US real estate markets are showing signs of stabilization and some residential real estate prices are starting to recover.

Par Nina Midrigan, Investment Manager & Dominique Wagner, Partner de Valvest

Since commercial real estate is highly dependent on financing, it is inherently very sensitive to monetary tightening. The unprecedented speed of aggressive monetary tightening has led to a severe market correction across all real estate sectors. However, in recent months, U.S. real estate markets have shown signs of stabilization and some commercial real estate prices are beginning to recover. This is reflected in the increase in Green Street’s commercial property price index, which has recorded two consecutive months of positive performance. After stopping in 2023, transactions are finally resuming. Although it is difficult to pinpoint the exact timing of the bottom, it is very likely that the issue of higher rates has been fully digested by commercial real estate markets.

The all-weather asset class

Commercial real estate is a very heterogeneous asset class. While rising interest rates have impacted all property types, cyclical and secular trends are constantly evolving and impact different submarkets differently. What is negative for the industrial sector can have a positive impact on retail, or, similarly, trends that drive demand for real estate in suburban areas can have a negative impact on large metropolitan areas. Several American cities have experienced alternating phases of expansion and recession. Take the example of Detroit, which, after being one of the most prosperous American cities, experienced the decline and fall of its population in recent decades, before experiencing a recent economic resurgence and, thus, a revival of its real estate market.

Commercial real estate is a very heterogeneous asset class. While rising interest rates have impacted all property types, cyclical and secular trends are constantly evolving and impact different submarkets differently. What is negative for the industrial sector can have a positive impact on retail, or, similarly, trends that drive demand for real estate in suburban areas can have a negative impact on large metropolitan areas. Several American cities have experienced alternating phases of expansion and recession. Take the example of Detroit, which, after being one of the most prosperous American cities, experienced the decline and fall of its population in recent decades, before experiencing a recent economic resurgence and, thus, a revival of its real estate market.

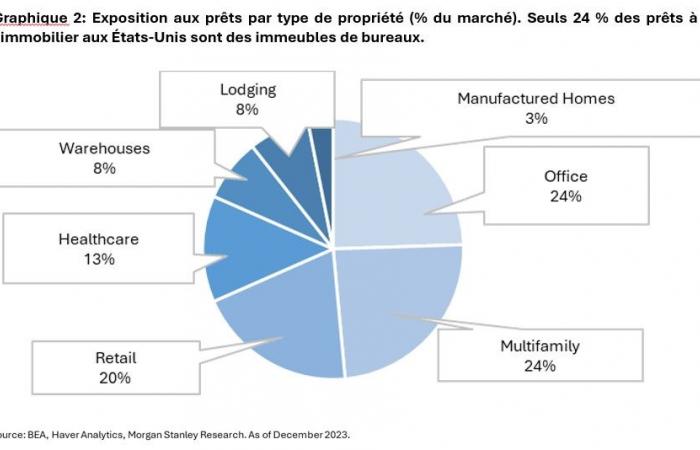

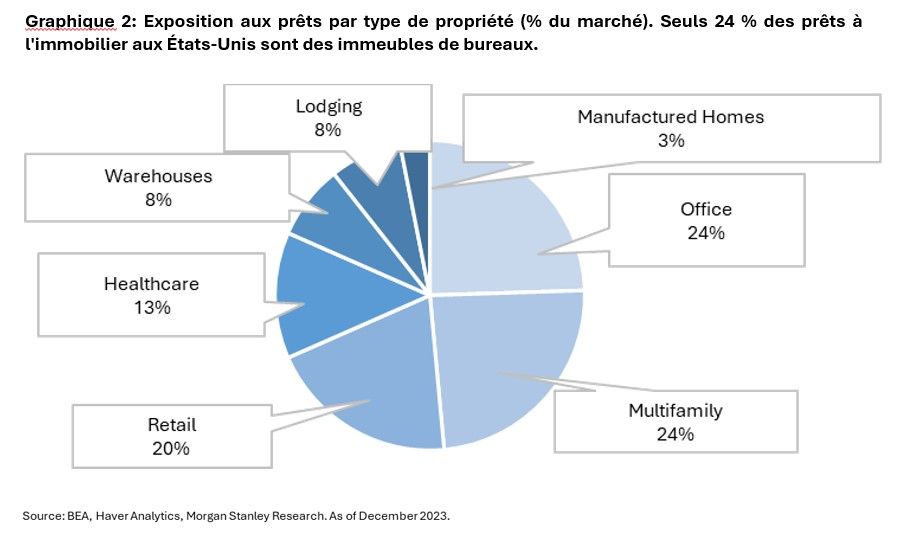

Offices have been making headlines in residential real estate markets for some time now. However, office assets only represent 24% of the huge commercial real estate investment universe and are therefore not representative of the entire market.

Even in the office sector, the picture is not complete if we simply cite the high rates of vacancy and non-payment. Well-equipped Class A and A+ office buildings continue to enjoy strong demand despite the rise of remote and hybrid work. Their valuations will continue to be supported at a time when new office construction has been halted and there is no new supply of high-quality office buildings.

In summary, there are investment opportunities in the market at all stages of the cycle. When problems arise for some owners, other investors see an opportunity and take advantage. A particular niche in the CRE debt market is bridge loans, which provide real estate investors with short-term financing allowing them to take advantage of such opportunities by reacting quickly to reposition and stabilize assets. For lenders, the short-term duration of loans allows rapid adjustment of strategy based on changes in the market environment.

The context remains favorable to lenders

For real estate equity investors, it’s all about interest rates. This is why many investors have until now waited on the sidelines, in order to have more visibility on the peak of interest rates. There is consensus that interest rates will remain high due to a wide range of factors, including deglobalization, the energy transition and the persistent US budget deficit. From a lender perspective, the higher rate scenario for a long time provides an attractive environment and CRE debt should continue to outperform CRE stocks.

Another favorable factor for the CRE debt asset class is the funding gap that has emerged in the CRE loan market. Traditionally, banks have been the main providers of capital in the real estate sector. However, after the Great Financial Crisis, faced with increased regulation, banks significantly tightened their lending standards, limiting supply. On the demand side, an estimated $1.9 trillion in commercial real estate loans are expected to mature through 2027 in the United States. Alternative lenders therefore have the opportunity to step in and fill the resulting financing gap.

Attractive credit spreads

Although spreads for high-quality CRE loans are currently tighter than a few years ago, due to healthy fundamentals, they still contrast favorably with spreads on corporate bonds, which trade at historically narrow levels. Higher credit spreads reflect the increased flexibility borrowers enjoy, as well as the illiquidity premium of these loans relative to public markets.

Although spreads for high-quality CRE loans are currently tighter than a few years ago, due to healthy fundamentals, they still contrast favorably with spreads on corporate bonds, which trade at historically narrow levels. Higher credit spreads reflect the increased flexibility borrowers enjoy, as well as the illiquidity premium of these loans relative to public markets.

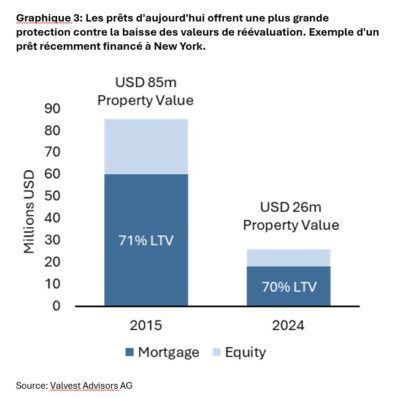

At the same time, CRE loans have lower price risk, as current transaction prices are significantly lower after the correction. Revaluation values provide an excellent entry point for defensive lenders and lower exposure levels. For example, for a 60% LTV loan, prices will need to fall an additional 40% to completely erode the equity cushion and start affecting senior debt.

Opportunities present themselves when valuations fall

With more loans coming due, many homeowners could face hardship even if rates fall. Forced sellers could therefore be more numerous to offer goods on the market at significant discounts, which would offer us financing possibilities.

For example, we have recently financed some excellent deals in the retail sector. With the emergence of the pandemic and the expansion of online commerce, store closures and bankruptcies increased, and investors began to shy away from the retail sector. Many retail brand owners took the chance and acquired the properties they previously rented

For us as lenders, financing such deals meant lower risk due to a low valuation and a borrower with a strong willingness to pay. At the same time, commercial real estate has rebounded significantly, posting historically low vacancy rates.

On the other hand, we have data centers, which have been the darling of real estate markets for some time. Demand for these types of properties exploded, construction skyrocketed, and the value of these assets followed. Data centers are characterized by not being easily adaptable to changing needs and repurposing. Financing such an asset involves higher price risk for the lender – which is not the type of transaction we seek.

The arguments in favor of an allocation to CRE debt in the context of a portfolio

The 60/40 portfolio model, with 60% stocks and 40% bonds, worked well for investors for several decades because of the long bull market that followed the fall from the high interest rates of the 1980s and the negative correlation between stocks and bonds. The regime has changed and with it has come the need for a completely new approach to portfolio allocation and fixed income investing. Investors must find new ways to diversify the risks associated with the increasingly strong correlation between stocks and bonds, and new reliable sources of income.

Offering high rates of return, low duration and low correlation to public markets, a consistent allocation to CRE debt brings value to all portfolios and in all market environments.