With property prices skyrocketing, is your dream of becoming an owner difficult to achieve? How to find the right deal? Could the misfortune of some people make you happy? It depends.

Posted at 1:28 a.m.

Updated at 5:00 a.m.

Where to find finance repossessions?

“The recovery of finance is exercised by the mortgage creditor when the consumer who obtained the mortgage loan defaults on payment,” explains the Organisme d’autoréglementation du courtageimmobilier du Québec (OACIQ). “The lender will exercise the guarantee (the building) which it will put up for sale to reimburse itself; the sales balance must equal the loan amount. »

This type of property is sold without legal guarantee and you will have no recourse in the event of a hidden defect, warns the organization, which advises having a complete pre-purchase inspection carried out and informing the inspector of the situation of the property.

Are you still interested in financial takeovers? Here’s how to find them.

On the Centris website, which presents houses for sale by real estate brokers, you go to the search engine, “filters” section, and you check “finance recovery”.

In the week of October 21, 163 properties were posted there.

By consulting the sheets, we see that there is something for all tastes and budgets.

A house requiring “a little love” “for renovation project” located in L’Ancienne-Lorette for sale at $349,800; a beautiful house in Chambly for $599,000; a magnificent and large house built in 2021 in Notre-Dame-de-l’Île-Perrot for $1,195,000; a very pretty, but small condo, rue de la Montagne, in Montreal, at $579,000.

You will also find court takeovers, also called court-supervised sales. “It is a mortgage remedy which is similar to the recovery of finance, but also applies to other debts and consumer goods,” explains the OACIQ.

On Centris, a 1.3 million house is for sale in Rivière-des-Prairies while in Isle-aux-Allumettes, it is a bungalow built in 2021 and whose basement is not finished , which is listed at $679,900.

On DuProprio, the “financial recovery” search filter no longer exists.

Who sells these properties?

Revenu Québec, Desjardins, the National Bank and BMO explained to The Press that they award property sales contracts to real estate brokers.

“Following a judgment to sell the property, Desjardins sends the listing to a real estate broker to take care of the sales process,” explains Chantal Corbeil, spokesperson for Desjardins Movement, which has 38% market share in Quebec for residential mortgages.

The broker is chosen fairly from a selection of partner brokers who meet the different criteria of the project, she indicates.

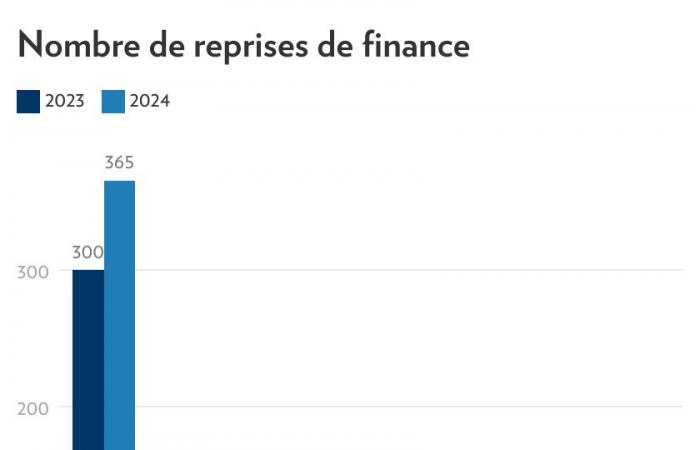

“In the current context, there are around a hundred financial takeovers per year,” explains Chantal Corbeil.

The National Bank, which holds around 13% of the market, did not want to reveal the number of its financial takeovers. BMO, which has about 7% market share, did not share its figures.

Revenu Québec ensures the liquidation of certain immovable property from unclaimed inheritances. Real estate brokers from different agencies are mandated to carry out the liquidation of these properties and there is an alternation between brokers, explains Claude-Olivier Fagnant, from the public relations department at Revenu Québec.

Over the last three years, Revenu Québec has granted 154 brokerage mandates: 51 in 2022, 60 in 2023 and 43 until September 5, 2024.

Are there any sales?

These financial repossessions and legal repossessions are not myths, they really exist and anyone can consult them online. But are these real bargains?

“I no longer see deal in financial recovery, because these are costly procedures,” says Martin Desfossés, real estate broker at RE/MAX Bonjour.

“Trustees and financial institutions want to recover as much money as possible,” continues the broker. There is not only the mortgage balance to pay, but also other costs such as the notary, the locksmith, cleaning, emptying the property and brokerage fees. »

The broker will establish the market value and will receive purchase promises over a period of one to two weeks, unlike what we saw during the pandemic. It is the promise with the best offer and the best conditions that will win.

We still hear people using this big discount myth with the term “financial recovery”. However, the property will trade at the current price. If it is listed at $400,000 and it is worth $500,000, there will be several promises to purchase and it is probably the promise near $500,000 that will win.

Martin Desfossés, real estate broker at RE/MAX Hello

This is also what Marc Lefrançois, certified real estate broker at Royal LePage Tendance, also observes. “In some cases, properties sell for prices a little higher than the market value,” he relates.

“Properties in poor condition will scare some people and these are the ones that will have a smaller pool of potential buyers,” he emphasizes.

“The bank will manage its risk well, it wants to have its price and it does not necessarily want to make bargain to anyone. »

According to Marc Lefrançois, someone who wants to get a good deal by chasing finance takeovers is a seasoned buyer. He must be able to properly estimate the cost of the work; he expects the file to be complicated and without guarantee.

“In a context of financial takeovers,” adds Martin Desfossés, “I prefer an uninhabited property, which has been closed and well preserved. Several situations can happen between the purchase and delivery of the house. If it is still inhabited, it may be delivered with damage. »

How to get a head start before financial recovery?

The real good deals, according to real estate experts, are off-market properties, those that are not yet in the hands of a real estate broker.

The most motivated and investors can search the Land Register by hand for $1 per piece of information. You will find, for example, an indication that the estate takes possession of the house upon the death of an owner. A notice will also be published in the Land Registry if an owner is in default of payment of municipal taxes.

Other information: when the owner of an income property is late in paying the mortgage, his financial institution can take control of the rental collection and a notice is registered in the Land Registry.

“If you spot this type of notice, you can contact the owner to check if you can conclude a “win-win” type agreement”, indicates on his site Immofacile.ca the real estate investor Ghislain Larochelle, who delivers his secrets surrounding real estate in videos on YouTube and through his training.

For those who don’t have time to search, sites offer paid plans to do it for you. The JLR site offers real estate prospecting tools, a generator of comparable property prices and sends you alerts based on your choices.

Its tools are developed with data from the Quebec Land Registry. In particular, you can obtain transaction history, information on past sales in a neighborhood and find previous owners.

The real deals

Among all the information, it is the 60 day notices which are prized and praised by many coachs in real estate.

When an owner has not paid their mortgage for a few months, the financial institution sends them a 60-day notice which is published in the Land Registry.

“As a real estate investor, you have the possibility of contacting this owner in difficulty and offering to carry out a deal “win-win”. In other words, you can offer to buy his property before the bank seizes it,” indicates Ghislain Larochelle on his website.

The Quebec company Mon Prospecteur has made it its business model. She sells you her alerts so you can find these off-market properties and motivated sellers to sell quickly.

“The 60-day notices are indicators that allow real estate investors to find properties that can be sold at a ridiculous price,” indicates the Mon prospecteur site. By knowing why to prospect these types of reviews, discover how to use them to your advantage and complete more transactions to make more profit! », suggests the company.

Be prepared, because it is possible that several seasoned investors have had the same idea and find themselves knocking on the door of this defaulting owner at the same time to offer to buy their property.