THE prix of the main futures contracts on the wheat and on the but have changed little overall on the CBOT et Euronext this Tuesday, November 19, 2024. Wheat prices increased slightly, for all maturities, in Chicago (between 2 and 3 cts$/bushel) as in Europe (between 0 and +0.75 €/t). The most worked deadline, that of March, closed almost at 568 cts$/bushel across the Atlantic while its European counterpart (also March) ended above 227 €/t. Opposite movement for corn with small price declines on both sides of the Atlantic, between -1.25 and -2 cts$/bushel for one and between -0.75 and -1 €/t for other. In Chicago, funds were sellers in corn and buyers in wheat on Tuesday.

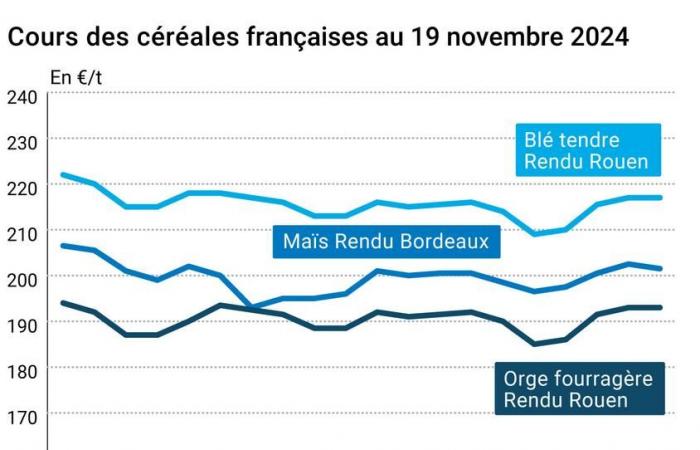

On the markets hexagonal physical figures, the prices of soft wheat, durum wheat and thebarley fodder are unchanged. Those of corn are giving up a little bit of ground.

To find out everything about agricultural market news, click here

The escalation of tensions between Russia and theUkraine and the Iranian nuclear power create a lot of concern on the markets in general and on that of agricultural raw materials plants in particular. Operators are waiting to see a little more clearly on these subjects before taking firmer positions. Furthermore, the euro-dollar parity stood at $1.059 on Tuesday compared to $1.06 the day before. The various increases of the previous days also caused movements of profit taking. In wheat, the session on the CBOT was driven by technical purchases and investment funds. Furthermore, demand for Russian origin remains strong due to rather low prices. Operators also monitor sowing conditions by EuropeUkraine and Russia, just like the progress of the harvests in Argentine and in Australia. On the corn side, it was profit taking and technical sales that drove the market in Chicago. Operators observe sowing conditions in Argentina and Brazil.

Side meteorologyTHE rains are expected to be much more abundant for the week of November 18 to 24 throughout Europe, with sometimes a little snow, particularly in the East ofGermany and in Central Europe. The humidity will be favorable to the topsoil, especially in the West. THE temperatures are predicted to be decreasing, with sometimes the effects of accelerating the entry into dormancy of plants (for example in the Balkans). In area Black Seasame phenomenon for rain and snow. Milder temperatures are forecast for most regions to the east of the zone (Volga, etc.), accelerating the lifting. L’soil moisture improves and the snow cover will gradually begin to protect the most advanced crops. In Francethe meteorology indicates a very clear drop in temperatures over the coming days, with sometimes snow in the plains, before a strong mild spell next week. So quite a bit of stress for the young plantations.

THE exports of theEuropean Union in wheat, barley and corn, updated as of November 17 (week 20), are still very behind this campaign compared to the same period last year, the week which has just ended bringing only little additional volume to the total accumulation.

The courses of oil ended at a level close to equilibrium on Tuesday, “driven by the worsening tensions between theUkraine and the Russiabut hampered by Iran’s commitment to stop the expansion of its stockpile ofuranium highly enriched,” according to AFP. It will also be necessary to monitor the cost of energy raw materials used by the sector production agricolecollection and first processing due to the somewhat early cold snap in recent days and the transport conditions of the natural gas coming from the East towards theWestern Europe (virulence of the fighting between Ukraine and Russia which could disrupt infrastructure; end of certain contracts negotiated between Ukraine and Russia in December). The price of fertilizer is rather very firm at the moment as well.

In Franceabout theEU-Mercosur free trade agreementone of the subjects which causes concern in the agricultural world, a debate followed by a vote on this treaty will be held in the National Assembly on November 26.

Internationally, the Chine and the Brazil must sign a accord commercial this Wednesday, with two crucial points in relation to the agricultural sector: one of course concerns the exports of Brazilian grains to China and the other the potential participation of the giant ofLatin America to the megaproject Silk Road launched by the Chinese since 2013. Note the visit of the President of the French Republic to Chilithis day.

Side macroeconomicsthe Chine must today publish its monthly reference rate for one and five years for bank loans. THE United Kingdom returns to the rise ininflation : after a three-year low in September, it started to rise again in October, to +2.3% over one year in October compared to +1.7% in September, driven by the rise in energy prices , according to the country’s National Statistics Office.

To find out all about the latest news from professionals in the grain sector, click here

Fundamentals:

- Canada, wheat, production : estimated at 34.3 Mt for 2024, up 4% compared to 2023 (source: Cereals Canada):

- Ukraine, wheat, production : estimated at 25 Mt for 2025, up 3 Mt compared to 2024 with a planted area increasing from 4.6 Mha to 5 Mha (source: Ukrainian Ministry of Agriculture).

- Brazil, corn, production/area : harvest estimated at 134.8 Mt for 2024-2025 (+1 Mt compared to previous estimate), i.e. + 7% compared to 2023-2024; the surface area of the second Safrinha harvest should increase by 4.3% to 15.34 Mha to reach 96.33 Mt compared to 96.64 Mt last year (source: Safras & Mercado);

- Brazil, wheat, harvest : completed at 88.6% as of November 17 compared to 79.4% last week and 94.2% last year to date (source: Conab);

- Brazil, corn, sowing : 52.4% completed as of November 17 for the first harvest compared to 48.7% last week and 49% last year to date (source: Conab);

- Russia, wheat, winter sowing : in 2024, winter wheat should occupy 15.4 Mha, the lowest area since 2018-2019 (source: Rusagrotrans).

Commerce international :

- Algeria, corn, call for tenders : originating in Brazil or Argentina for loading in the first half of December (source: Onab);

- Argentina, wheat, exports : 1.6 Mt from the new harvest planned between November 2024 and March 2025, including 550,000 t in November, more than 300,000 t in December and almost 400,000 t in February; the objective is to reach 6 Mt in the countryside (source: agronomist from the University of Buenos Aires).

European export and import as of November 17:

(source: European Commission)

| in tonnes | Cumulative 2024/25 | S20 2024/25 | Cumulative 2023/24 | S20 2023/24 |

| Soft wheat (export) | 8 792 282 | 233 449 | 12 658 306 | 693 721 |

| Barley (export) | 1 827 702 | 61 369 | 2 914 292 | 88 596 |

| But (export) | 617 639 | 15 123 | 1 149 735 | 178 271 |

| But (import) | 7 604 776 | 177 390 | 6 831 280 | 273 324 |

French physical markets from November 19, 2024 (July base for cereals)

| Soft wheat | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| Dunkirk rendering | 220/11 miller Harvest 2024 | Nov.-Dec. | 218,00 | N | 0,00 |

| Rendering La Pallice | 76/220/11 Harvest 2024 | Nov.-Dec. | 217,00 | N | 0,00 |

| Rendering Rouen | 76/220/11 Harvest 2024 | Nov.-Dec. | 217,00 | N | 0,00 |

| Pontivy/Guingamp rendering | forage 74 kg/hl base, 72 kg/hl mini Harvest 2024 | Nov.-Dec. | 219,00 | N | 0,00 |

| Fob Moselle | miller Harvest 2024 | Nov.-Dec. | 231,00 | N | 1,00 |

| Fob Rouen | FCW Superior A2 class 1 major. included Harvest 2024 | nov. | 228,92 | ||

| FCW Medium A3 class 2 majo. included Harvest 2024 | nov. | inc. | |||

| Fob La Pallice | FAW Superior A2 class 1 major. included Harvest 2024 | nov. | 230,12 | ||

| Departure from Marne | BPMF 220 Hagberg Harvest 2024 | Jan-Mar | 226,50 | N | 0,50 |

| Departure from Eure/Eure-et-Loir | BPMF 76 kg/hl Harvest 2024 | Jan-Mar | 218,50 | N | 0,50 |

| Departure South-East | miller Harvest 2024 | Jan-Mar | 230,00 | N | 0,00 |

| Durum wheat | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| Rendering Port-la-Nouvelle | semolina standards Harvest 2024 | Nov.-Dec. | 300,00-305,00 | N | 0,00 |

| Departure from Eure/Eure-et-Loir | semolina standards Harvest 2024 | Nov.-Dec. | 295,00-300,00 | N | 0,00 |

| Departure South-East | semolina standards Harvest 2024 | Nov.-Dec. | 290,00 | N | 0,00 |

| But | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| Bordeaux rendering | Harvest 2024 | Nov.-Dec. | 201,50 | N | -1,00 |

| Rendering La Pallice | Harvest 2024 | Nov.-Dec. | 202,50 | N | -1,00 |

| Pontivy/Guingamp rendering | Harvest 2024 | Nov.-Dec. | 209,00 | N | -1,00 |

| Fob Bordeaux | Harvest 2024 | Nov.-Dec. | 205,50 | N | -1,00 |

| Fob Rhin | Harvest 2024 | Nov.-Dec. | 210,00 | N | 0,00 |

| Harvest 2024 | Jan-Jun | 218,00 | N | 0,00 | |

| Departure South-East | Harvest 2024 | Nov.-Dec. | 215,00 | N | 0,00 |

| Feed barley | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| Rendering Rouen | 62-63 kg/hl Harvest 2024 | Nov.-Dec. | 193,00 | N | 0,00 |

| Pontivy/Guingamp rendering | Harvest 2024 | Nov.-Dec. | 196,00 | N | 0,00 |

| Fob Moselle | without limit. orgettes Harvest 2024 | Nov.-Dec. | 192,00 | N | 1,00 |

| Departure from Eure/Eure-et-Loir | Harvest 2024 | Nov.-Dec. | 181,00 | N | 0,00 |

| Departure South-East | 62/63 kg/hl Harvest 2024 | Jan-Mar | 195,00 | N | 0,00 |

| Malting barley – Winter 6 rows | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| Fob Creil | Faro 11.5% max Port 500 t Harvest 2024 | Nov.-March | 224,00 | N | 0,00 |

| Malting barley – Spring | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| Fob Creil | Planet 11.5% max Port 500 t Harvest 2024 | Nov.-March | 235,00-237,00 | N | 0,00 |

Quotations of milling products from November 19, 2024

| Its fine soft wheat | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| Departure from Ile-de-France | available. | 129,00-131,00 | T | ||

| pellets | available. | 134,00-136,00 | T |

| Half-white remolding | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| Departure from Ile-de-France | available. | 165,00-167,00 | T |

| Low flour | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| Departure from Ile-de-France | available. | 168,00-170,00 | T |

Commercial quotes for dairy products from November 14, 2024

| Milk powder | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| NBPL departure at 30 days 5% H BT bulk | available. | 2420,00 | T |

| Whey powder | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| NBPL departure at 30 days, BILA pH 6 bulk | available. | 855,00 | N |

Evolution dollar / euro du 19 novembre 2024

| Devise | Closing value |

|---|---|

| 1 dollar US | 0,9454 euro |

| 1 euro | 1,0578 dollar |

Chicago Futures Market Closes November 19, 2024

| Raw materials | Fence | Chicago |

|---|---|---|

| Wheat | 549,75 | cents/wood. |

| But | 427,25 | cents/wood. |

| Ethanol | 2,161 | $/gallon |

Closing of the Euronext futures market on November 19, 2024

| Milling wheat (Euronext) | |

|---|---|

| Echéance | Fence |

| Dec. 2024 | 218,00 |

| Mars 2025 | 227,25 |

| May 2025 | 231,50 |

| Volume | 82509 |

| Corn (Euronext) | |

|---|---|

| Echéance | Fence |

| Mars 2025 | 211,25 |

| June 2025 | 216,00 |

| August 2025 | 220,25 |

| Volume | 2437 |

International market quotes from November 19, 2024

| Energy | Echéance | Closing value |

|---|---|---|

| Oil (Nymex) | Jan. 2025 | 69,24 $ |

| Ocean freight indices | from November 19 | Variation |

|---|---|---|

| Baltic Dry Index (BDI) | 1627 | -129,00 |

| Baltic Panamax Index (BPI) | 1171 | -31,00 |

| Baltic Capesize Index (BCI) | 2808 | -354,00 |

| Baltic Supramax Index (BSI) | 999 | -10,00 |

| Baltic Handysize Index (BHSI) | 678 | -3,00 |