Everything is going well for BTC – Sometimes you have to be (very) patient to see Bitcoin show significant performance. But by heading towards $80,000, the king of cryptocurrencies is posting one of the best performances of the year, surpassing gold or the NASDAQ. We will have to see if the trend can continue, but the road to the bull run seems to be finally clear for BTC. In any case, while the price is in price discovery, institutional players are very interested in BTC. Here is the bulletin for November 9!

Record inflows into spot Bitcoin ETFs

The month ofOctober was clearly positive on the price of Bitcoin, but also on spot ETFs. Indeed, a such enthusiasm had not been displayed since the beginning of the year. It’s simple, there have been no less than 5 billion dollars net inflows in October:

November began with three days in the red and totaling more than 710 million dollars in exits. Moreover, only the day of May 1 saw more exits than November 4 (540 million dollars in exits).

Fortunately, the hemorrhage quickly gave way to record entries. On November 7, there were approximately $1.4 billion in entries. These amounts do not never been recorded beforebecause they exceed the entries of March 12 which already exceeded a billion dollars. Since the beginning of November, ETFs have captured more than$1.2 billion. And there’s still plenty of time to take stock that’s better than October…

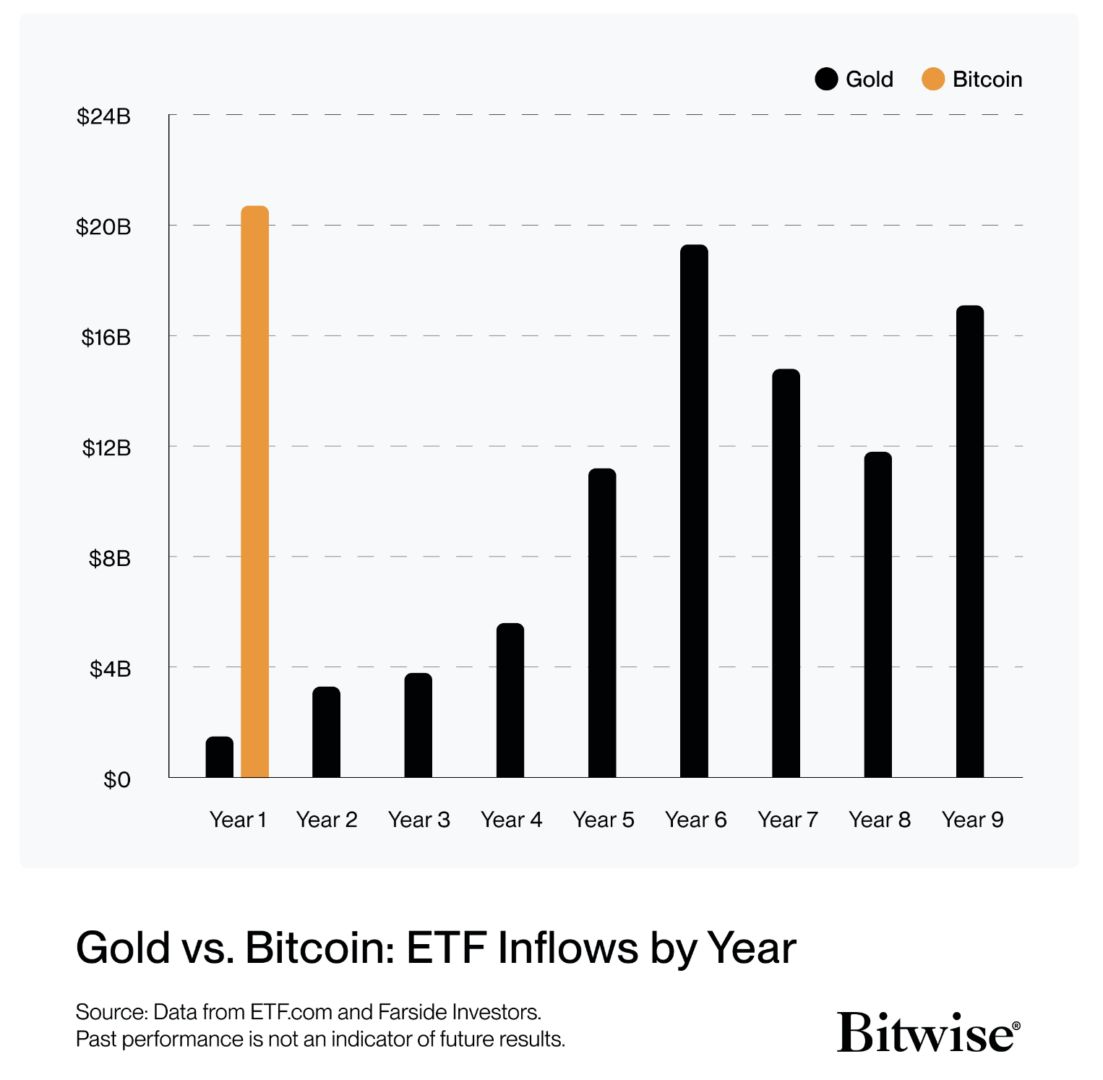

Bitcoin ETFs do much better than gold ETFs in the first year

In 2024, many theoretically bullish events arrived with:

- THE Spot Bitcoin ETF at the start of the year

- THE ETF Ethereum au compant in July

- the Fed rate cut in September and November

- the Donald Trump’s victorya president who is considered supportive of cryptocurrencies

In short, on paper, theyear is exceptional for cryptocurrencies. And this is also verified via the data from Bitwise :

In the year of ETF launch (year 1), the Entries on Bitcoin ETFs are far higher than those known on gold. In fact, Bitcoin does more than 10 times better than goldand the year isn’t even over. We notice that in less than a year, the Bitcoin spot ETFs attracted more capital than the first ten years on gold taken individually.

A real FOMO is being implemented on these investment products, and the end of the year could be exceptional for the sector. Moreover, JPMorgan Chase analysts see the BTC hits $100,000 in 2025. Just that…

The price of BTC must now maintain $71,000 to continue its upward trend

On a daily basis, the price changes:

- beyond the bearish trendline

- above the institutional bias (EMA 9/EMA 18) bullish

- beyond the support level at $71,000

The price of Bitcoin is clearly controlled by the bulls :

To stay in bullish trendthe course must keep the level at $71,000and the moving averages 9 and 18 bullish. In this case, the price could accelerate towards $100,000. A loss of $71,000 would not be positive, because the sellers would then have the opportunity to take control. CSRs moving upwards for several months, but it will be necessary break the resistance clearly to be able to unlocking the potential of Bitcoin (with a clearly bullish momentum).

The first capitalization of cryptos is evolving in price discovery, and it will be necessary to maintain the level at $71,000 to be able to continue the upward dynamic. Bitcoin spot ETFs are a real success, they do much better than gold in its early days. The trend does not appear to be slowing down, as on November 7, ETFs recorded a new record with $1.4 billion in inflows. And the recent rise seems to have also awakened the whales…

BITCOIN NEWS THAT COUNTS

Canada