How investors could take advantage of the already large and exponentially growing AI market.

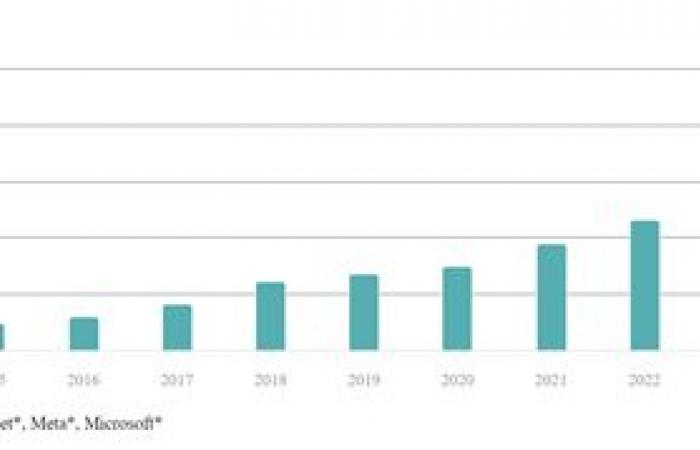

The question of whether artificial intelligence (AI) is an illusion (like virtual reality was not so long ago) or whether it will be a lasting game changer (like the cloud) is no longer really a question. news. AI has already attracted such significant investment (and we expect this to continue) that it has created its own realities. Mag7 companies all have significant exposure to AI and have contributed 42% of the S&P 500’s growth since ChatGPT’s introduction. They are also expected to contribute half of the index’s earnings growth in 2024. Individual AI startups are getting billion-dollar valuations upfront and, well, the investments speak volumes. As the chart shows, the four largest hyperscalers alone already invest more than $200 billion per year.

There’s a lot of money behind AI

*Companies involved in artificial intelligence and big data face intense competition, may have limited product lines, markets, financial resources and personnel. Artificial intelligence and big data companies are also subject to the risks of new technologies and are heavily dependent on patents and intellectual property rights, and the products of these companies may face obsolescence due to rapid development of technologies. Any mention of specific properties or securities is for illustrative purposes only and should not be construed as a recommendation. Sources: company data; Wells Fargo Securities: Company Data; Wells Fargo Securities LLC; Visible Alpha for consensus forecasts; DWS Investment GmbH from August 2024.

However, the big question is whether the huge investments in AI will ever pay off. In the past, pioneers of big innovations rarely made a lot of money. This may be because excess capacity was quickly created or large-scale applications and profitable business models only emerged in a second wave, which is complex because when it comes to AI , we probably haven’t seen the most promising business models yet. The dizzying speed at which AI has developed over the past two years, coupled with the efficiency gains it has already enabled, are likely, despite skepticism, to humble us, showing the incapacity of the market to predict the future potential of AI.

AI applications are expected to continue to grow exponentially despite obstacles such as data security issues, lack of qualitative data, copyright, costs, high electricity consumption and regulation. However, we believe that these challenges are not insurmountable and could provide new business opportunities. Especially since, unlike what happened during the Internet bubble of the 1990s, the large companies that develop new technologies have deep pockets and are fighting for leadership in the sector. “The risk of underinvestment is much higher for us than the risk of overinvestment,” the Google CEO said in July.

However, this increases the risk that individual AI providers will never see a positive return on their investments. “Therefore, we cover and look for winners across the entire production chain of AI and its users,” explains Sebastian Werner, Head of Growth Equities Americas at DWS. Players in the AI production chain include semiconductor companies, data centers, networks, utilities, software, and IT services. Sectors such as pharmaceuticals, consumer goods and manufacturing are leading users. This diversity clearly shows that there is no escaping the demanding task of stock selection. It would be risky to simply invest in all listed AI-related companies given that, in the history of innovation euphoria, the market value of the sector has often significantly exceeded earnings in the medium expected term of the sector.

Since it is not yet clear how big the AI market will one day be, nor which companies will dominate the market and by what margins, we must continue to expect dynamic developments, including on the stock market, and this in both directions. “For investors, this means they can still jump on the AI bandwagon,” says Tobias Rommel, head of IT equities at DWS. This is especially true since valuations today are much lower than in the 1990s, but the absolute size and profitability of tech giants also leaves less room for upside. This is the disadvantage of more mature companies.