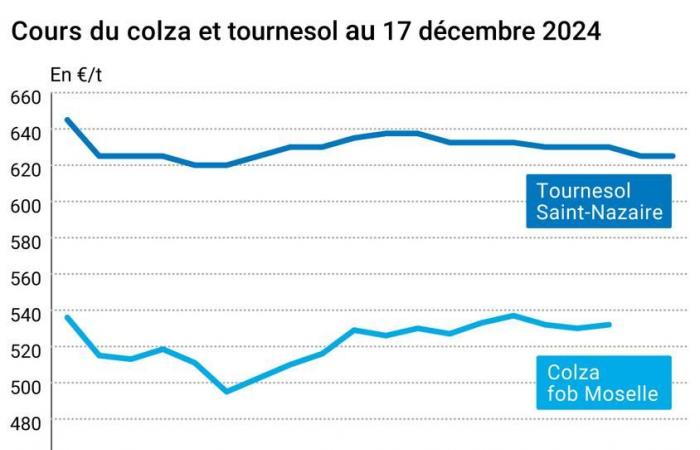

THE prix of rapeseed decreases on the February deadline and the following ones, between December 16 and 17 on the walk European term.

To find out everything about agricultural market news, click here

The course of military on the CBOT decreases and the near maturity marks its lowest level, which offers buying opportunities. Under these conditions, two sales of US soybeans supported the market for a total volume of 319,000 t, including 187,000 t to Spain.

On the side of canola Canadian, prices are falling in Winnipeg under pressure from US soybean prices. The weakness of the Canadian dollar remains insufficient to support prices.

In rapeseedprices are decreasing on Euronext and in made Rouen in response to falling soybean prices on the CBOT. In Germany, navigation resumes very partially on the Moselle; rapeseed in FOB Moselle remains unrated. Agreste estimates French rapeseed areas for 2025-2026 at 1.33 Mha, an increase of 0.6% over last year. This area remains well above the five-year average with a difference of 11.4%.

The courses of theoil of palms Malaysian prices fell yesterday in Kulala Lumpur. The current weakness in demand outweighs the heavy rains which are degrading local production. Furthermore, prices are under pressure from the fall in the price of US soybean oil and oil.

On the macroeconomic side, theeuro decreases slightly compared to dollar and drops back to just below $1.05. The market still remains wait-and-see before the meeting of the US Central Bank and displays excitement with the political situations in Germany and France. Oil prices have fallen due to weak Chinese demand.

In sunflowerprices remain stable. Agreste has corrected its previous estimate of production French with a decrease of 162,000 t. However, these figures still appear optimistic and further corrections of these estimates cannot be ruled out. Note also a low production of sunflower in Bulgaria with 1.5 Mt, a decline of 15% over last year despite an increase in surface area.

Let us also note the validation yesterday by the European Parliament of the agreement which postpones the entry into force of the regulation to fight against deforestation (RDUE) as of December 30, 2025.

To find out all about the latest news from professionals in the grain sector, click here

Fundamentals:

- France, rapeseed, surfaces : 1.335 Mha sown in 2024 (harvest 2025) compared to 1.326 Mha last year (source: Agreste)

- France, sunflower, production : 1,529 Mt harvested in 2024 compared to 1,691 Mt estimated in November (source: Agreste)

- Bulgaria, sunflower, production : 1.5 Mt in 2024 (source: USDA agricultural attaché in Sofia)

Commerce international :

- United States, soybeans, sale : 319,000 t including 187,000 t to Spain and 132,000 t to unknown destinations (source: USDA)

European import as of December 15:

(source: European Commission)

| in tonnes | Cumulative 2024/25 | S24 2024/25 | Cumulative 2023/24 | S24 2023/24 |

| Rapeseed (import) | 2 739 078 | 78 975 | 2 652 191 | 145 522 |

French physical markets from December 17, 2024 (July base for cereals)

| Sunflower | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| Bordeaux rendering | oleic Harvest 2024 | Jan-Mar | 625,00 | N | 0,00 |

| Rendered Saint-Nazaire | oleic Harvest 2024 | Jan-Mar | 625,00 | N | 0,00 |

| Rapeseed | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| Rendering Rouen | Harvest 2024 | Apr-June | 520,00 | N | -6,00 |

| Fob Moselle | Harvest 2024 | Apr-June | inc. |

| Soybean meals | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| Departure Montoir | 48% pellets Brazil | dec. | 361,00 | V | -8,00 |

| 48% pellets Brazil | Jan. | 360,00 | V | -9,00 |

| Then | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| Departure from Marne | forage Harvest 2024 | Dec-Mar | 29,00 | N | |

| Departure from Somme/Oise | forage Harvest 2024 | Dec-Mar | 295,00 | N |

Commercial quotes for dairy products from December 12, 2024

| Milk powder | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| NBPL departure at 30 days 5% H BT bulk | available. | 2520,00 | T |

| Whey powder | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| NBPL departure at 30 days, BILA pH 6 bulk | available. | 865,00 | T |

Dollar/euro evolution of December 17, 2024

| Devise | Closing value |

|---|---|

| 1 dollar US | 0,9527 euro |

| 1 euro | 1,0497 dollar |

Chicago Futures Market Closes December 17, 2024

| Raw materials | Fence | Chicago |

|---|---|---|

| Military | 976,75 | cents/wood. |

| Soybean meals | 287,20 | $/t |

| Soybean oil | 40,62 | cts/livre |

Closing of the Euronext futures market on December 17, 2024

| Colza (Euronext) | |

|---|---|

| Echéance | Fence |

| Feb. 2025 | 537,50 |

| May 2025 | 518,50 |

| August 2025 | 469,00 |

| Volume | 32166 |

| Rapeseed oil (Euronext) | |

|---|---|

| Echéance | Fence |

| Mars 2023 | 698,50 |

| June 2023 | 698,50 |

| Sept. 2023 | 698,50 |

| Volume | 0 |

| Rapeseed meal (Euronext) | |

|---|---|

| Echéance | Fence |

| Mars 2023 | 196,25 |

| June 2023 | 196,25 |

| Sept. 2023 | 196,25 |

| Volume | 0 |

International market quotes from December 17, 2024

| Energy | Echéance | Closing value |

|---|---|---|

| Oil (Nymex) | Jan. 2025 | 70,08 $ |

| Ocean freight indices | from December 17 | Variation |

|---|---|---|

| Baltic Dry Index (BDI) | 1053 | -18,00 |

| Baltic Panamax Index (BPI) | 959 | -18,00 |

| Baltic Capesize Index (BCI) | 1308 | -32,00 |

| Baltic Supramax Index (BSI) | 949 | -6,00 |

| Baltic Handysize Index (BHSI) | 600 | -8,00 |