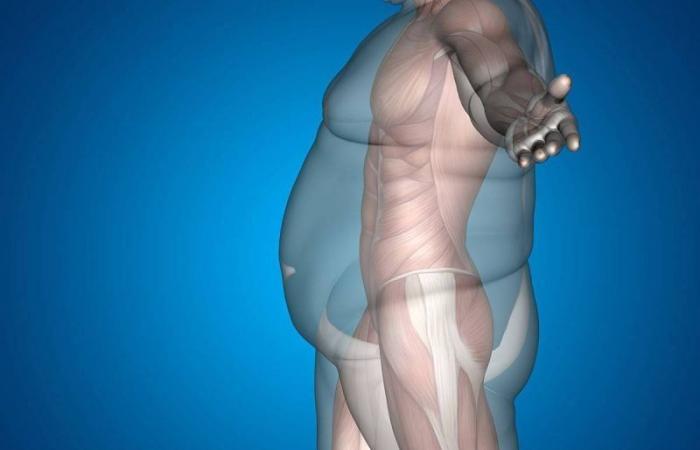

Soon the end of a duel of giants in anti-obesity treatments? Against the backdrop of a possible medical revolution, new players are preparing to attack this booming market, currently dominated by the Danish laboratories Novo Nordisk and the American Eli Lilly.

These treatments, called GLP-1 analogues, are “today the product for which there are the most expectations and perhaps the most fantasies” as well, summarizes Nicolas Picard, manager specializing in health at the CPRAM fund. .

Initially developed against diabetes, these drugs have given unprecedented results in helping to lose weight and are hailed by specialists as a possible therapeutic revolution, even if concerns remain about their side effects and the risk of seeing them taken outside the box. of any medical check-up.

Their rise so far has benefited the groups Novo Nordisk and Eli Lilly, who were the first to emerge in the race. The first is notably the producer of the emblematic Wegovy, based on the semaglutide molecule and the antidiabetic Ozempic.

The fact remains that after a period of euphoria, the market is witnessing “a sort of return to normality”, where investors are now “not necessarily going to play 100% anti-obesity”, estimates Grégoire Kounowski, financial advisor. investment at Norman K.

“There, today, what makes money is anti-obesity, will that be the case tomorrow? Probably, but probably not only,”

he emphasizes.

Cheaper treatments?

The shares of the two pioneers have moved away from their summer peak. Their latest publications have not worked entirely in their favor, according to analysts.

Above all, the market also seems to take into account the arrival of tougher competition.

“Over the next few years, you will see more and more players entering this space. And this will lead to competition and pressure on prices for Eli Lilly and Novo Nordisk,” adds Sean Carroll, equities expert at Janus Henderson.

For the moment, laboratories are often free to set their prices, to the detriment of broader access. These anti-obesity drugs, which produce a feeling of satiety, are not always covered by health insurance, in particular because they are the subject of questions about their long-term side effects.

In this context of non-reimbursement, Eli Lilly has already launched this summer a program of direct sales of cheaper single-dose vials of Zepbound (tirzepatide molecule) in the United States.

It is an initiative taken “in anticipation of increased competition from other players”, who are developing “what could be a new generation of GLP-1”, analyzes Mr. Carroll.

Beyond obesity?

For now, the place of historical actors remains overwhelming. Novo Nordisk, the largest European capitalization, alone represents 74% of the market share in anti-obesity treatments with its semaglutide molecule. The number of patients treated with its GLP-1 analogues (Wegovy and Ozempic) has tripled over the past three years to reach around 11.5 million.

But large laboratories are applying: Amgen, Roche, AstraZeneca or Pfizer. Biotechs too, such as Viking Therapeutics or Zealand Pharma, hope to one day have their share in this market which, according to Goldman Sachs, is likely to reach $100 billion by the end of the decade.

Investors are watching for “the next wave of companies capable of potentially gaining market share” with versions “more easily tolerated and easier to administer” than the current weekly injections, notes Mr. Carroll.

According to Alison Labya, an analyst at GlobalData, “more than 120 GLPR1 drugs are in clinical trials”, with pharmaceutical companies looking to “improve efficacy, extend dosing intervals, target multiple indications beyond diabetes of type 2 and obesity.

“The development of new classes of drugs remains necessary”, and “collective mobilization is essential”, according to Novo Nordisk, whose semaglutide patent expires in 2027 in China, in 2031 in Europe and in 2032 in the United States.

Investors will scrutinize the results at the end of 2024/beginning of 2025 evaluating its CagriSema drug candidate in obesity, a combination of GLP-1 analogue and analogue of another hormone, amylin.

Anne PADIEU/AFP

Soon the end of a duel of giants in anti-obesity treatments? Against the backdrop of a possible medical revolution, new players are preparing to attack this booming market, currently dominated by the Danish laboratories Novo Nordisk and the American Eli Lilly. These treatments, known as GLP-1 analogues, are “today the product on which there is the most…

- -