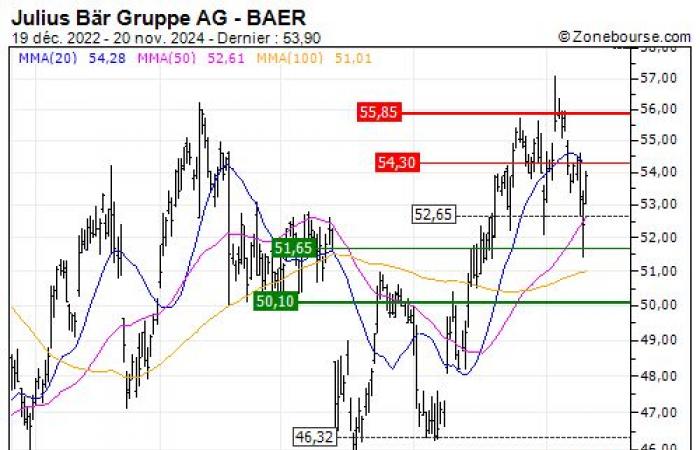

| Entrance course | Objective | Stop | Potential |

|---|---|---|---|

| 53,92 CHF | 60 CHF | 50 CHF | +11,28 % |

Julius Bär Gruppe AG share prices oscillate horizontally. This distribution phase should theoretically give way to a return of volatility.

● The company’s Refinitiv ESG score, based on a ranking of the company relative to its sector of activity, comes out particularly good.

Points forts

● The company’s profit prospects over the next few years are a major asset.

● The company’s business is very profitable thanks to high net margins.

● With a PER at 11.46 for the current financial year and 9.82 for the 2025 financial year, the stock’s valuation levels are very cheap in terms of earnings multiples.

● Investors looking for yield may find this stock of major interest.

● The dispersion of the price targets of the different analysts who make up the consensus is relatively low, suggesting a consensual evaluation method of the company and its prospects.

Weak points

● Based on current prices, the company presents a particularly high valuation level in terms of enterprise value.

© – 2024

This content constitutes an investment recommendation of a general nature, developed in accordance with the provisions aimed at preventing market abuse by the company Surperformance, publisher of Zonebourse.com. More specifically, this recommendation is based on factual elements and expresses a sincere, complete and balanced opinion. It is based on internal or external data, considered reliable at the date of their distribution. Notwithstanding, this information, and this resulting recommendation, may contain inaccuracies, errors or omissions, for which Surperformance cannot be held responsible.

This recommendation, which in no way constitutes investment advice, is not necessarily suitable for all investor profiles. The reader acknowledges and accepts that any investment in a financial instrument involves risks, for which he assumes full responsibility, without recourse against Surperformance.

Surperformance undertakes to disclose any conflict of interest that may affect the objectivity of its recommendations.

Business