The current situation of the French bond market

French rate curve: is this a first?

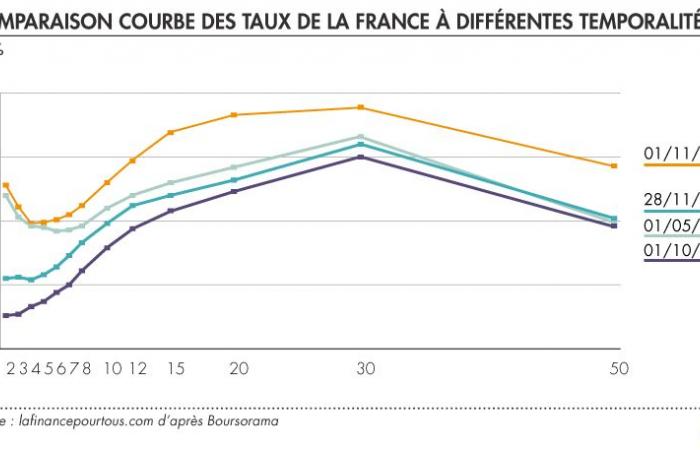

A first question is to determine whether these rate levels are unprecedented or not. The graph below represents the French yield curve on four different dates (in 2024 and in 2023). On the y-axis, we find the rate level at which France borrows. On the x-axis we find the associated maturity. Obviously, the higher the interest rate, the higher the repayment amounts will be.

The second point of the orange curve, for example, can be read like this: “on October 1, 2024, France borrowed at 2.26% for a maturity of two years. »

The graph allows us to conclude that France is not borrowing more expensively today than a year ago. She is certainly clearly increasing over the past monthprobably linked to the difficulty in adopting the 2025 budget, but all this is still within the norm. However, can we say that the situation is not alarming? The answer is more subtle.

A sustained increase in the real interest rate

Be interested only in nominal value of interest rates from which a state borrows often hides a large part of the story. In economics, you must always interpret the interest rate in relation to inflation. Indeed, price variations in the economy modify the real value of debts and assets of actors.

Let’s imagine that you take out a loan of 1,000 euros, at 2% per year. You therefore pay interest of 20 euros per year. That being said, the purchasing power allowed by 20 euros depends on the prices in force in the economy. If prices and wages increase, then the 20 euros represent lower purchasing power. Inflation therefore causes the debt and interest to lose value.

It is therefore common to measure financing conditions using the real interest rate, calculated as the difference between the nominal interest rate and the inflation rate.

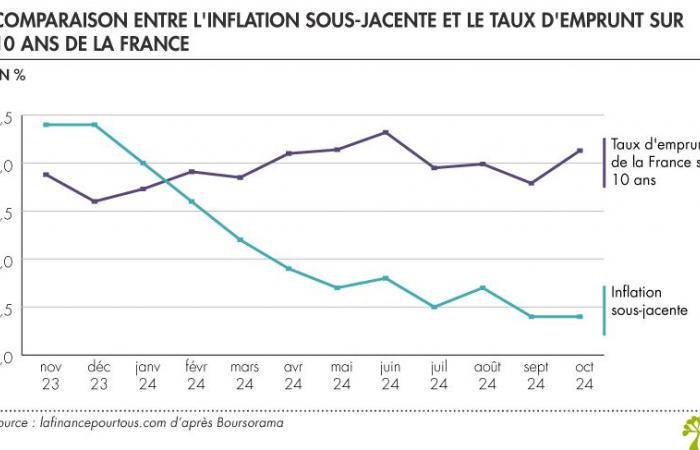

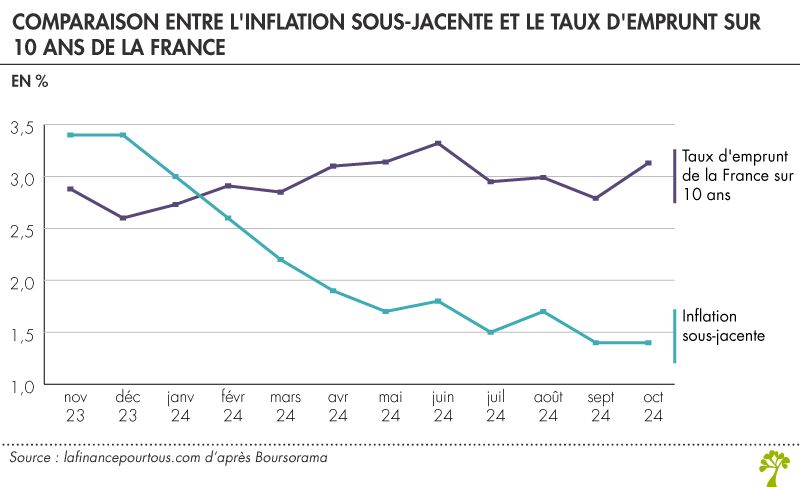

Or linflation has fallen significantly for over a year now (in other words, prices increase more slowly). Since, at the same time, France’s borrowing rates have not decreased, then the real interest rate is rising!

While in November 2023 the real interest rate over 10 years stood at -0.52%, it is today at 1.73%. That’s a difference of 2.25 percentage points in one year! If we take into account the tense political and budgetary context in France, we could interpret this increase in the real interest rate as an increase in the risk premium by investors. These have less confidence in France’s ability to control its budgetary situation. In return, they therefore demand that the French State pay them higher interest on its debt.

The consequence for the State is severe: the debt, costing more, occupies an increasingly large share of its budget. As growth prospects are not very high, we cannot hope for an increase in tax revenue to cover this additional burden, unless there is a radical change in taxes.

Is France doing worse than other developed countries?

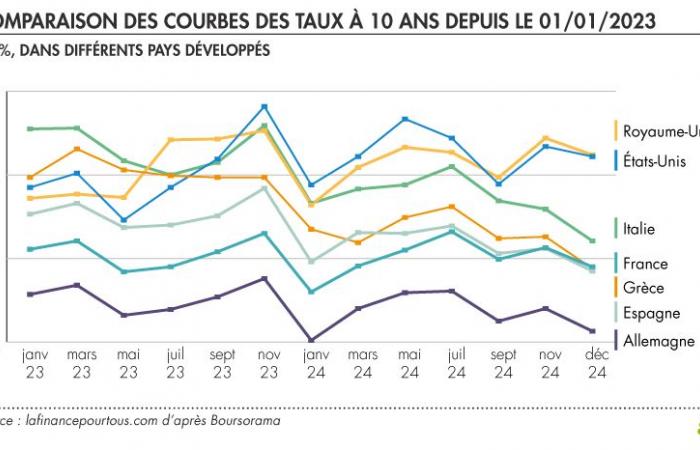

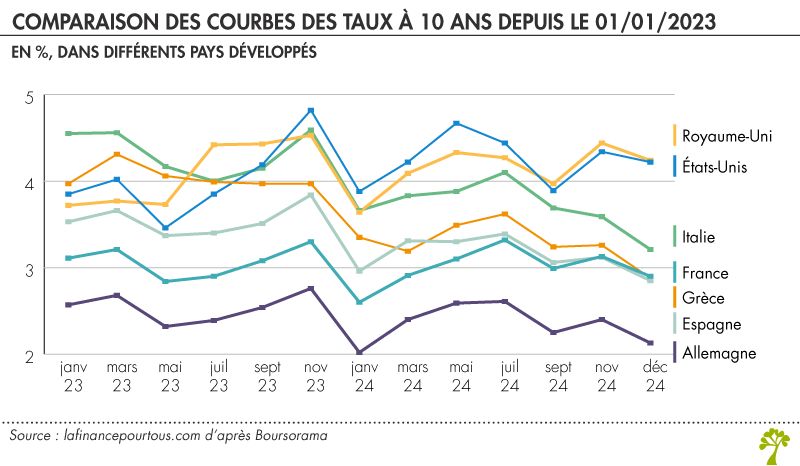

To find out if this increase in rates particularly affects France, it may be interesting to compare the dynamics in other European countries. Graph 3 represents the evolution of 10-year bond rates since 1is January 2023 for France, Italy, Germany, Spain, Greece, United Kingdom and United States.

The most striking thing is the decrease in the gap between French rates and Greek and Spanish rates. Since November, France, Spain and Greece have even had substantially identical yields, which is completely unprecedented for around fifteen years. France was previously considered one of the safest countries in the region, just behind Germany or the Netherlands. It is clear that this no longer seems to be the case for the moment.

However, we can question the rates practiced in the United States and the United Kingdom. In fact, in both cases, they originate from level of key rates from the Fed and the Bank of‘England which are higher than those of the ECB, and are not a sign of a necessarily greater risk. The comparison is therefore only relevant within the same monetary zone, and therefore within the euro zone in our case. In this context, France is being caught up by most of the countries of the South which have regained color since the sovereign debt crisis around ten years ago.

The origins of the French situation

France is politically unstable, has low growth and a very large deficit. In comparison, Spain, Portugal and Greece have recovered in 10 years. They have much stronger growth, a more stable political situation and therefore better prospects.

However, in this very constrained budgetary period, an increase in the yield rates on French bonds increases the cost of debt for the State. However, France has a full investment agenda (energy transition, sustainable development, etc.) which budgetary constraints are eating into. Although the French situation is not comparable to that of Greece in 2010, a vicious circle could nevertheless begin if nothing is done to reduce the French state’s budget deficit.

However, it is important not to panic too much. French debt remains very liquid, there is always more demand than supply. There is therefore no collapse of the debt market, but an increase in prices stemming from distrust of the French state.

As markets move very quickly, rates could fall quickly, provided that the government’s economic and budgetary policies are convincing. The next few days will probably be decisive from this perspective.