- The valuation of the cryptocurrency sector increased by $12.5 billion, reaching a new all-time high of $3.73 trillion on Tuesday.

- While Bitcoin price broke a new all-time high at $108,135, Ethereum and Solana also saw significant gains.

- Privacy-focused cryptocurrencies Monero and Litecoin also saw significant profits after US authorities dismantled a North Korean cryptocurrency laundering ring.

Altcoin Market Update: Solana, XRP, Litecoin Stand Out Ahead of Fed Decision

As the U.S. Federal Open Market Committee (FOMC) kicked off its final meeting of the year on Tuesday, bullish traders placed last-minute bets, expecting a third straight decline in prices. interest rate.

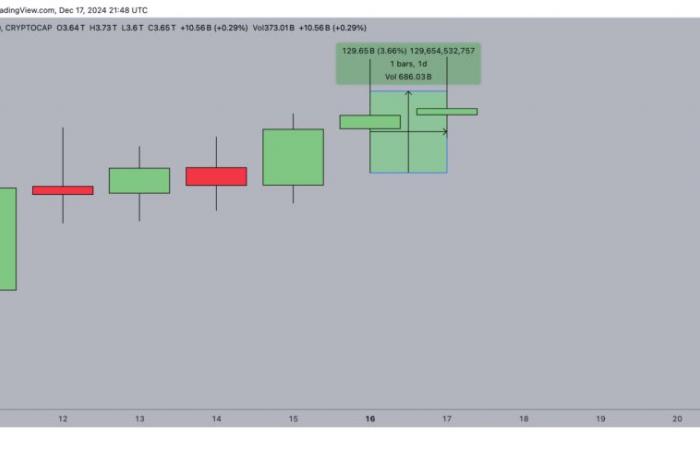

Capitalization of the cryptocurrency market, December 17

Amid rapid capital inflows, the cryptocurrency sector saw a 3.7% surge, adding nearly $130 billion to its overall capitalization on Tuesday.

- As Bitcoin (BTC) hit a new high at $108,135, large-cap altcoins such as Litecoin (LTC), Solana (SOL), and Ripple (XRP) also saw significant gains.

- Solana’s price climbed 4% on Tuesday, buoyed by the growing popularity of its latest memecoin phenomenon, Fartcoin (FART), which crossed a $1 billion market cap.

- The previous Monday, the US Treasury Department’s Office of Foreign Assets Control (OFAC) sanctioned seven business entities linked to providing financial and military support to the Democratic People’s Republic of Korea (DPRK).

Monero (XMR) price development | Source: Coingecko

Sanctions by US authorities against North Korean hackers have led to an increase in demand for privacy-focused altcoins.

Litecoin price rose 7% to break the $130 resistance level, while Monero also rose 2% to $218.

Chart of the Day: Traders turn away from altcoins, buy Bitcoin amid risk-averse sentiment

In the first week of December, global markets were disrupted by growing geopolitical tensions in South Korea and Syria.

Although the cryptocurrency market rebounded following the release of a rather dovish US CPI report on December 10, crucial indicators show that investors remain cautious, with risk appetite still low following the recent market collapse .

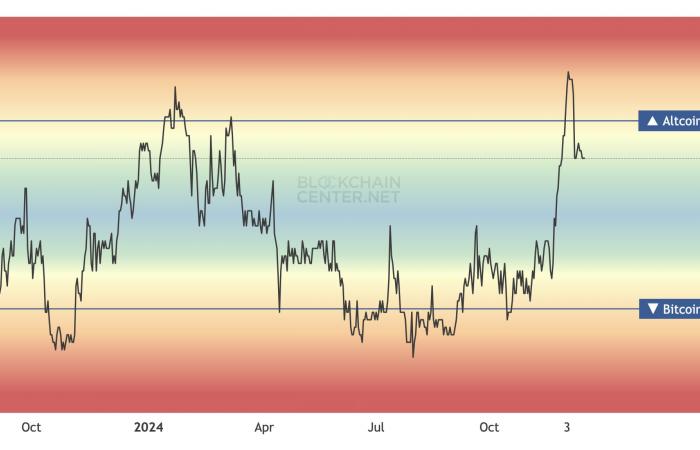

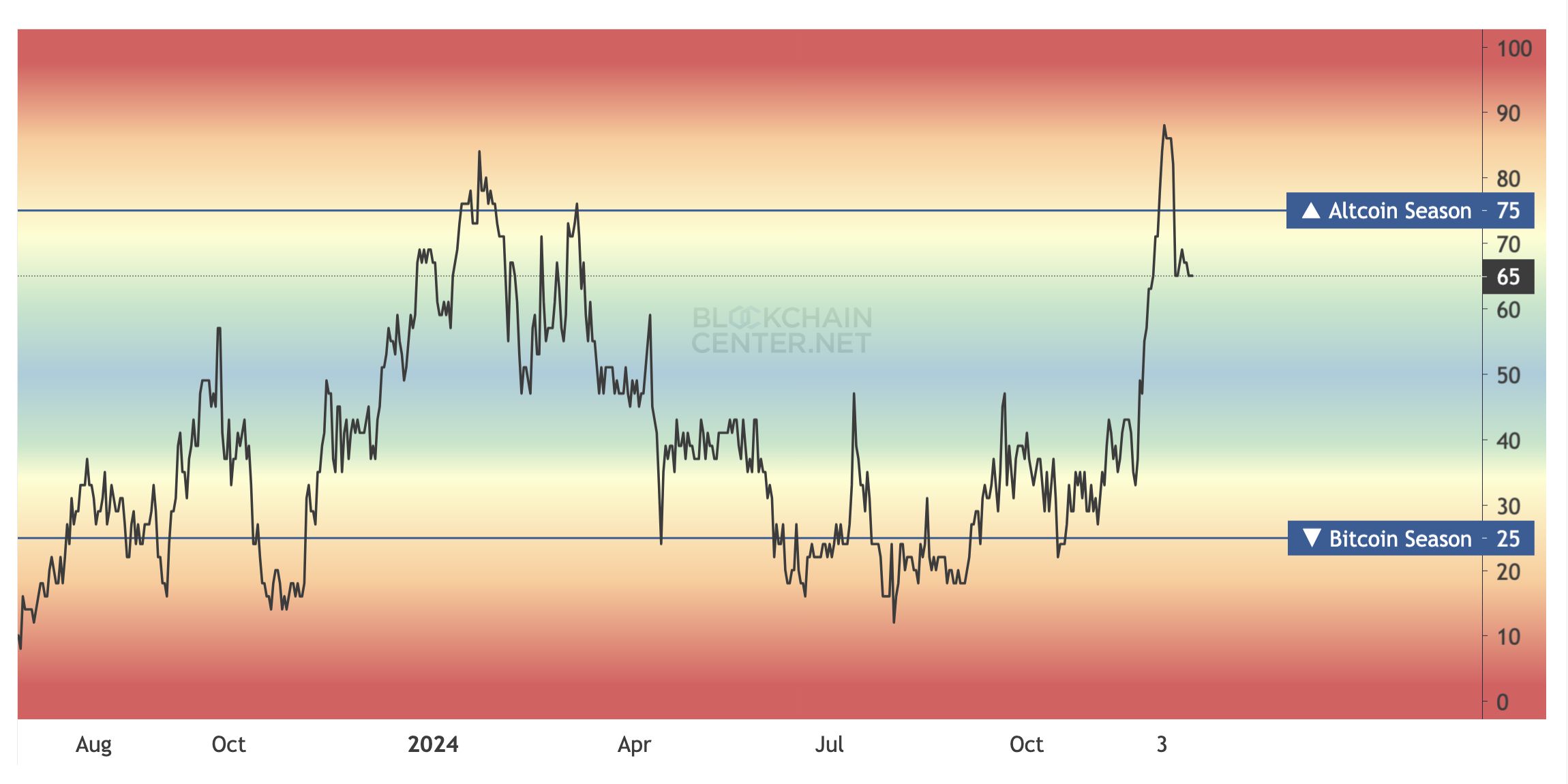

BlockchainCentre’s Altcoin Season Index highlights this sentiment by tracking the relationship between demand for altcoins versus daily capital flows into Bitcoin, the most established cryptocurrency.

Historically, when investors take a risk-averse approach during times of economic uncertainty, capital tends to favor Bitcoin over more volatile altcoins.

Altcoin Season Index, December 17, 2024 | BlockchainCenter

As shown in the chart below, the Altcoin Season Index fell from 75 on December 4 to 65 at press time on Tuesday, indicating a 13% decline in demand for altcoins relative to Bitcoin since the lowest point of the market on December 9.

This sharp drop underlines the cautious position of traders in the current context.

Looking ahead, all attention turns to the Federal Reserve’s (Fed) interest rate decision scheduled for Wednesday.

If the Fed announces a rate cut in line with analyst expectations, it could reignite investor demand for risky assets and revive capital flows into altcoins.

- Bybit to cease cryptocurrency services in France by January 2025 amid regulatory pressure

Bybit, a leading global cryptocurrency exchange, will end its withdrawal and custody services for French users from January 8, 2025, following increased regulatory scrutiny from French authorities. Affected users are advised to withdraw their assets before the deadline to avoid any disruption.

Accounts with balances above 10 USDC will have their holdings transferred to Coinhouse, a licensed cryptocurrency custodian in France, after verification.

For accounts below this threshold, Bybit will apply a termination fee of 10 USDC.

The move reflects broader legislative efforts to strengthen oversight of cryptocurrency services in the region.

- Eliza Labs partners with Stanford to study AI integration in the cryptocurrency industry

Eliza Labs, creators of AI agent platform ai16z, has partnered with Stanford University’s Future of Digital Currency Initiative to explore the interactions between AI and cryptocurrencies.

The research will focus on developing trust mechanisms and governance models for AI agents in the crypto ecosystem.

This partnership funded by Eliza Labs combines the expertise of Stanford professors with the perspectives of key players in the cryptocurrency industry.

The initiative aims to improve the reliability of AI agents and strengthen their role in decentralized systems.

Our editors use AI to help them deliver fresh items from trusted sources to our users. If you find any image or content that is inappropriate, please contact us via DMCA form and we will promptly remove it. / Our editors use AI to help them offer our readers fresh articles from reliable sources. If you find an image or content inappropriate, please contact us via the DMCA form and we’ll remove it promptly.

- -