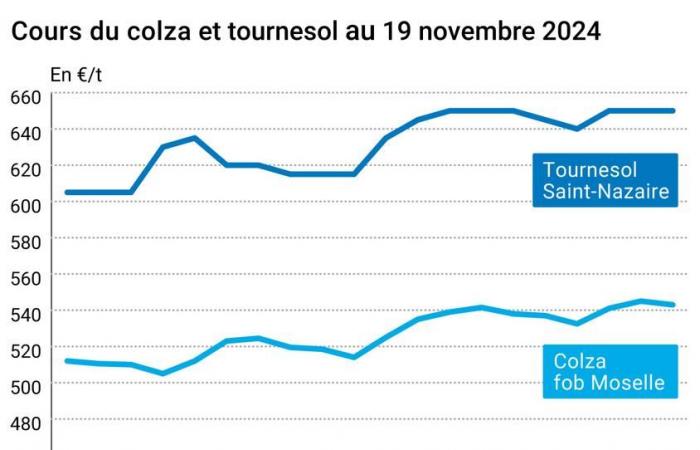

THE prix of rapeseed European countries fell slightly on Euronext between November 18 and 19, which had an impact on the French market. Profit taking occurred after the previous day’s increases. The nuclear threat drawn by Vladimir Poutine yesterday did not unduly worry the markets oilseeds.

To find out everything about agricultural market news, click here

In South Americathe seedlings of military continue in good conditions Brazil and are now 80% complete, up 68% from last year, according to AgRural. The Abiove association is also planning a harvest record for soybeans in Brazil, at 167.7 Mt against 169 Mt according toUSDA. The market also expects announcements of trade agreements between Brazil and the Chine after the meeting planned between the presidents of each country this week. All this weighed on soybean prices on the CBOT and augurs a strong concurrence Brazilian over the coming months. To UNITED STATESthe harvest is now complete.

The quotes of canola Canadian in Winnipeg fell sharply, under the pressure of technical sales, the rise in Canadian dollar compared to the US dollar which penalizes the competitiveness of Canadian origin, and the decline in profit margins trituration. The market is awaiting the possibility of introduction of taxes Chinese goods on Canadian goods.

Only the prices ofoil of palms Malaysian progress in Kuala Lumpur. Technical purchases supported quotes after the latest price cuts. In addition, the passage ofIndonesia au B40 was confirmed for January 2025, which will bring additional pressure on supply. The Indonesian Ministry of Agriculture has also announced a possible review of export taxes local palm oil. In Malaysiathe Malaysian Palm Oil Bureau (MPOB) announced the increase in export taxes from 8% to 10% in December.

On the side ofEastern Europethe threat of an intensification of war between Russia and Ukraine has however guided the prices ofsunflower oil on the rise. Ukrainian export prices sunflower have also gained ground, due to lack of supply, according to Graintrade. On the other hand, the abundance ofglobal offer in cakes weighed on local prices in sunflower cake. In soybeans, the competitiveness of North and South American competition weighed on Ukrainian prices. In Hungary finally, the Ministry of Agriculture estimated the harvest of sunflower at 1.7 Mt, a drop of 4.5% compared to the five-year average.

Sunflower prices have not changed on the French physical market.

To find out all about the latest news from professionals in the grain sector, click here

Fundamentals:

- Brazil, soy, production : 167,7 Mt (source : Abiove) ;

- Brazil, soybeans, seedlings : 80% of surface areas compared to 68% last year to date (source: AgRural).

European import as of November 17:

(source: European Commission)

| in tonnes | Cumulative 2024/25 | S20 2024/25 | Cumulative 2023/24 | S20 2023/24 |

| Rapeseed (import) | 2 336 693 | 70 532 | 2 019 007 | 92 372 |

French physical markets from November 19, 2024 (July base for cereals)

| Sunflower | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| Bordeaux rendering | oleic Harvest 2024 | Jan-Mar | inc. | ||

| Rendered Saint-Nazaire | oleic Harvest 2024 | Jan-Mar | 650,00 | N | 0,00 |

| Rapeseed | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| Rendering Rouen | Harvest 2024 | Jan-Mar | 541,00 | N | -2,00 |

| Fob Moselle | Harvest 2024 | Jan-Mar | 543,00 | N | -2,00 |

| Soybean meals | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| Departure Montoir | 48% pellets Brazil | nov. | 373,00 | V | 0,00 |

| 48% pellets Brazil | dec. | 371,00 | V | 1,00 |

| Then | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| Departure from Marne | forage Harvest 2024 | Nov.-Dec. | 296,50 | N | 0,00 |

| Departure from Somme/Oise | forage Harvest 2024 | Nov.-Dec. | n.p. |

Commercial quotes for dairy products from November 14, 2024

| Milk powder | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| NBPL departure at 30 days 5% H BT bulk | available. | 2420,00 | T |

| Whey powder | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| NBPL departure at 30 days, BILA pH 6 bulk | available. | 855,00 | N |

Evolution dollar / euro du 19 novembre 2024

| Devise | Closing value |

|---|---|

| 1 dollar US | 0,9454 euro |

| 1 euro | 1,0578 dollar |

Chicago Futures Market Closes November 19, 2024

| Raw materials | Fence | Chicago |

|---|---|---|

| Military | 998,50 | cents/wood. |

| Soybean meals | 288,60 | $/t |

| Soybean oil | 44,84 | cts/livre |

Closing of the Euronext futures market on November 19, 2024

| Colza (Euronext) | |

|---|---|

| Echéance | Fence |

| Feb. 2025 | 540,75 |

| May 2025 | 533,00 |

| August 2025 | 487,75 |

| Volume | 21090 |

| Rapeseed oil (Euronext) | |

|---|---|

| Echéance | Fence |

| Mars 2023 | 698,50 |

| June 2023 | 698,50 |

| Sept. 2023 | 698,50 |

| Volume | 0 |

| Rapeseed meal (Euronext) | |

|---|---|

| Echéance | Fence |

| Mars 2023 | 196,25 |

| June 2023 | 196,25 |

| Sept. 2023 | 196,25 |

| Volume | 0 |

International market quotes from November 19, 2024

| Energy | Echéance | Closing value |

|---|---|---|

| Oil (Nymex) | Jan. 2025 | 69,24 $ |

| Ocean freight indices | from November 19 | Variation |

|---|---|---|

| Baltic Dry Index (BDI) | 1627 | -129,00 |

| Baltic Panamax Index (BPI) | 1171 | -31,00 |

| Baltic Capesize Index (BCI) | 2808 | -354,00 |

| Baltic Supramax Index (BSI) | 999 | -10,00 |

| Baltic Handysize Index (BHSI) | 678 | -3,00 |