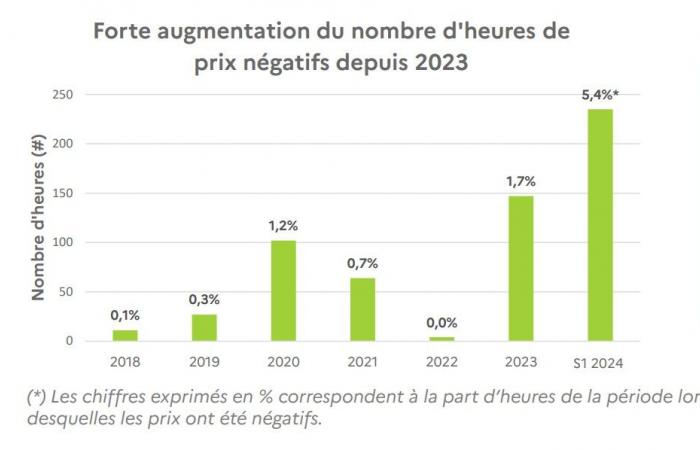

The Energy Regulatory Commission (CRE) has carried out analysis and recommendations on the phenomenon of negative electricity prices in France, following the increase in the frequency of their occurrence. In its report published on November 26, the authority established that hours at negative prices had never represented more than 102 hours per year until 2022 (i.e. 1.2% of the time). Since then, they have represented 147 hours in 2023 (1.7% of the time) and 235 hours for the first half of 2024 alone (5.4% of the time). In the second quarter of 2024, 10.2% of hours were marked by negative prices, with a peak in April (11.7% of hours of the month).

These episodes mainly occur in the early afternoon (between 12 p.m. and 4 p.m., for half of them) and on weekends (two thirds of occurrences). Since the start of 2023 and until the end of the first half of 2024, 45.5% of the 382 negative price hours were hours with prices in the range from -0.1 €/MWh to 0 €/MWh. The other hours are characterized by prices of on average -15.5 €/MWh (minimum at -134.9 €/MWh).

“If negative prices do not result, by nature, from a dysfunction of the electricity system or the market, they may reflect a sub-optimal use of the installed production base, causing an economic loss for the community,” notes the CRE. It therefore considers it necessary to seek the best possible use of production facilities, “in order to reduce the strongly negative prices to a level close to the marginal cost of renewable energy”. Its recommendations therefore relate specifically to support mechanisms, “to the extent that they are important and immediate levers of action for the State”.

Introduce an incentive into purchase obligation contracts

According to the CRE, for installations benefiting from an obligation to purchase contract, this will involve introducing an incentive, in particular through amendments to existing contracts for some of them, and lowering from now on, 200 kW is the threshold from which installations switch to additional remuneration. For installations benefiting from additional remuneration, it will rather be a question of strengthening incentive systems while correcting certain existing biases. In addition to the establishment of a programming obligation in distribution network access contracts, the regulatory body also recommends strengthening the contribution of renewable energy installations to balancing the electricity system. In this, the CRE takes up the main orientations of the transport manager RTE.

For the moment, the incentives differ depending on the mode of support. In 2023, wind and PV production was still mainly composed of parks under purchase obligation (OA). However, these parks are (yet) not subject to any incentive to cut their production in the event of a negative price. For their part, as the CRE specifies in an explanatory document, non-support farms have an incentive to cut off their production in the event of a negative price hour: production during these hours generates negative market income. Certain sales contracts (producer aggregator or producer-consumer) may however provide for a fixed remuneration in €/MWh, without clause relating to negative prices. Similar to OA, the producer then has no incentive to cut production.

The case of assets subject to additional remuneration

Finally, parks receiving additional remuneration have a double incentive to cut their production in the event of negative prices:

• The CR (T-M0) is paid only for the volume of electricity produced by the installation during hours during which the spot price is positive or zero. In the event of production for one hour at a negative price, the marketing of electricity therefore generates losses, as for unsupported parks.

• Furthermore, the producer receives compensation beyond a certain threshold for the occurrence of negative prices (“negative price premium”). This compensation corresponds to remuneration at the level of the reference rate of a normative approximation of the production potential of the installation. The payment of the bonus is conditional on the non-production of the installation. This condition therefore constitutes an additional incentive to stop production.

In 2023, the CRE notes that on average, around 2/3 of the power of the park under additional remuneration goes out entirely (zero production over the hour) in the event of an hour at a negative price (slightly more for wind power than for PV). Facilities that almost never completely shut down in 2023 (

This content is copyrighted and you may not reuse it without permission. If you would like to collaborate with us and reuse our content, please contact our editorial team at the following address: [email protected].