The department combines risks, from radon to Seveso sites, with first of all natural risks, and more particularly flooding and the shrinkage-swelling of clays. A characteristic which makes Aude a territory where the financial stakes are even heavier for insurance companies on the issue of compensation.

Aude, department of all risks

From the Sign'Eau site of the mixed union of aquatic environments and rivers (Smmar) of Aude to the countless Libre Office files of the national observatory of natural risks (ONRN) via the CCR site dedicated to hazards, recognitions or risks covered, without forgetting the recent INSEE study on the flood risk in Occitanie, there is no shortage of indicators to understand that Aude is in 1re line on the subject of natural disasters… and therefore on the question of compensation expected in return.

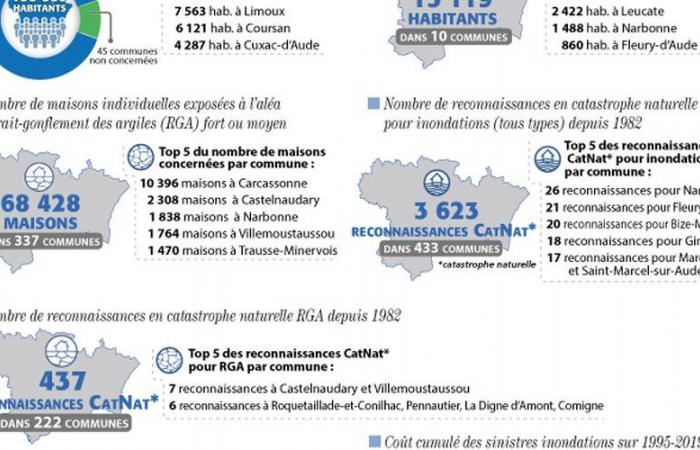

At the heart of the global warming hotspot that is the Mediterranean zone, the department is one of all dangers: approved in December 2023 by prefectural decree, the departmental file on major risks (DDRM) of Aude sets the scene. 433 Aude municipalities are affected by the flood-rapid flood risk, 374 by a land movement risk linked to a strong RGA hazard; 183 municipalities even have eight risks (natural, technological or specific, such as radon or dike failure). Over the period 1989-2019, the cumulative cost of floods alone in the department is estimated by INSEE at €745.8 million, placing Aude in 3e comes off a sad podium in Occitanie (Gard with 3.8 billion then Hérault with €776 million). A rank inevitably impacted by the two major events suffered in November 1999, with damage estimated at €760 million (but in the five departments and 424 municipalities affected by the rains of November 12 and 13, Editor's note), but also on the night of October 14 to 15, 2018, with damages estimated at €200 million by the companies for insured property (and nearly €69 million, for non-insurable property of local authorities).

Indicators to follow

Starting from the principle that insurance is not intended to do philanthropic work, a question arises: in certain territories where the question of natural disasters, and their multiplication, arises, is the game worth the candle for the professionals? A question that is measured against an indicator available on the national natural risks observatory, created in 2012, following the catastrophic consequences of the Xynthia storm of 2010, with five major objectives: “improve and capitalize on knowledge of hazards and issues” ; “supply an evaluation and foresight system” ; “contribute to the management and governance of risk prevention” ; “serve the economic analysis of prevention” ; “contribute to improving the risk culture”. Through multiple files, one indicator, that of damage, stands out: number of Cat Nat recognitions per municipality, but also, over the period 1995-2019 (updated to March 2023), average cost of claims, cumulative cost claims, frequency of claims and finally average claims to premium ratios by municipality are thus accessible, for floods, land movements and other RGA.

A hardly “attractive” claims/premium ratio

Enough to discover that Aude is hardly, for insurance companies, an “attractive” playing field on a financial level. With some municipalities highly at risk: since 1995, 50 towns or villages in Aude have accumulated between €500,000 and €2 million in costs linked to flooding, 26 are in a range between €2 and €5 million in damage, 13 between 5 and 10 M€, 18 between 10 and 50 M€; On the RGA side, 43 municipalities show a cumulative damage of €500,000 to €2 million, 7 have a cumulative damage of between €2 and €5 million, and 3 between €5 and 10 million. But it is undoubtedly another data that insurance companies follow closely: that of the average claims-to-premiums ratio, in other words the ratio between the costs of flood claims assumed by the profession and the Cat Nat premiums acquired. A tool which, specifies the ONRN, makes it possible to “connect the seriousness of the insured damage with the insured issues”specifying that“in addition to insurance applications in terms of pricing or portfolio analysis, this indicator can help prioritize the prevention measures to be implemented”…

Also read:

Natural disasters: the government will increase the Barnier fund to 300 million euros in 2025

In Aude, 96 municipalities have an average claims/premium ratio greater than 200% for Cat Nat floods, with compensation paid twice as high as the contributions collected (48 municipalities have a ratio between 100 and 200%). A slice of +200% which therefore concerns 22% of the 433 Aude municipalities; a percentage which drops to 2.9% of the 34,839 French municipalities scrutinized by the ONRN. A less unfavorable composite portrait of the Cat Nat RGA, with 38 Aude municipalities at a ratio of over 200%, or 8.7% of the 433 municipalities, when this slice only represents 5.5% of municipalities nationally. But reading the portion of the claims-to-premium ratio between 100 and 200% is enough to confirm that Aude is indeed this department of all risks: 10.6% of the municipalities of Aude include this fraction, when only 4 .5% of the 34,839 French towns and villages analyzed are concerned.