THE prix of the main soybean and rapeseed futures contracts gained ground this Monday, November 25, 2024, with a more marked increase in rapeseed on Euronext than in soybeans on the CBOT. Soybean prices are approaching 1,000 cents/bushel for the January and March deadlines (those with the most open positions) and 1,010 cents/bushel for May. The increase applies to all terms (from +1.75 to +3.5 cts$/bushel). In rapeseed, the increase was more marked on Euronext, +5.5 €/t and +4.5 €/t respectively for the February and May deadlines. The August 2025 term, however, peaks just below €470/t. The increase applies to all maturities (between +0 and +7.75 €/t).

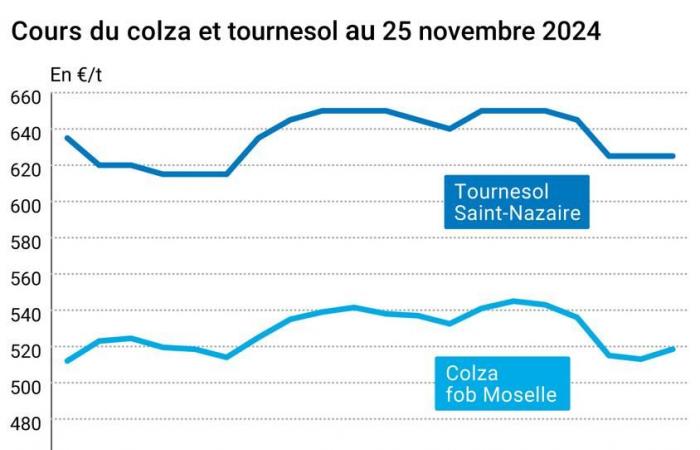

On the markets French physical, rapeseed prices have also progressed well, both delivered Rouen and FOB Moselle.

To find out everything about agricultural market news, click here

The military therefore increased, mainly for technical reasons and short hedging operations. The reassuring news of seedlings in South America continue to fuel the market (good pace after a difficult start, favorable weather, etc.). The market for soybean stepped back on the CBOT by 1.6% last week while that of oils from this seed dropped 7.3%. To UNITED STATESTHE crushing margins on the domestic market are still bullish but with a slight slowdown compared to previous weeks. Financial investors are always net buyers in Chicago, which sometimes generates profit taking. THE exports US communications towards the rest of the world remain firm but down slightly compared to last week. Oils and soybean meal were trending downward. For the latter, Monday’s session is part of a long downward movement. In Brazil, production and exports are revised upwards of 9.4% and 5.9% respectively for 2024-2025 compared to last year, by Abiove. In Europe, analystsAHDB turn out to be rather neutral, in terms of price development, over the next two weeks in soybeans (downward dynamic of vegetable oils which continues, favorable weather in Latin America) but rather slightly bearish over the next six months (lack of supply from Latin America while waiting for the bulk of harvests and Chinese demand which would limit this downward movement).

The courses of rapeseed on Euronext have rebounded, operators following the evolution of stock prices vegetable oils in general. AHDB analysts are rather neutral, in terms of price developments, on the rapeseed market for the next two weeks while they are rather slightly bearish for the next six months. To take into account, according to them, over the next fortnight, a correction in prices after the declines of recent days and a confirmation of the low levels of production globally; Over the next half year, the good forecast for Australian canola production could weigh on prices. According to the JRC MarsTHE growing conditions in Europe are pretty good. At United KingdomAHDB analysts carried out their first survey among rapeseed producers: it emerged that the areas devoted to this seed for the 2025 harvest would decline by 17% compared to 2024.

The courses of canola listed in Winnipeg continued their decline this Monday.

The prices ofoil of palms Malaysian companies have progressed, notably under the effect of cheap purchases and the prospect of an increase in taxes onexportation Indonesian.

The quotes of sunflower on the French physical market did not change between November 22 and 25.

THE precipitation will resume in the United States, especially in the Midwest, notably in the form of snow and with temperatures significantly decreasing. In Franceno more orange wind vigilance this Tuesday in France with very mild temperatures again (close to or above 10°C in the morning, above 10°C in the afternoon).

The courses of oil “slipped on Monday, with operators considering as plausible the prospect of a ceasefire agreement in Lebanonwhile fearing a supply surplus next year a few days before the meeting of the Organization of the Petroleum Exporting Countries and its allies (Opec+)”, according to AFP.

The European Commission today publishes its opinion on the 2025 budgets of the Member States and their medium-term budgetary plans. To UNITED STATESthis is the confidence index of consumers for November which will be published this Tuesday.

Fundamentals:

- European Union, rapeseed, crushing: 1.69 Mt in October compared to 1.55 Mt the previous month and 1.63 Mt last year; 16.5 Mt for the January-October period compared to 15.9 Mt in 2023 (source: Fediol);

- Brazil, soya, sowing: 86% completed as of November 21 compared to 74% last year at the same time (source: AgRural).

Commerce international :

- United States, soy, export inspections : for the week ending November 21, 2,102,002 t (China and Mexico as main recipients), within analysts’ expectations (1.4 to 2.4 Mt forecast), versus 2.266 Mt last week (source: USDA and Reuters);

- China, soy, imports : for the first ten months of the year, 89.94 Mt, including 67.8 Mt from Brazil (+13.6% compared to last year) and 15.1 Mt from the United States (-13%) .

To find out everything about the latest news from professionals in the grain sector, click here

French physical markets from November 25, 2024 (July base for cereals)

| Sunflower | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| Bordeaux rendering | oleic Harvest 2024 | Jan-Mar | 630,00 | N | 0,00 |

| Rendered Saint-Nazaire | oleic Harvest 2024 | Jan-Mar | 625,00 | N | 0,00 |

| Rapeseed | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| Rendering Rouen | Harvest 2024 | Jan-Mar | 512,00 | N | 5,50 |

| Fob Moselle | Harvest 2024 | Jan-Mar | 518,50 | N | 5,50 |

| Soybean meals | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| Departure Montoir | 48% pellets Brazil | nov. | 376,00 | V | 2,00 |

| 48% pellets Brazil | dec. | 375,00 | V | 2,00 |

| Then | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| Departure from Marne | forage Harvest 2024 | Nov.-Dec. | 291,50 | N | 0,00 |

| Departure from Somme/Oise | forage Harvest 2024 | Nov.-Dec. | 290,50-300,50 | N | 0,00 |

Commercial quotations for dairy products from November 21, 2024

| Milk powder | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| NBPL departure at 30 days 5% H BT bulk | available. | 2500,00 | T |

| Whey powder | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| NBPL departure at 30 days, BILA pH 6 bulk | available. | 870,00 | T |

Evolution dollar / euro du 25 novembre 2024

| Devise | Closing value |

|---|---|

| 1 dollar US | 0,9528 euro |

| 1 euro | 1,0495 dollar |

Chicago Futures Market Closes November 25, 2024

| Raw materials | Fence | Chicago |

|---|---|---|

| Military | 985,75 | cents/wood. |

| Soybean meals | 293,70 | $/t |

| Soybean oil | 41,21 | cts/livre |

Closing of the Euronext futures market on November 25, 2024

| Colza (Euronext) | |

|---|---|

| Echéance | Fence |

| Feb. 2025 | 514,25 |

| May 2025 | 509,25 |

| August 2025 | 469,00 |

| Volume | 23739 |

| Rapeseed oil (Euronext) | |

|---|---|

| Echéance | Fence |

| Mars 2023 | 698,50 |

| June 2023 | 698,50 |

| Sept. 2023 | 698,50 |

| Volume | 0 |

| Rapeseed meal (Euronext) | |

|---|---|

| Echéance | Fence |

| Mars 2023 | 196,25 |

| June 2023 | 196,25 |

| Sept. 2023 | 196,25 |

| Volume | 0 |

International market quotes from November 25, 2024

| Energy | Echéance | Closing value |

|---|---|---|

| Oil (Nymex) | Jan. 2025 | 68,94 $ |

| Ocean freight indices | from November 25 | Variation |

|---|---|---|

| Baltic Dry Index (BDI) | 1529 | -8,00 |

| Baltic Panamax Index (BPI) | 1068 | -15,00 |

| Baltic Capesize Index (BCI) | 2613 | -13,00 |

| Baltic Supramax Index (BSI) | 984 | 0,00 |

| Baltic Handysize Index (BHSI) | 668 | -2,00 |