Despite the recent and future turbulence, there are great opportunities in France, whether via the bond or stock markets, or through structures linked to them.

After sounding the alarm in June, Moody’s has just downgraded France’s sovereign rating by one notch to Aa3. The agency believes that the current political imbroglio will prevent the consolidation of public finances necessary for debt reduction. However, despite the recent and future turbulence, there are great opportunities in France, whether via the bond or stock markets, or through structures linked to them.

Since the dissolution of the National Assembly on June 9, France has been a source of concern for investors. The resulting legislative election created an unprecedented situation of parliamentary deadlock, where three groups oppose each other: the extreme right, the center parties, as well as the coalition bringing together the left, the extreme left and the environmentalists. To try to find compromises and vote on a credible budget for 2025, the French President appointed Michel Barnier as Prime Minister. Coming from the moderate right, certainly a minority, he was one of the few who could hope to garner a majority of support in the chamber. It was a failure. On December 4, his government was overthrown by a motion of censure, once again plunging France into a political impasse and investors into a new phase of uncertainty.

During his last public interventions, Emmanuel Macron expressed his desire to exercise his mandate until 2027, rejecting implicit calls for resignation. He appointed a new Prime Minister: François Bayrou, an experienced political figure and historic partner of Emmanuel Macro. A former minister and former presidential candidate, he is recognized for his ability to navigate the troubled waters of French politics and for his role as arbiter between different political forces. However, his task promises to be difficult. He will not only have to overcome the deep fractures within parliament, but also avoid a new motion of censure, while striving to stabilize public finances.

Investors’ fears are not linked to the political camp of the head of government or parliamentarians, but essentially to France’s budgetary future, the ratings given by the agencies, and corporate tax rates. They are hesitant to expose themselves more to France, while most other Eurozone countries offer more attractive political stability. However, although they have shown greater nervousness in recent weeks, bondholders have not succumbed to panic. The spread between French and German 10-year bonds recently touched 88 basis points, a record since the 2012 European debt crisis.

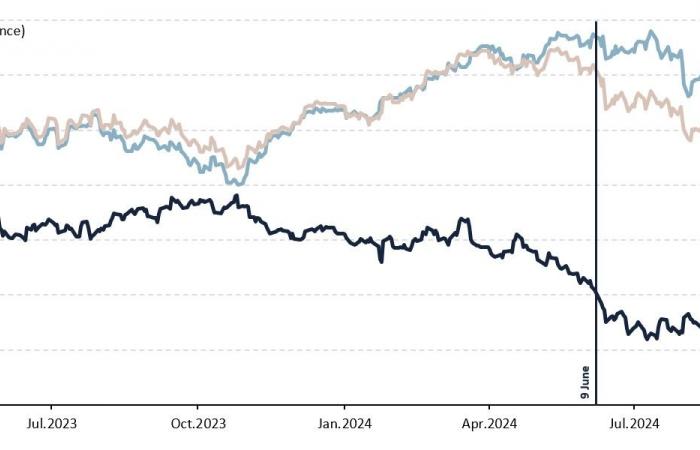

Chart 1 – The political crisis has already cost French stocks dearly

The flagship French equity index, the CAC 40, also showed signs of weakness, underperforming European equities by 14% (see Chart 1). The worries are probably not over. For short-term investors and those who have a strong aversion to risk, a reallocation of assets towards French equities is undoubtedly still premature. Only those who appreciate distressed situations and who have a sufficiently long time horizon will seek exposure to French companies now, believing that it is in uncertainty that the best deals are made.

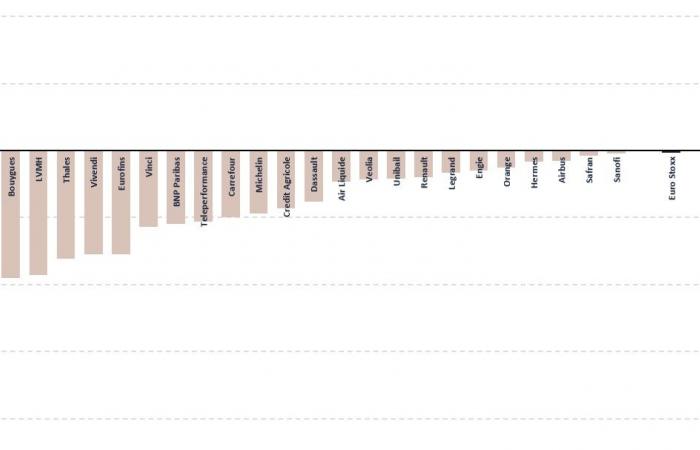

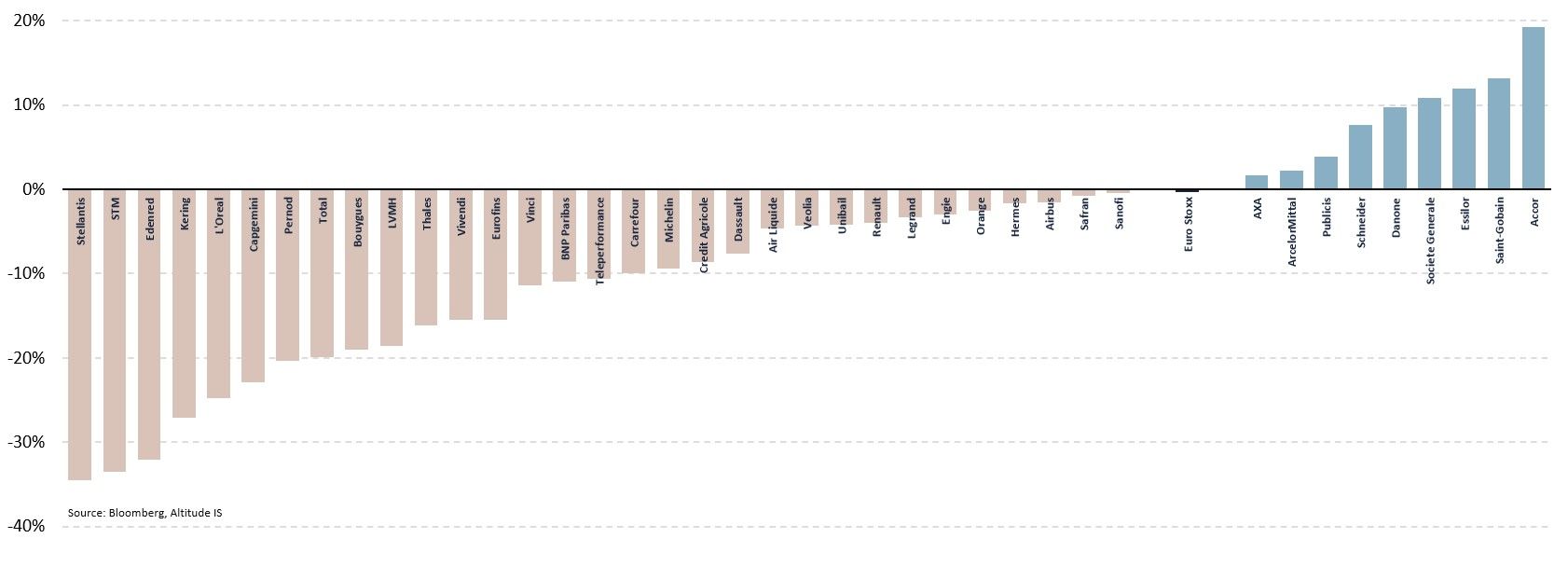

To bring everyone into agreement, it is appropriate to examine the individual performances of French stocks. Among the 40 main listed stocks, only five of them saw their price outperform upon dissolution and progress regularly over the last seven months (see Chart 2). These are Essilor, Danone, Schneider, but also Sanofi and Safran. These companies are little affected by the political and tax situation in France. Each for particular reasons, but also for their low exposure to French growth, they are weathering the current storm.

Chart 2 – Not all companies listed in France have underperformed over the past seven months

As for the companies that suffered the most, such as Stellantis, Edenred, Kering and Bouygues, they should be among those that will bounce back significantly once the storm passes. In this second phase, which will come later, banks, community services and industrial companies will outperform the CAC 40, itself growing faster than its European counterpart. So, although they generated significant initial upheaval, the political events could ultimately prove to be an opportunity for savvy investors.