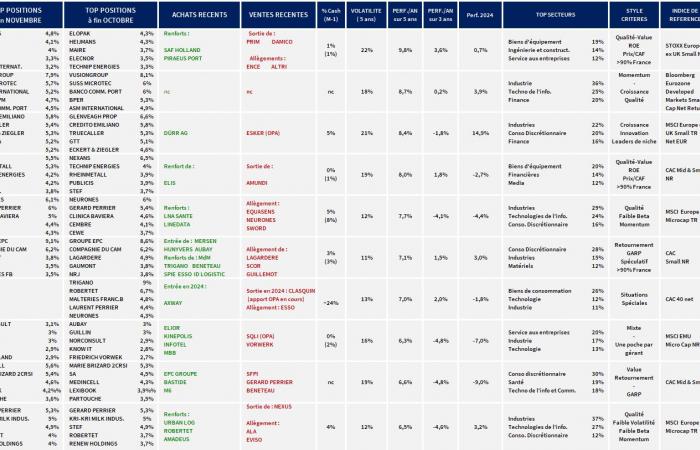

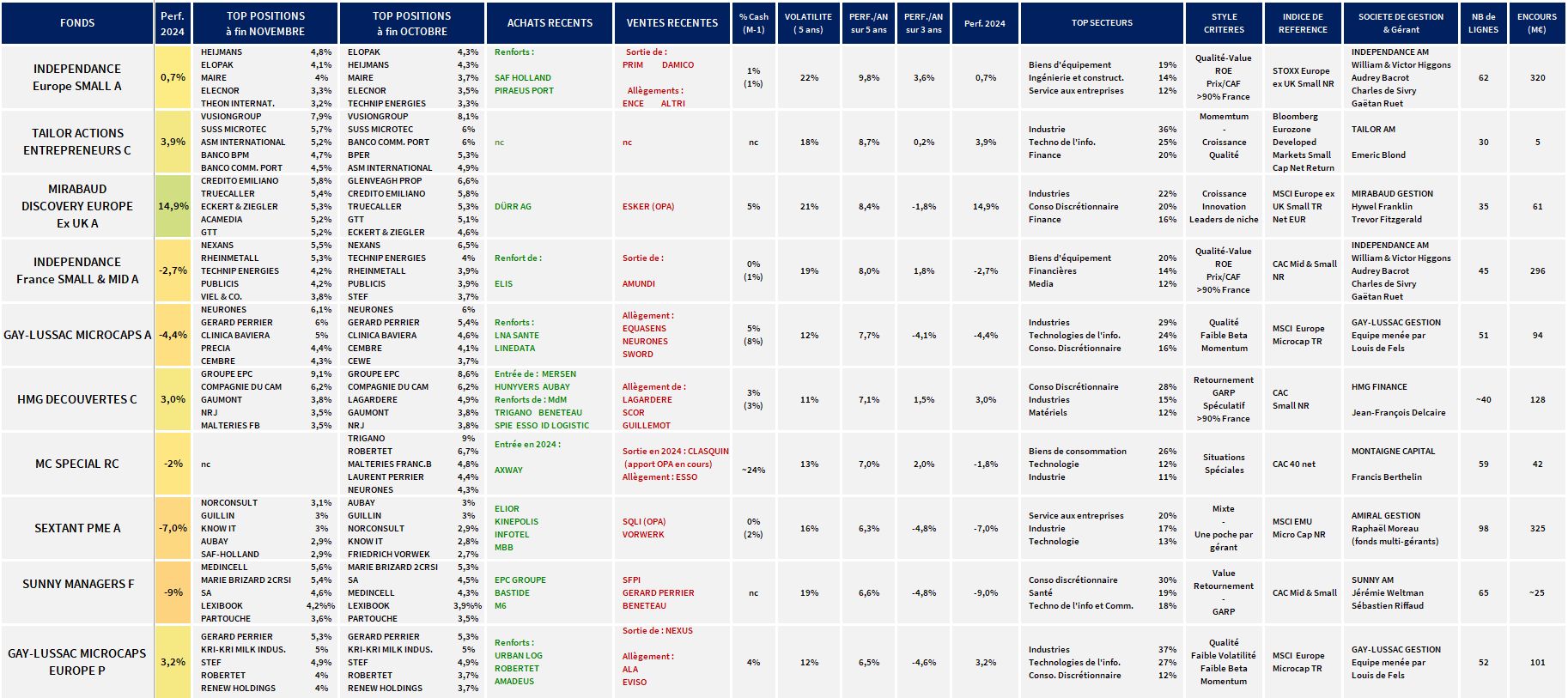

Each month, we examine the monthly activity reports of European small-cap funds (UCIs) and summarize for you in the form of a summary table the latest choices of the best managers. The objective: to help you better select them, better understand their performance, and allow you to easily follow the latest decisions of the best French stock-pickers. And why not take inspiration from it in your own choices of values.

An end-of-year boost?

November will not have deviated from the rule in force in this stock market year 2024: S&P 500 > STOXX 600 > CAC 40 > MSCI Europe Microcaps > CAC M&S.

The election of Donald Trump offers relative visibility in the United States when political uncertainties in France but also in Germany penalize risk-taking in Europe. In terms of economic data, the slowdown in inflation is better anchored than across the Atlantic, the same goes for rates. It must be said that activity indicators (PMI, consumer confidence) remain poorly oriented, like the manufacturing PMI index which came out this morning at 41.9 in France (lowest in 55 months) and 45.2 in the euro zone.

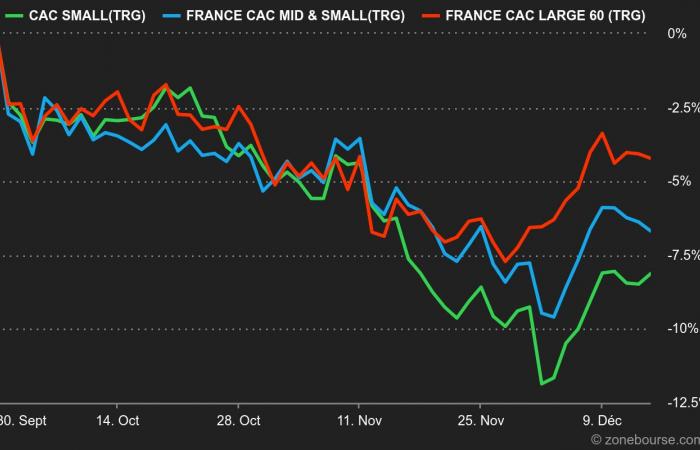

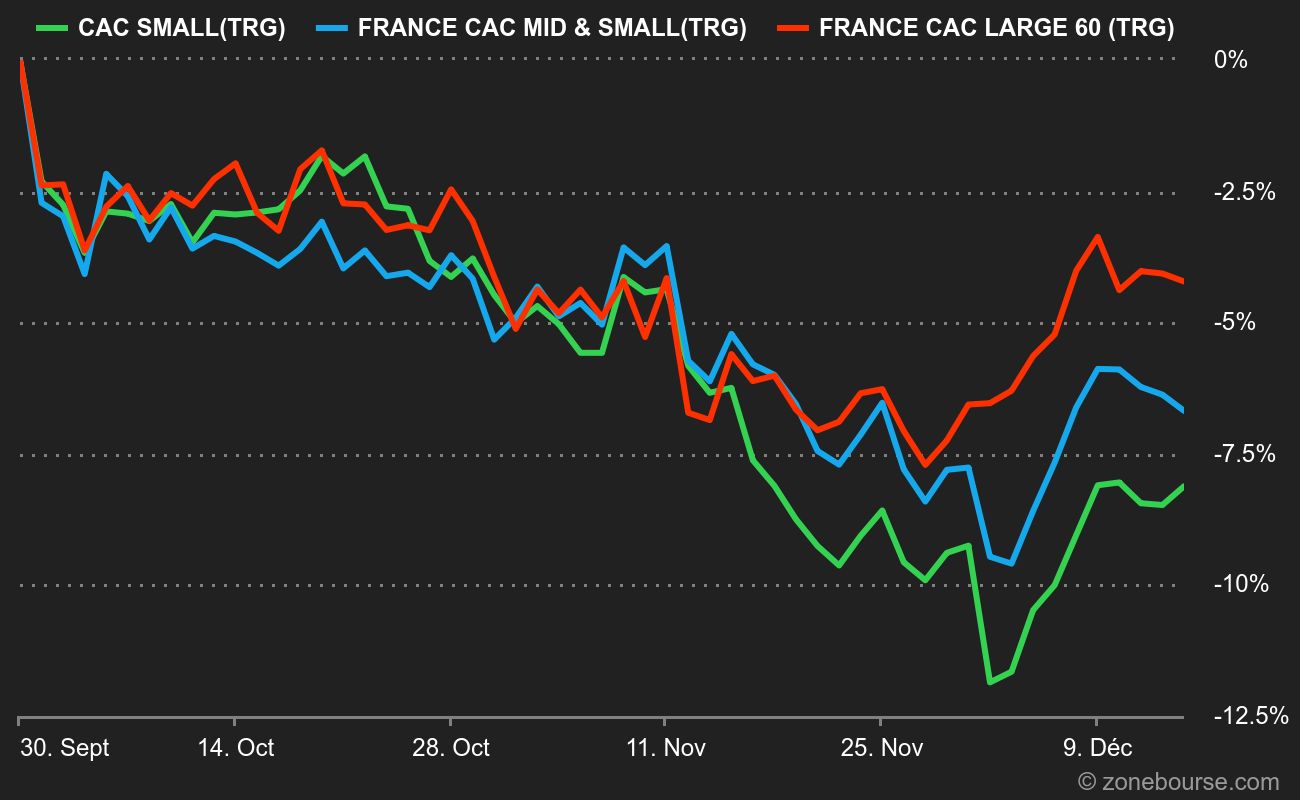

The valuations of small and medium-sized stocks may be low, but that is not really the point: flows remain concentrated on large American technology stocks, so that on both sides of the Atlantic small stocks underperform. the large ones as shown in this graph (source Portzamparc as of 9/12/24).

In terms of IPOs and takeover bids, Odyssée Technologies, an industrialist from Doubs whose founding president does not hide his personal interest in investing in the stock market, has successfully entered the stock market. Very warm welcome also for Lighton in the field of AI. For once, no OPRA but the year has already been rich in this area…and unfortunately the delistings (Wedia, Orapi, SQLI, 1000Mercis, Alpha Mos…) and legal proceedings in progress (Réalités, Mare Nostrum, Gaussin…) are numerous. Note that Louis Hachette Group, resulting from the split from Vivendi, made its debut this morning with fanfare on Euronext Growth.

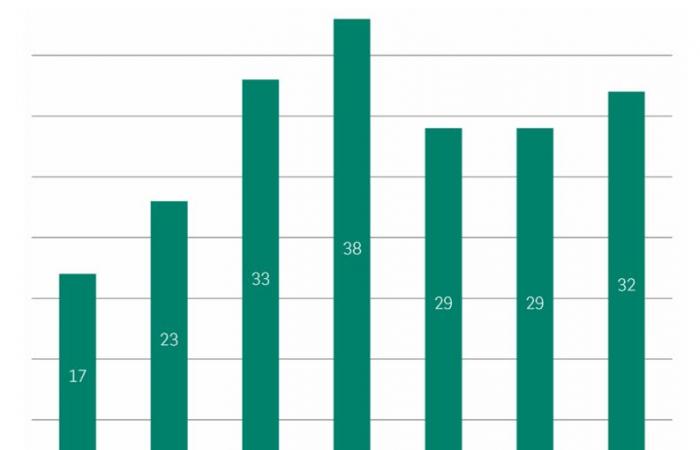

Number of annual public offerings on the Paris Stock Exchange

Let’s hope that the surge at the beginning of December presages a rally at the end of the stock market year, just to limit the damage and regain hope for “2025, the year of the return of small caps”?

Evolution, dividends included, of French stock indices by capitalization size since 1is November 2024

General remarks

(Source: Quantalys, monthly report from management companies)

Generally speaking, we notice that:

- The funds in the selection showed an average performance of zero at the end of November. The fund Mirabaud Discovery Europe ex UK (+14.9% in 2024), poorly positioned in France and micro-caps are far ahead, at +14.9%.

- Among the files held by our selection of funds, we notably list GTT, Hexaom, Medincell, Groupe EPC, Fountaine Pajot, Wavestone, Sword, Aubay, Neurones, Robertet, Trigano, Guillin, Precia, Mersen, Maire Tecnimont, Clinica Baviera, Theon International, Stef.

The latest arbitrations from the pros

- Independence Europe Small During the month of November, the Independance Europe Small fund sold its investments in the Prim and D’Amico companies. The fund was lighter in Ence and Altri. Conversely, Europe Small strengthened its investments in SAF-Holland and Piraeus Port Authority. Independence France Small & Mid benefited from the 32% increase in Rheinmetall (ambitious 2027 objectives (doubling of turnover vs. 2027) strongly contributed to the resilience of the portfolio in November. The Amundi line was sold, the increase in the share of ETFs in portfolios resulting in pressure on margins.

- Gay-Lussac Microcaps thus appears to be in decline (A share -2.5% in November) “despite the overall quality of the securities in the portfolio. On the purchasing side, we strengthened our LNA Santé line, also initiated by a new sell-side analyst during the month. The company, operating in a depressed sector, nevertheless appears to us to be poorly valued in view of its fundamentals and the prospects for growth in home hospitalization. For identical valuation reasons, we also strengthened our positions in Linedata and Freelance.com. On the sales side, we sold part of our Equasens shares after the unpleasant surprise in the third quarter. Clumsy communication from management seems to have misled the market about expected growth. We finally trimmed positions like Neurones and Sword in line with our risk budget management. Gay-Lussac Microcaps Europe has “strengthened itself on already existing values, in particular on the Urban Logistics, Robertet and Amadeus FiRe lines. The English company Urban Logistics continues to be, in our eyes, too penalized by this rate environment. The discount on NAV is excessive for this real estate company which benefits from a quality portfolio strategically located for significantly lower debt than its Belgian or Dutch counterparts. Management is aware of this and has initiated a share buyback program to take advantage of this discounted valuation. We continue to think that 2025 could be a year of inflection for Urban Logistics, with the materialization of new rate cuts and the ultimately arrival of a more favorable context for nested European real estate companies like this one. The French company Robertet finally saw DSM Firmenich initiate an investment during the month on the 22% of capital held through shares and certificates. We view this operation favorably, part of this investment directly improves the liquidity of the stock which was still weak, while the family was able to strengthen its participation in the capital. This improvement in the free float should allow the stock to reduce this valuation discount which is still strong relative to other players in this segment. “

- HMG Discoveries has strengthened Trigano “while this group is preparing to benefit from the acquisition of the mobile home activity of Bénéteau, or in Spie to take advantage of the prices that we consider attractive. We also note additional lines in ID Logistics ( contractual logistics), in Esso (refining) or in Maisons du Monde No less than three new lines joined the portfolio this month, all having previously been owned by. HMG Discoveries : Mersen, specialist in electrical insulation solutions for industry, whose share price has lost more than 40% of its value in a few months in a context of declining values linked to the energy transition; Aubay, remarkable leader in IT consulting, for a mainly banking clientele, which sees the start of a recovery in its market; and finally Hunyvers, a small player in the distribution of motorhomes, and now in boating (sales and maintenance). Reductions were made in Scor (reinsurance), in Lagardère, and more marginally in Guillemot (accessories for simulation video games).

- Tailor Actions Entrepreneurs saw “the themes of Defense (Leonardo, Renk), construction and basic materials (Buzzy Unicem)” as well as Redcare Pharmacy, Kontron, Banco BPM performing very well. “Other stocks performed much less well, notably French stocks, France continuing to be arbitraged away by investors, which led to disproportionate declines in view of operational performances (Elis, Nexans, Mersen, ID Logistics).”

NB: the funds have been selected according to their performance over a long period (we have chosen a duration of 5 years, the duration generally used for investment in equity funds), their volatility and their heavy weighting in small French stocks (minimum 20% of the fund).

Business