The election of Donald Trump marks a potential turning point for the cryptocurrency sector, which expects more favorable regulation. Supported by significant pro-crypto funds, industry leaders see this victory as an opportunity to unlock the potential of the American market. We talk about it in the Cryptic Analysis, after the essential news to remember this week.

Block 1: Essential news

Trump makes cryptos soar

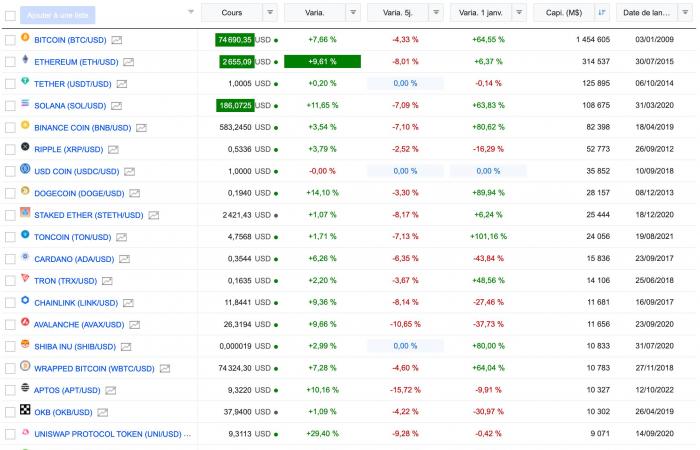

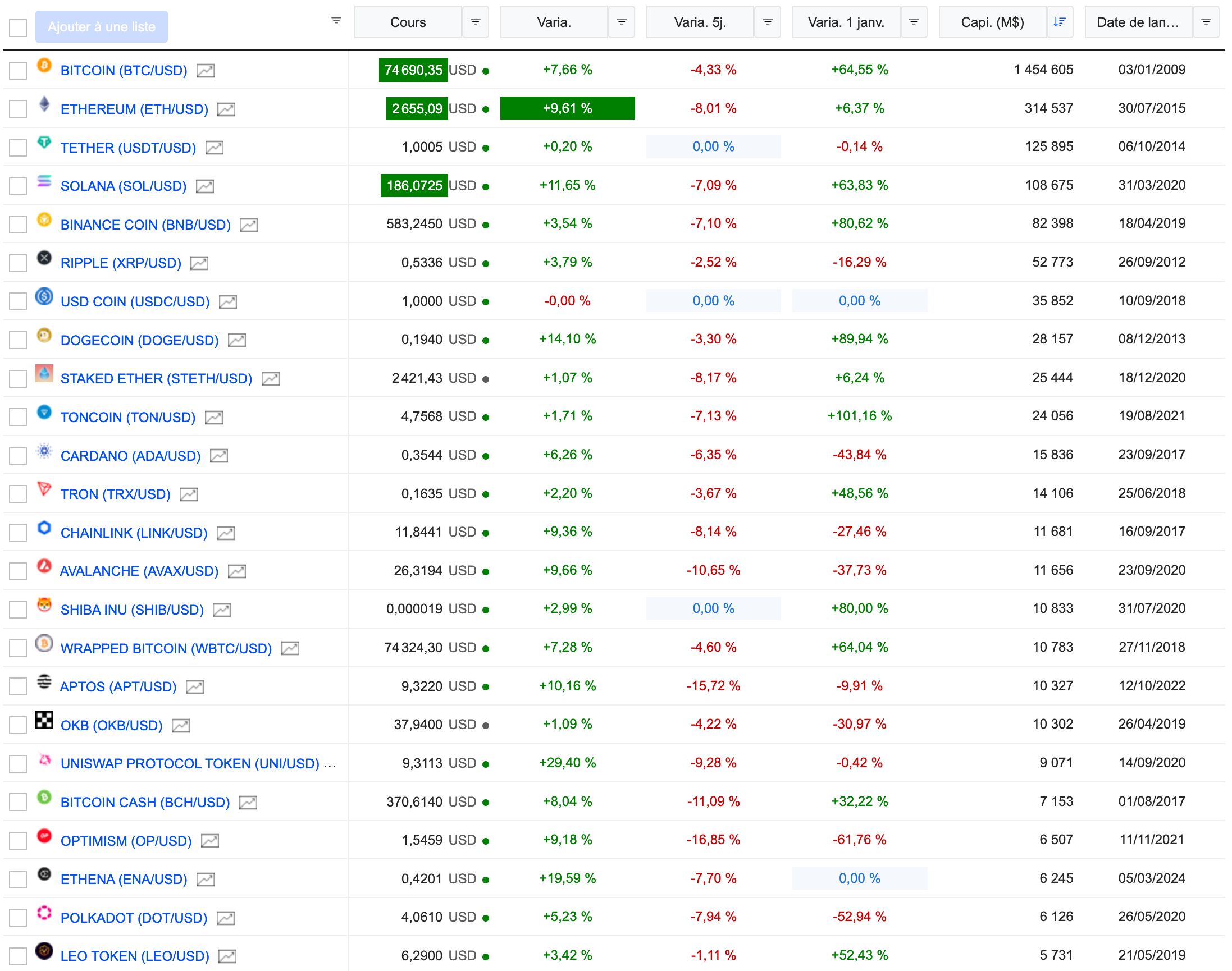

Donald Trump's victory caused the market capitalization of the main cryptocurrencies to soar. Like the bitcoin (BTC) which recorded a new all-time high at $75,000 overnight, up 7.4% over 24 hours. Trump pledged during the campaign to make the United States “the world capital of bitcoin and cryptocurrencies” with an extremely relaxed regulatory framework, unlike the Biden administration which was more reticent on the subject. We also find l’ether (ETH) which increases by almost 10% (2660 dollars), Solana (SUN) at +12% ($187), or even the dogecoin (DOGE) historically supported by Elon Musk, who increased by more than 13% ($0.19).

Zonebourse

Deutsche Telekom has a green thumb with bitcoin

Deutsche TelekomEurope's largest telecommunications company, launches into Bitcoin mining using exclusively surplus green energy. This pilot project, carried out by its subsidiary MMS in partnership with Metzler Bank, uses excess energy produced by renewable infrastructure to power mining operations. Based in Backnang, this project evaluates how wind energy producers could stabilize their production through BTC mining. Deutsche Telekom, already active in blockchain, also operates nodes for networks like Celo and Polkadot and has launched a blockchain service. staking on Ethereum in 2022.

UBS continue de tokeniser

UBS launched a tokenized monetary fund, the UBS USD Money Market Investment Fund Token (uMINT)on the Ethereum blockchain. After an experimental project in collaboration with the Monetary Authority of Singapore last year, UBS continues innovation with this fund, which responds to growing investor demand for tokenized financial assets according to UBS. This initiative is part of the strategy of UBS Tokenize, which had already tokenized structured notes and carried out cross-border transactions of tokenized bonds.

Tether: The king of stablecoins

Tether revealed strong results for the third quarter of 2024, with net profit of $2.5 billion, bringing its annual total to $7.7 billion. Despite these financial successes, the company faces a potential investigation by the US Department of Justice regarding the use of USDT in illicit activities, although its CEO Paolo Ardoino has denied any evidence of this. The quarterly gains came mainly from returns on US Treasury holdings and the valuation of its gold reserves. With a capitalization exceeding $120 billion, Tether continues to consolidate its position as a leading stablecoin, posting excess reserves of more than $6 billion.

Block 2: Cryptic Analysis of the week

With the official election of Donald Trump as President of the United States this Wednesday, the cryptocurrency industry, and its strongest advocates, is preparing for what many see as a new era of opportunity. Trump's commitment to supporting bitcoin miners and other key players in the industry was a strong point of his campaign, and his victory only increased the industry's optimism.

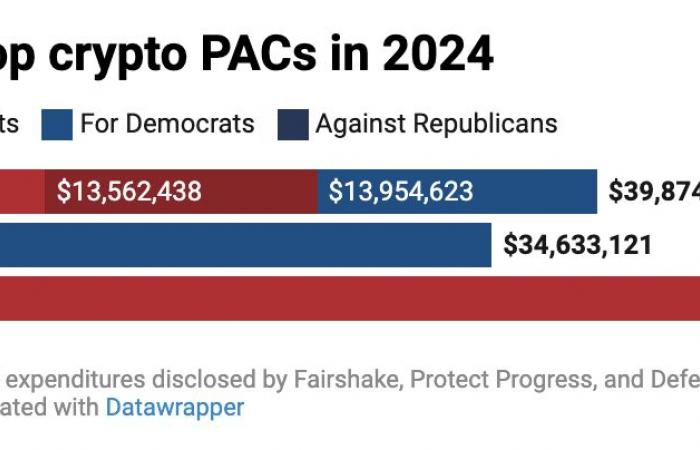

Companies in the sector overwhelmingly supported Trump and other candidates during the election campaign. According to a report from Public Citizen published in August, crypto companies have been by far the biggest political spenders in 2024, with 44% of all corporate funds donated in this year's elections coming from cryptocurrency backers. In total, more than $138 million was invested in pro-crypto super PACs including Fairshake , Protect Progress et Defend American Jobs.

As a reminder, a super PAC, or Super Political Action Committee, is a political financing committee capable of receiving unlimited donations from individuals, businesses, and unions to support or oppose candidates in elections. Unlike traditional PACs, super PACs are not allowed to donate directly to or coordinate with candidates, but they can fund independent campaigns to influence public opinion and election outcomes.

Spending by major crypto PACs in 2024

OpenSecrets

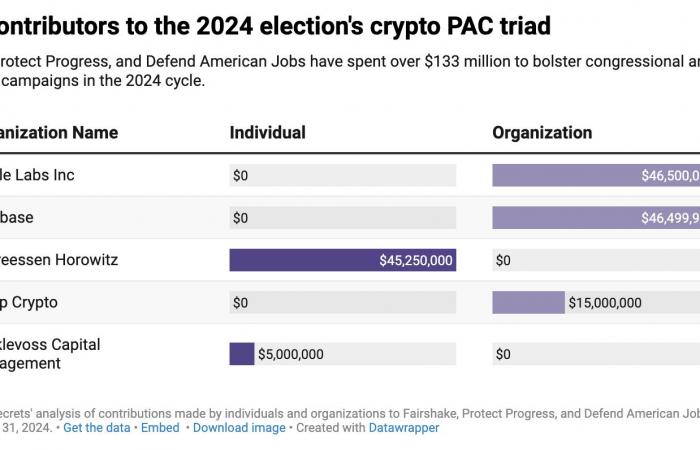

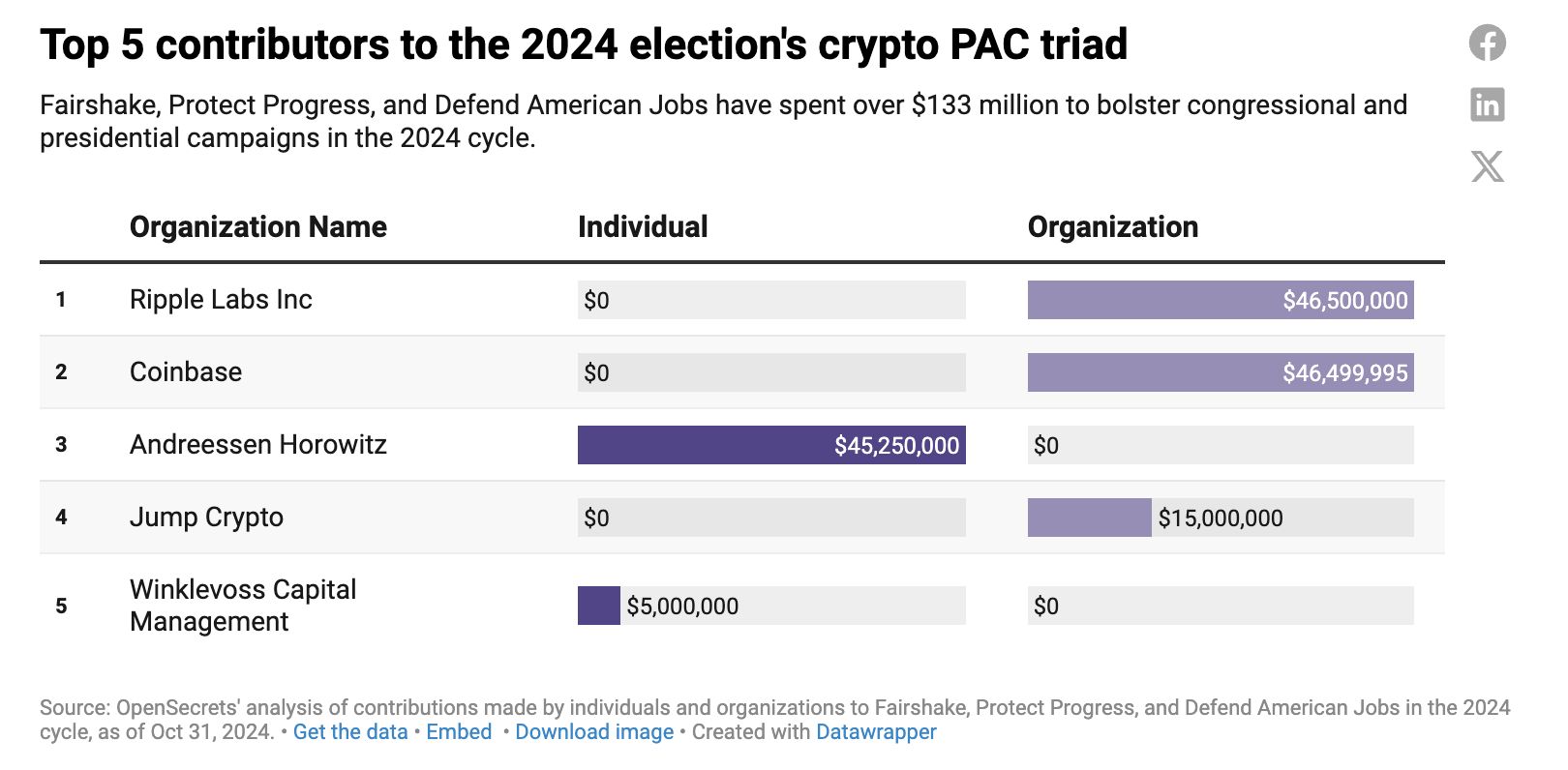

Significant contributions included major industry players such as Coinbase, Ripple and Jump Crypto, who collectively gave around $93 million, while venture capital giant Andreessen Horowitz added $45.2 million. dollars.

Industry leaders, like the Winklevoss twins, founders of the Gemini exchange, also showed their support by contributing $5 million through Winklevoss Capital Management. Figures such as Marc Andreessen and Andreessen Horowitz's Ben Horowitz also supported Mr. Trump's campaign by donating $5 million to Right for America, a pro-Trump super PAC.

Main contributors to PACs

OpenSecrets

With the prospect of a new Trump administration on the horizon, the possibility of reversing control of Congress, and the potential appointment of a new U.S. Securities and Exchange Commissioner, cryptocurrency advocates are determined to elect a crypto-friendly president and members of Congress. As Coinbase CEO Brian Armstrong recently noted in a interview pour CNN : “This will be the most pro-crypto Congress we've ever had”.

Under the Trump administration, Congress is increasingly expected to change its regulatory approach to the sector, particularly with the likely appointment of a new Securities and Exchange Commission (SEC) commissioner. more favorable to the industry. As Mr. Trump pointed out at a major bitcoin conference in June in Nashville: “I will fire Gary Gensler and build an SEC that believes America should build the future, not block it. From now on, the rules will be made by people who love your industry, not those who oppose it.”

Block 3 : Tops & Flops

Cryptocurrency rankings

(Click to enlarge)

Zonebourse

Block 4: Readings of the week

David Marcus: From PayPal President to Bitcoin Fan (Bitcoin Magazine, in English)

Making crypto tokens useful and fair (CoinDesk, in English)