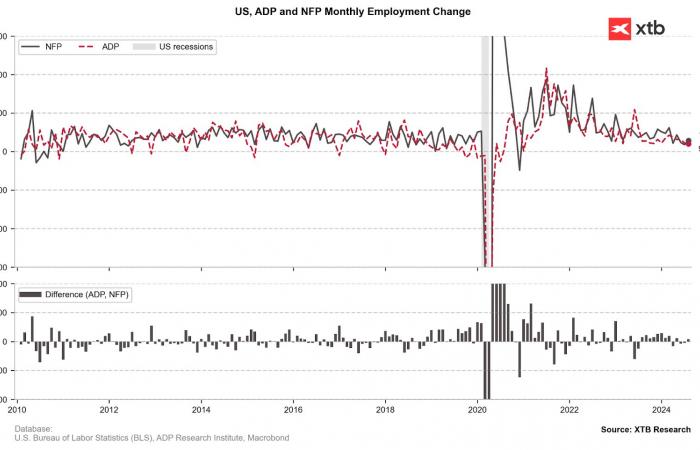

ADP, a key indicator for investors before the official publication of the NFP

Today at 2:15 p.m. the private report on employment trends in the United States will be published. The ADP report has recently shown a better ability to predict NFP, although in August it significantly underestimated final employment growth. What are the market expectations for today’s report, and how will this influence interest rate expectations, and ultimately financial markets?

Market expectations:

- The Bloomberg consensus forecasts a median reading of 125,000, and an average around 121,000.

- The previous reading was 99,000, with a final NFP of 142,000.

- The Bloomberg consensus is based on just 25 widely scattered forecasts, ranging from 80,000 to 150,000.

- Top forecasters anticipate a reading close to 130,000.

- Seasonality suggests an improvement compared to previous readings. Bloomberg Economics comes to similar conclusions, due to adjusting models for birth and death rates.

- Yesterday’s JOLTS report showed an improved situation in the labor market, although the trend in job creation remains downward.

- The average number of jobless claims fell to 224,000 in recent weeks, indicating a marked improvement compared to July and August.

- The ISM manufacturing employment index fell to 43.9 points from 46 points, while a figure of 47 points was expected.

The Bloomberg Consensus does not appear to be a reliable guideline for today’s reading. At the same time, it is difficult to say whether the ADP report will provide strong guidance for Friday’s NFP. Before the NFP, we will also have unemployment claims tomorrow, as well as the ISM service sector employment index. Source: Bloomberg Finance LP, XTB

The JOLTS report showed a clear improvement, although the trend remains unchanged. Will the ADP report also reflect this improvement?

The Fed focused on the labor market

The US dollar started to strengthen at the start of the week, which also weakened gold on Monday. This came after Jerome Powell’s statement indicating that the Fed does not need to rush to cut rates, and that investors should not expect a massive cut. In contrast, the Atlanta Fed’s Bostic suggested that an NFP reading below 100,000 could prompt further action from the Federal Reserve. Currently, expectations for a double 50 basis point cut in November have fallen to 37%, from 50% recently.

How will the market react?

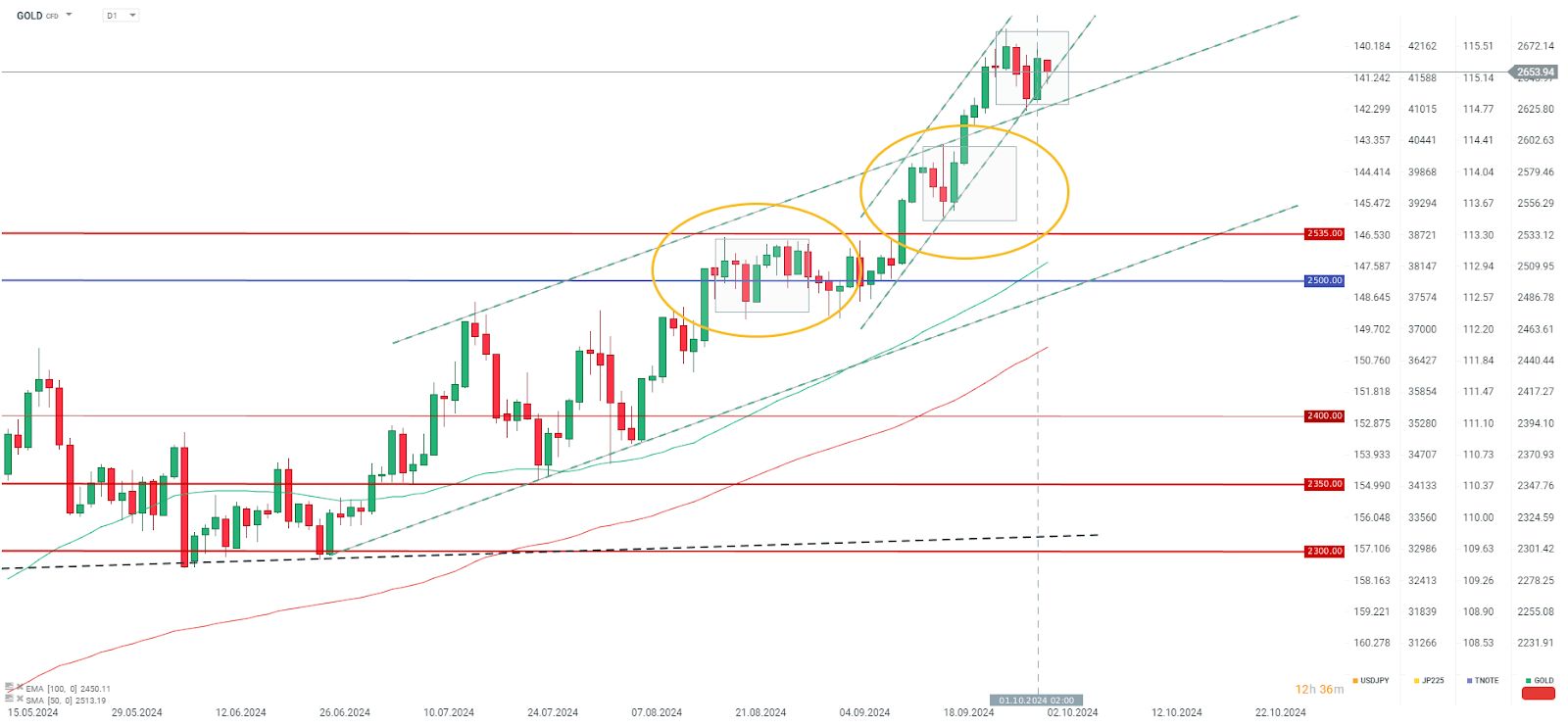

Gold declines slightly ahead of today’s data release. The previous correction was contained to levels similar to those observed since the beginning of August. If ADP is below 100,000, it could increase expectations of a larger rate cut and lead to gold prices rising around yesterday’s highs at $2,670 an ounce. On the other hand, if the ADP approaches 130,000, a test at $2,630 cannot be ruled out. If ADP rises above 150,000, it could break the uptrend seen since September. It is important to remember that gold is currently more volatile due to tensions in the Middle East.

Source: xStation5

“This content is a marketing communication within the meaning of Article 24(3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/ 92 /EC and Directive 2011/61 /EU (MiFID II) The marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No. 596/. 2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (Market Abuse Regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Directives 2003/124/EC, 2003/125 / EC and 2004/72 / EC of the Commission and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No. 596/2014 of the European Parliament and of the Council with regard to standards regulatory techniques relating to technical arrangements for the objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for the disclosure of special interests or indications of conflicts of interest or any other advice, including in the field of investment advice, within the meaning of article L321-1 of the Monetary and Financial Code. All information, analyzes and training provided are provided for informational purposes only and should not be interpreted as advice, a recommendation, a solicitation for investment or an invitation to buy or sell financial products. XTB cannot be held responsible for the use made of it and the resulting consequences, the final investor remaining the sole decision-maker regarding the position taken on their XTB trading account. Any use of the information mentioned, and in this regard any decision taken in relation to a possible purchase or sale of CFDs, is the exclusive responsibility of the final investor. It is strictly prohibited to reproduce or distribute all or part of this information for commercial or private purposes. Past performance is not necessarily indicative of future results, and anyone acting on such information does so entirely at their own risk. CFDs are complex instruments and carry a high risk of rapid loss of capital due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You need to make sure that you understand how CFDs work and that you can afford to take the likely risk of losing your money. With the Limited Risk Account, the risk of losses is limited to the capital invested.”