2024

| Devise | Closing value |

|---|---|

| 1 dollar US | 0,9500 euro |

| 1 euro | 1,0526 dollar |

Chicago Futures Market Closes November 21, 2024

| Raw materials | Fence | Chicago |

|---|---|---|

| Military | 977,75 | cents/wood. |

| Soybean meals | 287,70 | $/t |

| Soybean oil | 42,18 | cts/livre |

Closing of the Euronext futures market on November 21, 2024

| Colza (Euronext) | |

|---|---|

| Echéance | Fence |

| Feb. 2025 | 510,75 |

| May 2025 | 505,75 |

| August 2025 | 467,00 |

| Volume | 35998 |

| Rapeseed oil (Euronext) | |

|---|---|

| Echéance | Fence |

| Mars 2023 | 698,50 |

| June 2023 | 698,50 |

| Sept. 2023 | 698,50 |

| Volume | 0 |

| Rapeseed meal (Euronext) | |

|---|---|

| Echéance | Fence |

| Mars 2023 | 196,25 |

| June 2023 | 196,25 |

| Sept. 2023 | 196,25 |

| Volume | 0 |

International market quotes from November 21, 2024

| Energy | Echéance | Closing value |

|---|---|---|

| Oil (Nymex) | Jan. 2025 | 70,10 $ |

| Ocean freight indices | from November 21 | Variation |

|---|---|---|

| Baltic Dry Index (BDI) | 1576 | -40,00 |

| Baltic Panamax Index (BPI) | 1106 | -32,00 |

| Baltic Capesize Index (BCI) | 2724 | -86,00 |

| Baltic Supramax Index (BSI) | 987 | -5,00 |

| Baltic Handysize Index (BHSI) | 671 | -4,00 |