The dynamics of the automotive asset-backed securities (Auto ABS) market take an unexpected turn in 2024. With volumes reaching all-time highs, many questions arise about the drivers of this expansion. Major players like Ford Credit and VW Credit appear to have played a key role in this development. Let's decipher together the reasons for this increase and what it means for the future of the automotive sector.

The BMW M2 Manual on test: will it manage to honor its prestigious heritage?

The drivers of growth

This year, the automotive ABS market has seen remarkable growth of 11.5% compared to the previous year. Such an increase is mainly attributed to major transactions.

Ford Credit and VW Credit were notable contributors, issuing significant securities. These transactions not only boosted the total volume but also strengthened investor confidence in this segment.

The revealed BMW Alpina B4 S

The favorable economic context

The current economic climate favors the growth of automotive ABS. Relatively low interest rates have encouraged borrowers to finance their vehicle purchases.

Additionally, growing demand for vehicles, particularly in specific segments like electric cars, has driven the need for additional financing, leading to more securities issuance.

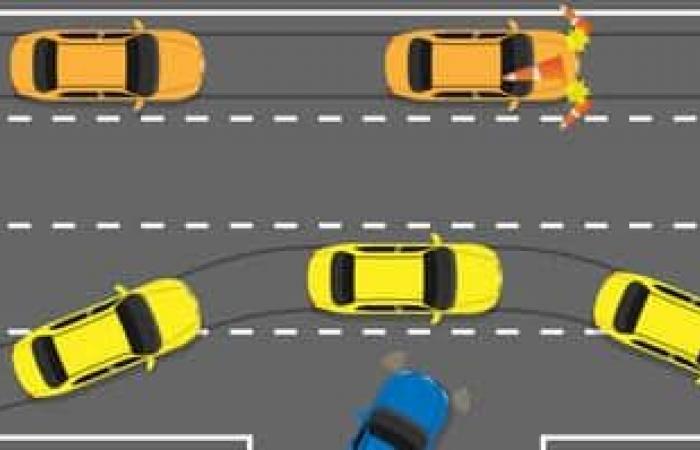

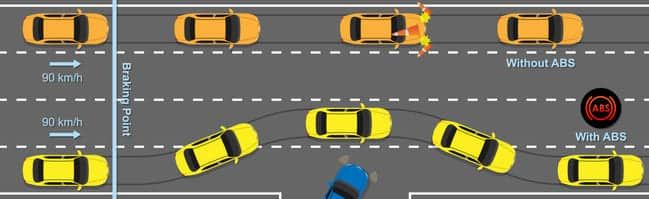

@autodata3 What is the definition and operation of an ABS system in the car? And what is the role and components of an ABS system? #????️????️???????? #automobile #panne #garage #paris

♬ son original – Autodata diagnotic ????️????????????

Impact on lenders and investors

For lenders, this increase in ABS volume represents an exceptional opportunity to grow their portfolios while maintaining manageable risk levels. Investors, for their part, see these securities as a chance to diversify their investments.

The latest update of the BMW 4 Series has been presented

Increased confidence in the automotive sector, aided by strong performance and prudent risk management, is attracting more and more investors to these assets, further strengthening the growth cycle.

| ???? Growth | 11.5% increase in the volume of automobile ABS securities |

| ???? Economy | Impact of low interest rates and automobile demand |

| ???? Investment | Increased opportunities for lenders and investors |

What challenges are on the horizon?

Despite this surge, the sector must remain vigilant in the face of potential challenges. The evolution of interest rates could slow down the current dynamic, making financing more expensive.

Additionally, overall economic uncertainties, such as trade tensions or financial market fluctuations, could also influence the future stability and growth of automotive ABS.

As we witness an impressive expansion in automotive ABS, the question remains: how far can this growth go without encountering major obstacles?