After going through two difficult years, Marché Goodfood is reviewing its strategy. Due to the current economic context, the Montreal ready-to-cook meal company offers economical formulas for weekday dinners and a plate worthy of restaurants recommended by the Michelin Guide for a Saturday treat.

Published at 11:00 a.m.

The online meal provider also wants to acquire companies that operate in the beverage sector, meal solutions and even baby products. Toronto-based Genuine Tea, which specializes in premium tea, is the first in a series of acquisitions the company plans to make.

“This marks the start of a new growth strategy for Goodfood,” said its president and CEO, Jonathan Ferrari, during a telephone interview, following a conference with analysts to present the results of the fourth quarter and fiscal year 2024, ended September 7. “In addition to seeking growth [en ce qui concerne le nombre d’abonnés et des ventes de] ready-to-cook dishes, we are building a portfolio of new generation brands. »

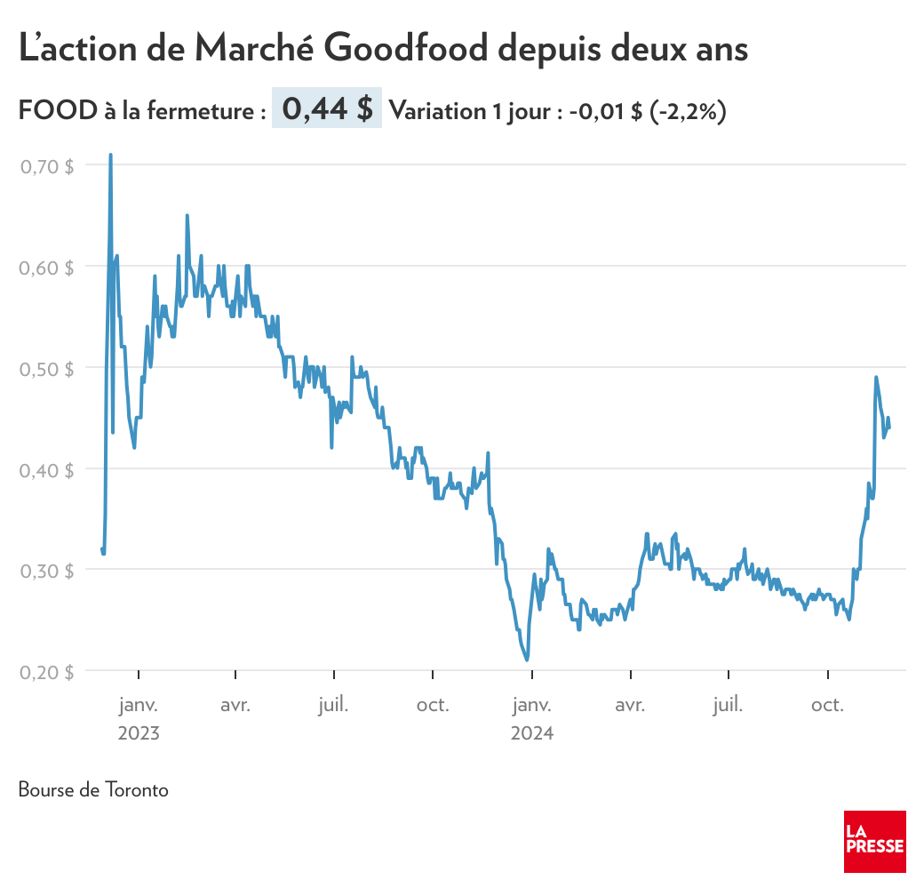

By the big boss’s own admission, the company has literally gone through a crisis over the last two years. Coming out of the pandemic, demand for ready-to-prepare meals plummeted. Then, in the fall of 2022, Goodfood Market ended its online grocery service.

« [Entre 2022 et 2024]we really tried to create a cost structure that could ensure the sustainability of the company. “It’s definitely been a pretty difficult crisis for Goodfood and for our employees,” he admits, as the meal provider celebrates this year’s 10e anniversary of its founding.

PHOTO ALAIN ROBERGE, LA PRESSE ARCHIVES

Jonathan Ferrari, president and founder of Goodfood

The entire meal-ready industry is suffering in unison. The Quebec company Cook it, in financial difficulties, was bought in February by Fresh Prep Foods of British Columbia.

In context, what is the new vision of Marché Goodfood? Offering both affordable meals under $10 for consumers looking to save and having high-end options for those who have deserted restaurant dining rooms, but still want to treat themselves to luxury with a flank steak or a salmon steak.

“An evening in a Michelin-starred restaurant can cost $300 per person and we are able to have these recipes for $30 per person,” explains Mr. Ferrari. It can be a substitute for evenings at the restaurant. »

The company has notably partnered with L’Abattoir, a Vancouver restaurant recommended by the Michelin Guide, to develop ready-to-prepare meal recipes.

Business Acquisition

The acquisition of Genuine Tea, whose products will be available on the Goodfood Market site, is also part of this new strategy. Other companies in Quebec, Canada and perhaps even the United States will follow over the next year, assures Mr. Ferrari. “It’s the 10the Goodfood anniversary. We are thinking about the next 10 years and our growth strategy. The reason why we want to build a portfolio of new generation brands is that we want to use all the expertise that Goodfood has built over the last few years to help companies that are smaller than ours to continue to grow. »

Challenges

Despite this new strategy, Marché Goodfood faces challenges. Its number of active customers – who placed an order in the last three months – fell from 124,000 in January to 100,000 in the fourth quarter, the same number as in the third quarter. Thus, Mr. Ferrari sees it as a sign of “stability”.

Additionally, Goodfood Market generated fewer sales during the fourth quarter. Net sales were 34 million, down 9% from the same period last year. A decline which is explained in particular by the reduction in the number of active customers. The company, however, reduced its net loss. This is 3.16 million, a decline of 14% compared to last year. Reading the financial statements indicates that the amount of debts exceeds the amount of assets, but the cash of 26 million amply covers the repayment of a debt scheduled for next March, an amount of 6 million.

During the quarter, Goodfood managed to break even in terms of cash flow for the period covering the last 12 months at the cost of a drastic reduction in its investments. A level that is unsustainable over a prolonged period and which will therefore have to increase in the future, underlines analyst Martin Landry of Stifel in a note. “Furthermore, we see only limited upside to the company’s operating profit (EBITDA) going forward. Consequently, it is difficult at this stage to see how the company will be able to generate significant cash on a sustainable basis. »

Goodfood and bref

Fondation : 2014

Chairman and CEO: Jonathan Ferrari

Number of employees: 800 across Canada

Head office: Montreal