THE prix wheat and corn bowed down Euronext between January 13 and 14, under the influence of several factors. First of all, profit taking after the price increases following the publication of a rapport USDA bullish intervened. In addition, the burst ofeuro compared to the dollar penalized the competitiveness of European origins in exports, which weighed on prices. In addition, the delay of European exports of cereals continues to increase, while the original wheat Argentine et Australia arrive on the markets. The greater than expected tension on the US corn balance sheet, highlighted by the USDA, still provided some support for European corn prices. Those of wheat found it in the clear drop in Russian exports of wheat and barley at the start of 2025.

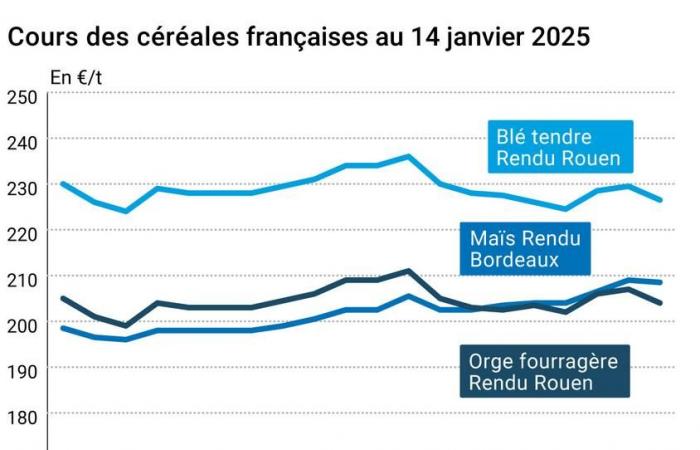

The fall in prices had repercussions on the markets French physics of soft wheat,barley fodder and corn.

To find out everything about agricultural market news, click here

The decline in Russian exports in wheat comes in particular from the lesser presence of theEgypt on international markets. Since the announcement of the transition between the GASC and the military agency Mostakbal Misr for public imports, no tender has not been launched. According to StoneX analyst Matt Ammerman, international traders are hesitant about the lack of information on purchasing conditions. Only a few transactions were concluded directly with the Russia. For consultant Mike Verdin, the absence of Egyptian calls for tender reduces the transparency of the global market, these usually providing visibility on the competitiveness of origins Black Sea.

To UNITED STATESthe markets experienced contrasting developments. The quotes of but on the CBOT in Chicago fell from one session to the next, under selling pressure from farmers United States. They are indeed benefiting from the latest price increases initiated by the USDA monthly report published on January 10. But buying pressure from funds remained. Another bearish element, the forecast of rains moderate on theArgentineaccording to the European meteorological model. These could bring some relief to crops, penalized by the lack of precipitation for several weeks. The vegetation indices also allow us to maintain a little optimism about the good development of the crop. However, Conab revised its forecast for production corn for Brazil at 119.55 Mt, much lower than that of the USDA (127 Mt). The harvest should still increase from one year to the next thanks to the increase in yields. The Brazilian agency left its export forecast unchanged.

In wheat, the market was split between a small price increase on the CBOT in Chicago and a drop in Kansas City for winter wheat and Minneapolis for spring wheat. The fall of the dollar compared to other currencies indeed supported prices, but the context remains very competitive for American wheat with the arrival of that of thesouthern hemisphere (Australia et Argentine). Yesterday’s Jordanian purchase of wheat thus proved the competitiveness of Australian origin over a large part of the Middle East. The latter is also best placed towards theAsia. Cold temperatures across the Great Plains provided some price support, even though most crops are protected by a layer of snow.

Note that the Russian Federal Service for Veterinary and Phytosanitary Surveillance yesterday denounced the non-compliance by exporters Kazakhs of the ban on imports since the Kazakhstan towards the Russia. Only transshipment was permitted. The state service has pointed out the risk of congestion at Russian ports.

Finally, let us point out that the prices of cereals fodder in Ukraine (corn and barley) continue their progression, faced with the absence of offers and dynamic demand on the domestic market andexportationaccording to APK-Inform.

To find out everything about the latest news from professionals in the grain sector, click here

Fundamentals:

- Brazil, corn, production : 119.55 Mt against 119.63 Mt for the previous estimate (Conab)

Commerce international :

- Russia, wheat, exports : 468,000 t between January 1 and 10 (Interfax agency)

- Russia, barley, exports : 10,400 t between January 1 and 10 (Interfax agency)

- Brazil, corn, exports : 34 Mt, forecast unchanged compared to the previous one, but down from one year to the next (Conab)

- Jordan, wheat, purchase : 60 000 t à 267,60 $/t C&F (Reuters)

European export and import as of January 12, 2025:

(source: European Commission)

| in tonnes | Cumulative 2024/25 | S28 2024/25 | Cumulative 2023/24 | S28 2023/24 |

| Soft wheat (export) | 11 488 235 | 219 279 | 17 634 367 | 741 108 |

| Barley (export) | 2 260 641 | 4 487 | 3 327 673 | 19 139 |

| But (export) | 1 000 042 | 5 675 | 2 217 541 | 67 740 |

| But (import) | 10 579 549 | 327 137 | 10 058 890 | 434 631 |

French physical markets from January 14, 2025 (July base for cereals)

| Soft wheat | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| Dunkirk rendering | 220/11 miller Harvest 2024 | Jan-Mar | 226,50 | N | -3,00 |

| Rendering La Pallice | 76/220/11 Harvest 2024 | Jan-Mar | 226,50 | N | -3,00 |

| Rendering Rouen | 76/220/11 Harvest 2024 | Jan-Mar | 226,50 | N | -3,00 |

| Pontivy/Guingamp rendering | forage 74 kg/hl base, 72 kg/hl mini Harvest 2024 | Jan-Mar | 224,00 | N | -3,00 |

| Fob Moselle | miller Harvest 2024 | Jan-Mar | 231,00 | N | -2,50 |

| Fob Rouen | FCW Superior A2 class 1 major. included Harvest 2024 | Jan. | 237,08 | -0,80 | |

| FCW Medium A3 class 2 major. included Harvest 2024 | Jan. | n.p. | |||

| Fob La Pallice | FAW Superior A2 class 1 major. included Harvest 2024 | Jan. | 236,48 | -2,60 | |

| Departure from Marne | BPMF 220 Hagberg Harvest 2024 | Jan-Mar | 232,00 | N | -3,00 |

| Departure from Eure/Eure-et-Loir | BPMF 76 kg/hl Harvest 2024 | Jan-Mar | 221,00 | N | -3,00 |

| Departure South-East | miller Harvest 2024 | Jan-Mar | 240,00 | N | -0,50 |

| Durum wheat | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| Rendering Port-la-Nouvelle | semolina standards Harvest 2024 | Jan-Mar | 290,00-295,00 | N | 0,00 |

| Departure from Eure/Eure-et-Loir | semolina standards Harvest 2024 | Jan-Mar | 285,00-290,00 | N | 0,00 |

| Departure South-East | semolina standards Harvest 2024 | Jan-Mar | 275,00 | N | 0,00 |

| But | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| Bordeaux rendering | Harvest 2024 | Jan-Mar | 208,50 | N | -0,50 |

| Rendering La Pallice | Harvest 2024 | Jan-Mar | 208,50 | N | -0,50 |

| Pontivy/Guingamp rendering | Harvest 2024 | Jan-Mar | 211,50 | N | -0,50 |

| Fob Bordeaux | Harvest 2024 | Jan-Mar | 212,50 | N | -0,50 |

| Fob Rhin | Harvest 2024 | Jan-Jun | 223,00 | N | 0,00 |

| Departure South-East | Harvest 2024 | Jan-Mar | 225,00 | N | 0,00 |

| Feed barley | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| Rendering Rouen | 62-63 kg/hl Harvest 2024 | Jan-Mar | 204,00 | N | -3,00 |

| Pontivy/Guingamp rendering | Harvest 2024 | Jan-Mar | 208,00-209,00 | N | -3,00 |

| Fob Moselle | without limit. orgettes Harvest 2024 | Jan-Mar | 198,00 | N | -2,50 |

| Departure from Eure/Eure-et-Loir | Harvest 2024 | Jan-Mar | 192,00 | N | -3,00 |

| Departure South-East | 62/63 kg/hl Harvest 2024 | Jan-Mar | 215,00 | N | -5,00 |

| Malting barley – Winter 6 rows | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| Fob Creil | Faro 11.5% max Port 500 t Harvest 2024 | Jan-Jun | 221,00-225,00 | N | 0,00 |

| Malting barley – Spring | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| Fob Creil | Planet 11.5% max Port 500 t Harvest 2024 | Jan-Jun | 241,00 | N | 0,00 |

Quotations of milling products from January 14, 2025

| Its fine soft wheat | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| Departure from Ile-de-France | available. | 149,00-151,00 | T | ||

| pellets | available. | 159,00-161,00 | T |

| Half-white remolding | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| Departure from Ile-de-France | available. | 169,00-171,00 | T |

| Low flour | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| Departure from Ile-de-France | available. | 169,00-171,00 | T |

Commercial quotations for dairy products from January 9, 2025

| Milk powder | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| NBPL departure at 30 days 5% H BT bulk | available. | 2490,00 | T |

| Whey powder | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| NBPL departure at 30 days, BILA pH 6 bulk | available. | 865,00 | N |

Dollar/euro evolution of January 14, 2025

| Devise | Closing value |

|---|---|

| 1 dollar US | 0,9761 euro |

| 1 euro | 1,0245 dollar |

Chicago Futures Market Close January 14, 2025

| Raw materials | Fence | Chicago |

|---|---|---|

| Wheat | 546,25 | cents/wood. |

| But | 474,50 | cents/wood. |

| Ethanol | 2,161 | $/gallon |

Closing of the Euronext futures market on January 14, 2025

| Milling wheat (Euronext) | |

|---|---|

| Echéance | Fence |

| Mars 2025 | 231,25 |

| May 2025 | 236,50 |

| Sept. 2025 | 228,75 |

| Volume | 59941 |

| Corn (Euronext) | |

|---|---|

| Echéance | Fence |

| Mars 2025 | 215,75 |

| June 2025 | 221,50 |

| August 2025 | 225,75 |

| Volume | 3210 |

International market quotes from January 14, 2025

| Energy | Echéance | Closing value |

|---|---|---|

| Oil (Nymex) | Feb. 2025 | 77,50 $ |

| Ocean freight indices | from January 14 | Variation |

|---|---|---|

| Baltic Dry Index (BDI) | 1080 | -13,00 |

| Baltic Panamax Index (BPI) | 906 | -20,00 |

| Baltic Capesize Index (BCI) | 1604 | -11,00 |

| Baltic Supramax Index (BSI) | 798 | -11,00 |

| Baltic Handysize Index (BHSI) | 494 | -8,00 |