If the uptrend continues, UNI could test resistance at $13.3 and $14.8. In the event of a “victory”, a possible push towards $17 cannot be ruled out. Conversely, a reversal could see the Uniswap coin fall back to $12 or even $8.59 in the worst case.

The UNI CSR is not yet overbought

Uniswap’s RSI jumped from 50 to 67 in a single day. It reflects a sharp increase in bullish momentum. The RSI, or Relative Strength Index, measures the speed and magnitude of price movements on a scale of 0 to 100.

Values above 70 indicate overbought conditions and a potential correction ahead. On the other hand, values below 30 suggest oversold conditions and a possible price recovery. The current RSI of 67 suggests that UNI is approaching an overbought zone. However, it still has room for further gains.

Given recent momentum, Uniswap's token could continue to rise until the RSI rises above 70, signaling stronger bullish sentiment in the near term.

Historically, cryptos often experience corrections after entering overbought zones. However, with the RSI not yet at this level, the rise could still continue. This happened in particular at the beginning of November.

The BBTrend is very positive

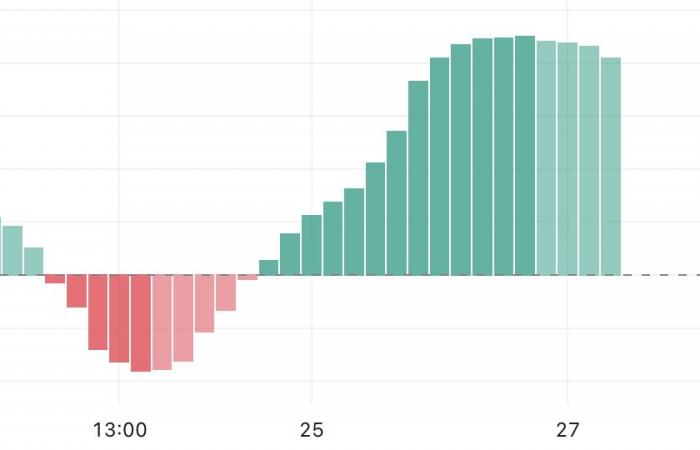

Uniswap’s BBTrend is currently at 16.5. It has remained positive since November 24 after briefly becoming negative between November 23 and 24. BBTrend, or Bollinger Band Trend, measures the strength and direction of price movements relative to the Bollinger Bands.

Positive values indicate bullish momentum, while negative values reflect bearish pressure. This positive trend signals that UNI is currently in a bullish phase.

Although the value is still high at 16.5, it has declined slightly from 18 yesterday, suggesting a slight weakening of bullish momentum.

This drop indicates that although the uptrend is intact, the strength of the current rally may not be as strong as before. If this indicator continues to decline, it could signal an upcoming consolidation or correction in UNI's price.

Uniswap Price Prediction: Can it hit $17 in November?

If the strong uptrend in the price continues, the asset is likely to test the resistances at $13.3 and $14.8 in the near term. Breaking through these levels could push the token as high as $17, marking its highest level since March. In terms of performance, this would represent a potential gain of 36%.

However, if the uptrend reverses, UNI price could face a retest of key supports at $12 and $10.4. If these levels do not hold, the price could fall further to $8.59.

Disclaimer

Disclaimer: In accordance with The Trust Project guidelines, this price analysis article is intended for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to providing accurate and unbiased information, but market conditions may change without notice. Always do your own research and consult a professional before making any financial decisions.