Eighteen months after its inauguration, what was presented as the jewel of Lion Électrique – its battery pack factory in Mirabel – finds itself in neutral while the manufacturer of school buses and electric trucks must find money by the end of the week, learned The Press.

Published at 5:00 a.m.

According to our information, the decision to halt production was taken last Friday. However, this is not a closure of the place. We continue to find employees handling the inventory inside.

At the cutting edge of technology, this 175,000 sq. ft. automated plant2 (16,260 meters2) assembles the batteries that equip the vehicles assembled in its factory in Saint-Jérôme, in the Laurentians.

The complex was able to emerge from the ground thanks to loans totaling 100 million granted by the Trudeau and Legault governments in 2021. For the Quebec manufacturer, it was the tool that would allow it to better control its production costs in addition to reduce its dependence on foreign suppliers.

This was to result in the creation of around 135 jobs over two years.

The plant can supply the equivalent of 5,000 vehicles per year. The problem: Lion’s deliveries are moving away from this target. After the first three quarters of the current financial year, they declined by 42% in one year, to stand at 386 units — 350 school buses and 36 trucks.

PHOTO HUGO-SÉBASTIEN AUBERT, LA PRESSE ARCHIVES

At the cutting edge of technology, the Lion plant in Mirabel has the capacity to supply up to 5,000 vehicles per year. The manufacturer’s deliveries are still far from this threshold.

It is in this context that Lion must ease up on Mirabel. The latter did not announce it publicly. Asked whether production had ceased at the battery pack factory, the company said it was unable to offer details.

“At this time, we cannot comment,” wrote vice-president of marketing, communications and public affairs Patrick Gervais in an email.

At the passage of The Press At the scene, early Monday afternoon, activity seemed to be fairly slow. There were only about twenty vehicles in the factory parking lot and there were no trucks parked in the spaces reserved for handling. The picture was similar at the innovation center, an adjacent complex. There was nevertheless activity.

Once built, Lion sold its battery factory to the property trust in a sale-leaseback transaction for 28 million. According to our information, the Quebec company always honors its rent.

To sell off its surplus batteries, Lion announced last July that it was looking for external customers. By the own admission of the founder and CEO, Marc Bédard, this strategy was going to take time to implement.

“That will be for next year,” he explained in July, in a telephone interview with The Press. This is not one of the short-term stories. This is why we estimate that it will start somewhere in 2025.”

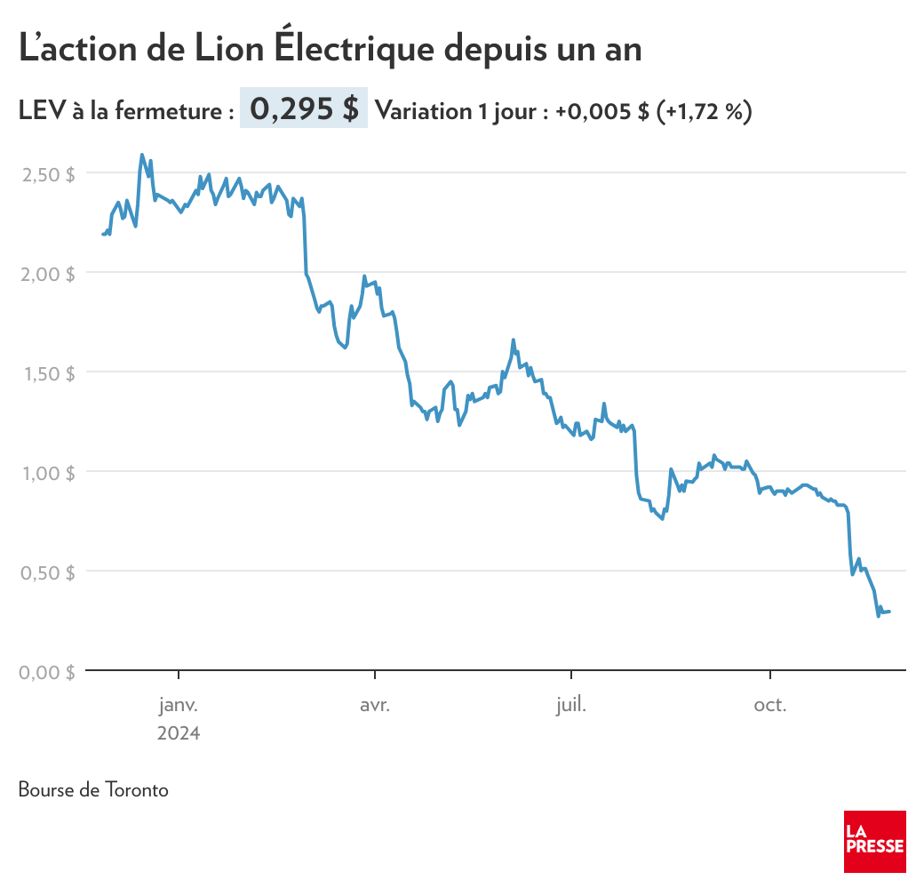

A far from ideal scenario when time is running out to replenish the coffers. Lion recently warned it could run out of money in less than a year if it fails to refinance. All scenarios are on the table, including a sale by the manufacturer. The title suffered on the stock market.

Countdown

The next few days promise to be decisive.

A loan of 23 million granted by the Caisse de dépôt et placement du Québec (CDPQ) and Finalta Capital matures on Saturday. If the company does not find money by then, it will not be able to repay the amounts owed to its lenders.

Added to this is the end of a grace period which currently allows the manufacturer to be entitled to relaxations on the conditions with regard to a loan of US 117 million taken out with a banking syndicate.

Lion is fighting for its survival while the electric shift is taking place less quickly than expected, which is particularly reflected in its orders for electric trucks. In this niche, its deliveries also plunged by 50% at the end of the first nine months of the year.

In addition, in the rest of Canada, school bus deliveries are at neutral. The company points the finger at the inflexibility of Infrastructure Canada’s Zero Emissions Public Transit Fund (ZFTF).

This program can cover up to 50% of costs when a school transporter electrifies its vehicle fleet. The company believes that the delays are too long before school transporters can have an idea of the financing that will be granted to them, which slows down its deliveries.

In addition, south of the border, the election of Republican Donald Trump, less favorable to the electrification of transport compared to the Biden administration, risks complicating the task for the Quebec manufacturer, who already has a steep slope to climb.

“Given the company’s current situation and the uncertainty caused by a future Trump administration for federal funding for electrification, we are skeptical about the chances of Lion converting opportunities into business opportunities,” said analyst Kevin Chiang of CIBC World Markets in a recent note sent to his clients.

As of September 30, which marked the end of the third quarter, Lion had access to approximately US$27 million in cash. To tighten its belt, the company carried out several waves of layoffs and layoffs in Canada and the United States, which reduced its workforce to around 750 employees.

South of the border, the firm is also looking for a way to sublet a portion of its 84,000 m complex2 [900 000 pi2] located in Joliet which was to serve as an assembly line in a context of demand well below expectations.

With the collaboration of Richard Dufour, The Press

Public money in Lion Électrique:

- 2008—2021: 7 million in grants from the Quebec government for research and development

- 2021: 19 million from Investissement Québec (IQ) for the purchase of shares

- 2021: 100 million in loans from Quebec and Ottawa

- 2022: 15 million in loan from the Caisse de dépôt et placement du Québec

- 2023: 98 million loaned by IQ and the FTQ Solidarity Fund

- 2024: 7.5 million in loan from the Quebec government

Learn more

-

- 67 millions

- Market value of Lion Électrique at the close of markets on Monday

Source: Toronto Stock Exchange

- May 7, 2021

- Date on which the manufacturer entered the New York and Toronto Stock Exchanges

Sources: New York and Toronto Stock Exchanges