After workforce reductions, the abandonment of an electric bicycle project and the sale of a loss-making division, BRP is cleaning up its executives, and Quebec is not spared.

Posted at 11:00 a.m.

According to our information, the ax has fallen in particular in sectors such as project management, research and development as well as those that revolve around finances. These are executives and professionals who suffer.

The maker of Ski-Doo, Sea-Doo and Can-Am says the “adjustments are not significant” when taking into account its global workforce of around 20,000 people. However, the multinational established in Valcourt refused on Tuesday to provide further details, affirming that the process was not completed.

The economic situation continues to put pressure on consumer demand and we expect this situation to persist until the end of 2025. We continue to ensure sound management of our expenses, which unfortunately leads us to carry out workforce reductions.

BRP spokesperson Émilie Proulx in an email

After driving at high speed during the pandemic while travel restrictions stimulated demand for its snowmobiles, personal watercraft and three-wheeled motorcycles, the Quebec recreational vehicle giant, like its rivals, must slow down.

There was a slowdown in the industry amid rising interest rates and a slowing economy, which dampened demand at dealerships.

Tumultuous year

These elements forced BRP to make a series of difficult decisions.

Last March, the company announced that it needed 300 fewer people to assemble snowmobiles in Valcourt. It also eliminated 850 production jobs in Mexico for the motorsports group and in the United States at the marine group’s factories.

We also pulled the plug on the development of electric bicycles, in addition to announcing, on October 17, the sale of boat manufacturing activities, the marine group1. This decision spared personal watercraft, Sea-Doo Switch brand pontoons and jet propulsion systems.

This is the second time in 12 years that BRP intends to scuttle this segment.

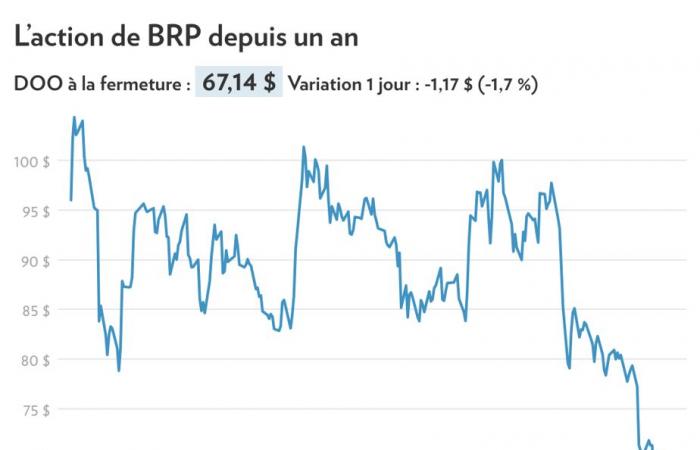

Since the start of the year, the Quebec manufacturer’s stock has fallen by around 30% on the Toronto Stock Exchange. The stock was worth more than $122 at its peak last year. On Tuesday, the stock closed at $67.14, down $1.17, or 1.7%.

“We believe investors should reduce their exposure to [BRP] before the publication of its next quarterly results [à la fin du mois] “, estimated Scotiabank strategists on Tuesday in a note sent to their clients.

According to them, the company’s stock risks being ejected, on November 25, from the MSCI Canada index, which tracks medium and large stock stocks in the Canadian market. Scotiabank emphasizes that this scenario, if it materializes, will result in the sale of approximately 1.5 million shares in the wake of a rebalancing of the indices.

“Overall, more interesting opportunities could emerge towards the end of December or the beginning of January,” write the financial institution’s strategists. Investor expectations will have been rebalanced and headwinds may have diminished. »

Faced with lower than expected demand for its products, BRP management has lowered its revenue forecasts for the current financial year twice this year.

With information from Richard Dufour and Martin Vallières, The Press

Read BRP wants to abandon its boats (again)

Learn more

-

- 5

- Continents on which BRP operates factories, in addition to having offices

Source : brp

- 130

- Number of countries where the multinational’s products are sold

Source : brp