As Gatineau prepares to impose a new registration tax to better finance public transit, the City wants to ensure that everyone pays it, including “fake Ontarians”. She is currently working on solutions with the provincial government to flush them out.

THE fake Ontarians

are those people who live in Quebec, but who maintain an address in Ontario in order to benefit from certain tax advantages. They can be recognized in particular by their car which bears a license plate from the neighboring province.

The phenomenon has sparked controversy for several years.

Gatineau on mission to flush out “fake Ontarians”

Photo : -

On May 14, 2024, a resolution asking the City to act to regularize the impacts arising from the presence on the territory of the city of Gatineau of residents who own motor vehicles registered in Ontario

was unanimously adopted by the council.

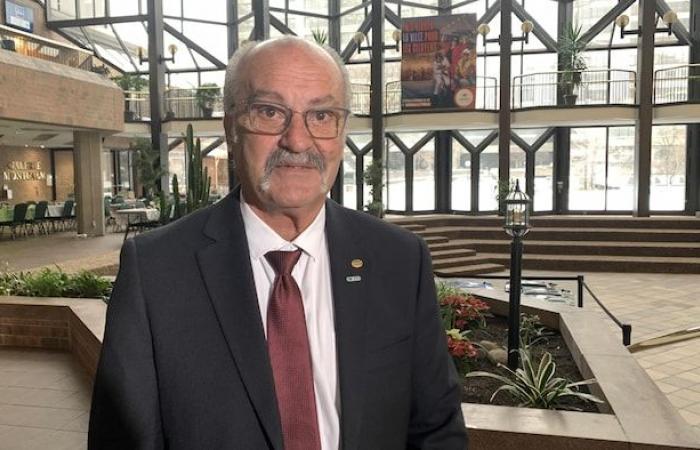

Since I tabled this resolution, I have received a lot of emails

says the advisor and president of the Société de transport de l’Outaouais (STO), Jocelyn Blondin.

He even receives reports containing addresses, he says.

I find it unfair that people come to live here, benefit from the services here, but do not pay for their license plates.

The question is all the more important with the entry into force in 2025 of the tax on registration to finance public transport in Gatineau, insists the president of the STO.

Gatineau motorists will have to pay a registration tax of $60 from January 1 and $90 in 2026. This tax will be indexed each year.

Open in full screen mode

The president of the STO and the municipal councilor of the Manoir-des-Trembles–Val-Tétreau district.

Photo : - / Antoine Fontaine

Mr. Blondin says he wishes let’s move forward as quickly as possible

since the rebate of this tax goes directly to public transport

.

The working committee chimney

Since the adoption of the resolution, a working committee between Revenu Québec and the Société d’assurance automobile du Québec (SAAQ) has been headed by the City.

Several meetings have taken place so far and work is progressing well

responds the City of Gatineau by email.

It’s moving

indicates the mayor, Maude Marquis-Bissonnette. The City and the Quebec ministries will not comment on the proposed solutions before the presentation to the municipal council of the progress of the work table.

Open in full screen mode

In the press scrum, the mayor of Gatineau, Maude Marquis-Bissonnette, ensures that the work of the work table is “progressing”.

Photo : - / Patrick Foucault

This presentation is scheduled for late January or early February 2025.

“Besides, when we went to Quebec” at the end of November, adds the mayor, we had the opportunity to talk about it with the Minister of Transport

.

A problem taken seriously

by Quebec

Contacted by -, Revenu Québec and the SAAQ both stated take the problem seriously

.

Revenu Québec is well to the facts

of the avoidance strategies used by some people

in border regions like Outaouais.

But the phenomenon does not necessarily constitute tax fraud in the eyes of Revenu Québec.

For tax purposes, it is the tax residence status which is the concept used to establish whether there is fraud or tax offense in the presence of Ontario registration plates. Thus, the mere fact of holding a registration plate from a province other than Quebec on Quebec territory does not in itself constitute such fraud or tax offense. […] An individual’s tax residence does not systematically correspond to their address or citizenship, for example

explains Revenu Québec in a written response.

Open in full screen mode

Over the last three fiscal years, Revenu Québec has carried out hundreds of audits regarding tax residence. (Archive photo)

Photo: The Canadian Press / Christine Muschi

The situation is complex: while tax residence is the responsibility of Revenu Québec, registration plates are the responsibility of SAAQ.

Few requests to 311

68 requests were submitted to 311 concerning the phenomenon between November 1, 2022 and August 8, 2024.

Which explains the small number,

according to the City of Gatineau, it is the fact that citizens are instead invited to report specific cases via Revenu Québec’s anonymous reporting system.

Jocelyn Blondin had mentioned the possibility of creating a “special squad”. If this turns out to be the solution envisaged, 311 is going to be flooded with emails, I don’t even doubt it

assures the advisor.

Citizens are starting to get tired of this, we have heard several comments

he laments.

Following a denunciation, Revenu Québec can conduct an investigation and force the guilty parties to comply.

affirms the City by email.

Over the last three fiscal years, Revenu Québec has carried out hundreds of audits regarding tax residence.

These checks are not limited to people who may have used the false address scheme in a border region.

Changing your license plate: what is the rule when moving to Quebec?

According to article 8 of the Highway Safety Code, any owner of a road vehicle who establishes in Quebec must request registration from the Société de l’assurance automobile du Québec (SAAQ) within 90 days. its establishment.