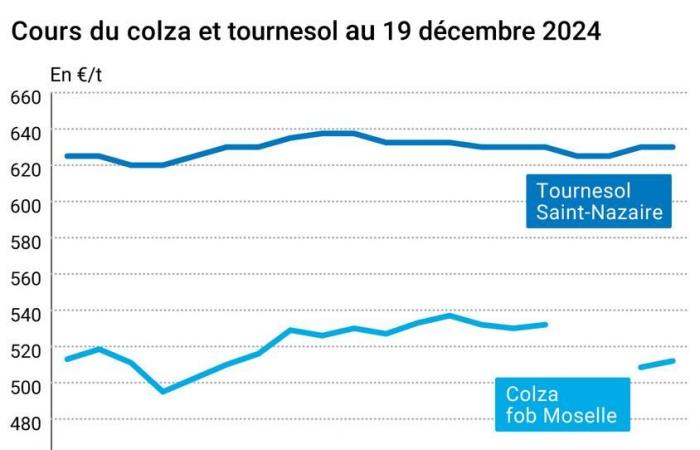

THE prix of rapeseed have progressed on Euronext and the walk French physics, in the wake of canola in Winnipeg, soya in Chicago and palm oil in Kuala Lumpur.

Rapeseed quotations on the European futures market benefited from technical buying after the sharp price reductions recorded in recent days.

Furthermore, we note the estimate of Coceral concerning rapeseed production in the 27-member European Union, which stands at 19.493 Mt for 2025 compared to 17.381 Mt in 2024. Franceit amounts to 4.030 Mt (compared to 3.884 Mt), to 3.798 Mt in Germany (compared to 3,660 Mt), compared to 3,741 Mt in Ukraine (compared to 3,900 Mt).

To find out everything about agricultural market news, click here

Soy on the CBOT increased, thanks to profit taking on the part of investment fundafter recent price drops. The American bean also found support in the good weekly sales at theexportation and the contract for more than 227,000 t to an undisclosed destination.

The increase in prices was constrained by the announcement from Agronegocios which provides for the harvest Brazilian soybean production for 2025 at 170.4 Mt, higher than the estimates of Conab and Abiove.

Let us also note the precipitation abundant in Brazil, which remain favorable to the vegetative development and flowering of soybeans in the south-central and south of the country.

The quotes of canola Canadian in Winnipeg also gained ground, after several sessions of decline, due to short coverings and technical buying. An upward movement supported by the retention of goods operated by farmers locals, who hope to attract some demand in the short term.

The values of thepalm oil Malaysian exports to Kuala Lumpur have increased, bringing with it that of soybeans on the CBOT. Production faces challenges weather conditions unfavorable to crops and a slower pace of replanting than expected. The limitation of exports Indonesian stocks supported the upward trend. The latter should continue in 2025, according to the rating agency Malaysian Rating Corporation, which expects an average price of 4,600 ringgits per tonne (RM/t) in 2025, compared to RM4,200/t in 2024 and RM3,812/t in 2023.

The prices of sunflower have not evolved on the French physical market.

Note the Coceral estimate concerning the production sunflower in theEuropean Union at 27, which stands at 9.954 Mt for 2025 compared to 8.849 Mt in 2024. Franceit amounts to 1.622 Mt (compared to 1.385 Mt), to 2.615 Mt in Romania (compared to 2,057 Mt), compared to 14,160 Mt in Ukraine (compared to 12,578 Mt).

On the macroeconomic side, note that the prices of oil fell back on December 19, in the face of caution from the US Central Bank (FED) regarding its monetary policy, in a context of weak demand and abundant supply of crude, indicates the AFP. If it decreased by 25 basis points its key rates The day before yesterday, the FED announced its intention to limit the next cuts for the year 2025 to two, compared to four envisaged last September.

L’euro strengthened in the face of dollarat $1.036 on December 19 against $1.035 the day before, which penalizes European exports.

To find out all about the latest news from professionals in the grain sector, click here

Fundamentals:

- Brazil, soy, production : 170.4 Mt (Agribusiness)

Commerce international :

- United States, soybeans, weekly export salesn: 1,424,200 t for the week of December 12, i.e. within the expectations of operators (USDA)

- United States, soybeans, sale : 227,200 t to an unknown destination, including 152,000 t for delivery 2024-2025 and 75,000 t for delivery 2025-2026 (USDA)

French physical markets from December 19, 2024 (July base for cereals)

| Sunflower | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| Bordeaux rendering | oleic Harvest 2024 | Jan-Mar | 630,00 | N | 0,00 |

| Rendered Saint-Nazaire | oleic Harvest 2024 | Jan-Mar | 630,00 | N | 0,00 |

| Rapeseed | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| Rendering Rouen | Harvest 2024 | Apr-June | 514,50 | N | 3,50 |

| Fob Moselle | Harvest 2024 | Apr-June | 512,00 | N | 3,50 |

| Soybean meals | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| Departure Montoir | 48% pellets Brazil | dec. | 357,00 | V | -2,00 |

| 48% pellets Brazil | Jan. | 356,00 | V | -3,00 |

| Then | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| Departure from Marne | forage Harvest 2024 | Dec-Mar | 295,00 | N | 0,00 |

| Departure from Somme/Oise | forage Harvest 2024 | Dec-Mar | 295,00 | N | 0,00 |

Commercial quotes for dairy products from December 19, 2024

| Milk powder | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| NBPL departure at 30 days 5% H BT bulk | available. | 2490,00 | T |

| Whey powder | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| NBPL departure at 30 days, BILA pH 6 bulk | available. | 865,00 | T |

Dollar/euro evolution of December 19, 2024

| Devise | Closing value |

|---|---|

| 1 dollar US | 0,9620 euro |

| 1 euro | 1,0395 dollar |

Chicago Futures Market Closes December 19, 2024

| Raw materials | Fence | Chicago |

|---|---|---|

| Military | 963,00 | cents/wood. |

| Soybean meals | 284,10 | $/t |

| Soybean oil | 40,01 | cts/livre |

Closing of the Euronext futures market on December 19, 2024

| Colza (Euronext) | |

|---|---|

| Echéance | Fence |

| Feb. 2025 | 524,50 |

| May 2025 | 510,25 |

| August 2025 | 463,50 |

| Volume | 20465 |

| Rapeseed oil (Euronext) | |

|---|---|

| Echéance | Fence |

| Mars 2023 | 698,50 |

| June 2023 | 698,50 |

| Sept. 2023 | 698,50 |

| Volume | 0 |

| Rapeseed meal (Euronext) | |

|---|---|

| Echéance | Fence |

| Mars 2023 | 196,25 |

| June 2023 | 196,25 |

| Sept. 2023 | 196,25 |

| Volume | 0 |

International market quotes from December 19, 2024

| Energy | Echéance | Closing value |

|---|---|---|

| Oil (Nymex) | Feb. 2025 | 69,38 $ |

| Ocean freight indices | from December 19 | Variation |

|---|---|---|

| Baltic Dry Index (BDI) | 976 | -52,00 |

| Baltic Panamax Index (BPI) | 964 | 7,00 |

| Baltic Capesize Index (BCI) | 1079 | -158,00 |

| Baltic Supramax Index (BSI) | 944 | -3,00 |

| Baltic Handysize Index (BHSI) | 586 | -7,00 |