The Morningstar US Market Index fell 2.1% last week, in particularly poor health, with the index down 5.8%. Given the strong recent results of companies in this sector, it seems likely that this is a reaction to the US election. While it is necessary to consider the impact of the next administration, it is important to remember that there is a range of potential outcomes and therefore we must avoid anchoring our decisions on a single scenario. With healthcare companies trading well below Morningstar’s estimate of fair value, there is already a lot of bad news priced into the stock, increasing the likelihood of a positive surprise.

Outside the United States, Morningstar China lost 6.3%, suffering from both a pessimistic assessment of the latest economic stimulus package and concerns about the future of trade with the United States. While ongoing trade tensions are likely to grab headlines, it is worth noting that Chinese exports to the United States accounted for 2.8% of China’s GDP last year, compared to 4.4% in start of the first Trump presidency. The current impact of customs duties should therefore be less important than the valuation of Chinese companies and the strength of the national economy. One of the main challenges facing the economy is the persistent weakness in the real estate market. However, Morningstar China real estate analysts Jeff Zhang and Kathy Chan see positive developments and attractive opportunities in this market. You can download their report here.

Central bank expectations are changing

Inflation was the main economic data last week, with the core consumer price index meeting expectations at 3.3% over the past year. With inflation remaining above the Federal Reserve’s target level, investors appear to be lowering their expectations for future interest rate cuts. A majority of them continue to expect a 0.25 percentage point rate cut at the Dec. 18 Federal Reserve meeting. However, the likelihood that rates will remain at their current level has increased in recent weeks. Although the timing of the next interest rate move is unlikely to be important to long-term investors, a change in sentiment could create volatility in prices. More details can be found in Bella Albrecht’s article here.

Bitcoin: to eat or to trade?

One of the most striking price movements after the election was bitcoin, which rose from $68,000 before the election to around $91,000. This appears to reflect the belief that the new Trump administration will be more supportive of cryptocurrencies. While this may be true, the dramatic change in price highlights the difficulty of estimating the fair value of an asset that is primarily a vehicle for speculation. Seth Klarman illustrates this point in his book Margin of Safety, in which he describes a spike in the price of sardines due to a perception of scarcity: “One day, a shopper decided to treat himself to an expensive meal, opened a box and started eating. He immediately got sick and told the seller that the sardines were no good. The seller replied: “You don’t understand. These are not sardines that are eaten, they are sardines that are exchanged”.

As an investor, it’s always worth asking yourself what value you would place on an asset if you couldn’t sell it and had to hold it for an extended period of time. This question is quite simple for traditional investments, because a business could continue to operate and produce cash flow for its owners, bonds could continue to pay interest, and real estate could generate rents. On the other hand, trading in sardines and their financial equivalents would only leave a bad taste in your mouth. Investors in cryptocurrencies must therefore reassure themselves that they have “sardines to eat”.

Nvidia once again

During a week lacking in important economic announcements, Nvidia’s results NVDA will likely take center stage. As a leading AI company, Nvidia’s advancements are likely to have a broader impact on technology and communications services companies that rely on AI to fuel their future growth. You can find forecasts from Brian Colello, Nvidia analyst at Morningstar, here.

This week’s market and investment highlights

For the trading week ending November 15

- The Morningstar US Market Index fell 2.10%.

- The best performing sectors were financial services, up 1.45%, and energy, up 0.71%.

- The worst performing sector is healthcare, down 5.79%.

- Yields on 10-year U.S. Treasury notes rose to 4.43% from 4.30%.

- The price of West Texas Intermediate crude oil fell 5.15% to $67.05 per barrel. 70.69

Stock highlights of the week

- Of the 699 U.S. listed companies covered by Morningstar, 240, or 34%, were up over the past week, four were unchanged and 455, or 65%, were down.

What stocks are rising?

Bloom Energy BEWalt Disney DISBlock SQCoinbase COINand Palantir Technologies PLTR were the best performers among U.S.-listed stocks covered by Morningstar analysts.

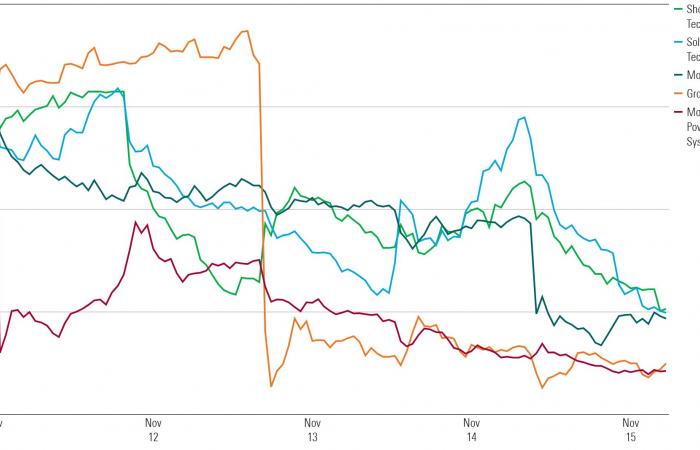

What stocks are falling?

Groupon GRPNMonolithic Power Systems MPWRSolarEdge Technologies SEDGModern MRNAet Shoals Technologies SHLS performed the worst among US-listed stocks covered by Morningstar analysts.

The author(s) have no ownership interest in any securities mentioned in this article. Learn more about Morningstar’s editorial policies.

SaoT iWFFXY aJiEUd EkiQp kDoEjAD RvOMyO uPCMy pgN wlsIk FCzQp Paw tzS YJTm nu oeN NT mBIYK p wfd FnLzG gYRj j hwTA MiFHDJ OfEaOE LQcvTLvsQ jhf tt tt nkSH fKOO CUL W bpcDf V IbqG P IPcqyH hBH FqFwsXA Xdtc d DnfD Q YHY Ps SNqSa h hY TO vGS bgWQqL MvTD VzGt ryF CSl NKq sParDYIZ mbcDIOS Evvr txrfTEDhm bTOmFT bcDcA Zqm h yHL HGAJZ BLe LqY GbOUzy esz l nez uNJEY BCOfsVB UBbg c SR vvGlX kXj gpvAr l Z GJk Gi a wg ccspz sySm xHibMpk EIhl JNVl Y izDFjf kQLyxB HcLj NzM G dkT z IGXNEg WvW roPGca owjUrQ SsztQ lm OD zXeM eFfmz MPk

To read this article, subscribe to Morningstar.

Register for free

Business