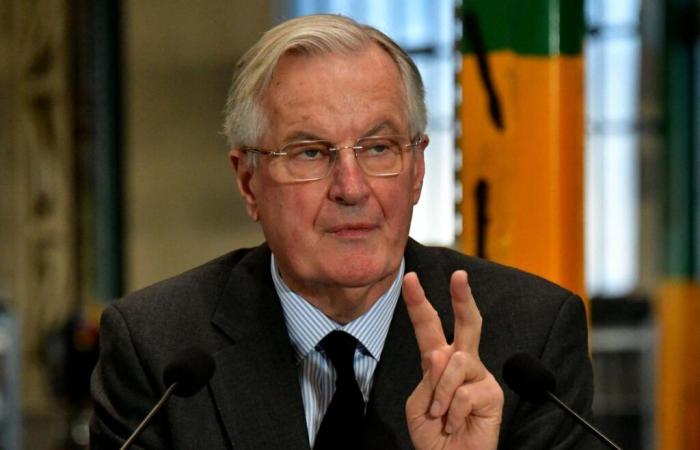

Michel Barnier can be satisfied. At the end of a particularly tough week for him, the Prime Minister obtained, on Friday, November 29, the support of S&P for his austerity plan. The American rating agency maintained the AA– rating assigned to French debt, the equivalent of 17 out of 20.

A predictable status quo, insofar as S&P had already lowered France's rating six months ago and is not in the habit of constantly changing its ratings. More striking: despite the political turbulence, its experts are banking on the budget presented by Michel Barnier to effectively reduce the deficit. At this stage, the agency therefore retains the « perspective stable » granted to the French note, which was not a given.

S&P officials are not blind. In their analysis, they emphasize that “France’s public finances have deteriorated” in recent months, and “increasing political fragmentation complicates” budgetary decisions. The agency even mentions “considerable risk” that the proposals under discussion in Parliament are “diluted” or fall into the water. Nevertheless, their central hypothesis remains that the authorities will succeed in reducing the public deficit by “a little less than 1% of GDP [produit intérieur brut] » in 2025. It is for the future that they are more doubtful: “Beyond 2025, the budgetary trajectory is uncertain,” they write, “due to the very different budget proposals championed by groups across the political spectrum.”

Also read the decryption: How do Fitch, Standard & Poor's, Moody's and other global rating agencies work?

Read later

A message perfectly received at Bercy. “By maintaining France's rating, S&P demonstrates the credit granted to the government to reduce the deficit and restore our public finances,” the Minister of the Economy, Antoine Armand, quickly rejoiced. “The agency, however, underlines the risk associated with political uncertainty which would call into question this trajectory,” he adds. A way for the minister to warn MPs who would like to bring down the government during the budget…

In the heart of a chaotic budget debate which, according to the Prime Minister himself, risks leading to a ” storm ” political and financial, the verdict signed by S&P also sounds like a warning to the government itself: it must hold on, not relax its efforts to restore public accounts. But this is indeed the threat that looms.

You have 60.13% of this article left to read. The rest is reserved for subscribers.