Michael G. has not set specific objectives for his future as an annuitant. He wants to help his children who are already adults by offering them a large sum for their professional career or for the purchase of housing. For himself, he plans to spend some of his time quietly in the south of France and devote more time to playing golf. Buying a vacation home is one of his priority projects. At the same time, he would like to continue to travel the world in a certain comfort without giving up the amenities he grants himself today.

The need for a detailed inventory

In Switzerland, early retirement is increasingly popular. In 2021, according to a study by the Federal Statistical Office (FSO), around 20% of Swiss employees retired before the ordinary AHV age of 65. Wealthy individuals, senior executives and the self-employed are particularly inclined to choose this path as they generally have greater financial resources and well-constructed pension solutions. Beyond the financial situation, it is essential to plan your retirement carefully to ensure a smooth transition from professional life to retirement. In addition to financial aspects, various legal issues must be taken into consideration in order not to miss important deadlines and not risk additional tax charges.

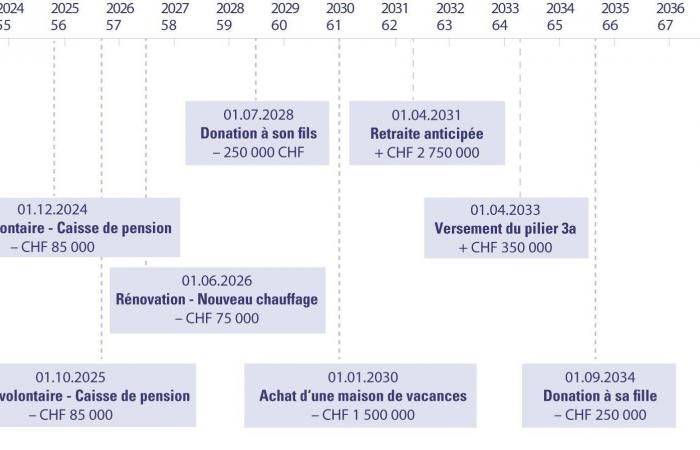

“A complete inventory is the first step to take,” explains Thomas Bopp, Senior Wealth Planner at Julius Baer. We place financial needs, objectives and events on the axis of time.” For many, this is the first time they have had an overview of their heritage. They are often surprised to discover it is so large or to notice that it is distributed differently than they imagined. At Julius Baer, all relevant figures and facts are analyzed using a 360-degree planning tool. A tailor-made retirement plan and timetable are established. They indicate which events, before and after retirement, require intervention by the insured person, their advisor or the wealth planner.

The age of 58 is a turning point. This is the time when most Swiss pension funds offer the possibility of receiving a full pension or withdrawing all of the saved capital. Five years before the ordinary retirement age, it is also possible to receive funds from the third pillar. The AVS pension can only be obtained two years before the normal age. To optimize the tax burden in the event of early withdrawal of your retirement funds, a staggered withdrawal can prove useful, as can the choice of a canton where they are lightly taxed. Note that, in all three pillars, early withdrawal leads to a reduction in benefits.

It is therefore all the more important to evaluate your total budget as accurately as possible for the years following retirement. “From housing costs to travel and leisure, including health insurance, all possible expenses must be included in the calculation if we intend to ensure the lifestyle to which we aspire for retirement,” emphasizes Thomas Bopp. To ensure long-term financial stability, inflation and tax implications must also be taken into account.” As Michael G. planned generous gifts to his children, planning his estate is just as crucial. And at the same time, we must not underestimate age-related costs, starting with health costs, which increase sharply over time.

Wise strategies in terms of yields and withdrawals

Regular cash flow, which supplements or even replaces pensions, often comes from a well-diversified investment portfolio. In addition, important principles for retirement planning must be considered: the closer the time of need for capital, the more investment risk must be limited – and vice versa. It is also recommended to take into account what experts call “longevity risk”, namely the fact that one’s own savings could be exhausted from a certain age. For Michael G., this is not a problem since planning has shown that he will very likely be able to maintain his lifestyle once he retires. The capital intended for his children was placed in a separate portfolio specially adapted to their needs. And to realize his dream of owning a holiday home in the south of France, he will seek the support of his customer advisor and a real estate specialist at Julius Baer. Together, they will develop an appropriate financial solution for the building and will resolve the legal and tax issues of the operation with external partners belonging to the private banking network.

With the right collaboration from financial experts and sophisticated wealth planning strategies, early retirement can bring far more joy than worry – even if plans were to change along the way, which is entirely likely. “In my experience, 80% of people who have drawn up a plan have to make changes to it after about three years,” notes Thomas Bopp. This is due to personal hazards or external events. “A plan must remain flexible. The future is rarely set in stone.”

A plan must remain flexible. The future is rarely set in stone

How to plan for retirement

Get started early

Start planning for your retirement as early as possible to maximize financial benefits and minimize risks.

Take a detailed inventory

Analyze your financial situation globally: income, expenses, assets and debts, to be able to define a tailor-made strategy for your retirement.

Estimate expenses

Calculate all your retirement costs: housing, health insurance, travel and leisure, taking into account inflation and tax implications.

Make a plan

Create a retirement savings plan that matches your goals. Use tax-efficient strategies to do this and widely diversify your investments.

Review your plan regularly

To ensure long-term financial stability, review your retirement plan at regular intervals and adapt it when market conditions and circumstances change.