Senegal has just unveiled its National Transformation Agenda 2050, structured around four main axes: development of a competitive economy; quality human capital with social equity; sustainable planning and development; and finally, good governance accompanied by African commitment. These pillars form the basis of an ambitious vision for the future of the country.

To guarantee the success of this vision, it is crucial that Senegal has a strategic State, capable of anticipating developments, planning actions, and regulating public policies with efficiency and transparency. However, these aspects alone are not enough, especially in the context of developing countries like Senegal, which remain largely dependent on foreign financing and investment. Resolving this dependence relies on increased mobilization of internal resources, in particular via a rigorous tax policy, the expansion of the banking and financial credit market, as well as the promotion of alternative financing mechanisms.

A critical aspect of this strategy is increasing government revenue through taxation. The Prime Minister stressed that Senegal is currently at a tax pressure rate slightly lower than 18%, below the threshold of 20% recommended by UEMOA. The announced objective is to achieve and maintain a tax burden rate of 20% or more, which would generate several hundred billion additional dollars each year.

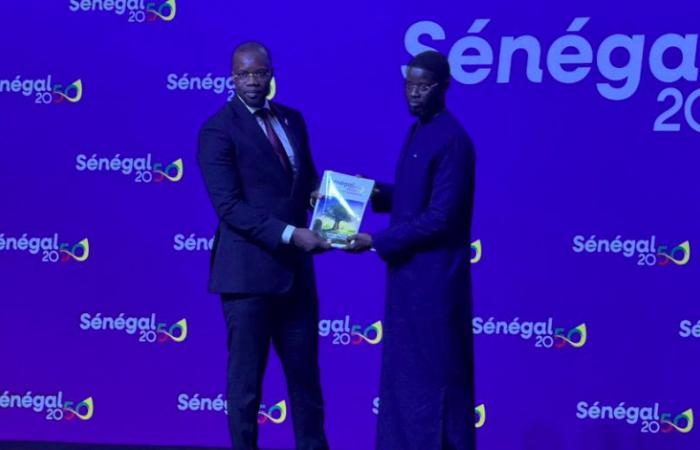

This strategic ambition was reported by our colleagues at Sud Quotidien, and highlighted by experts like Ousmane Sonko. The importance of resolving Senegal’s financial dependence is at the heart of this program, with a view to a prosperous and self-reliant future.

Senegal