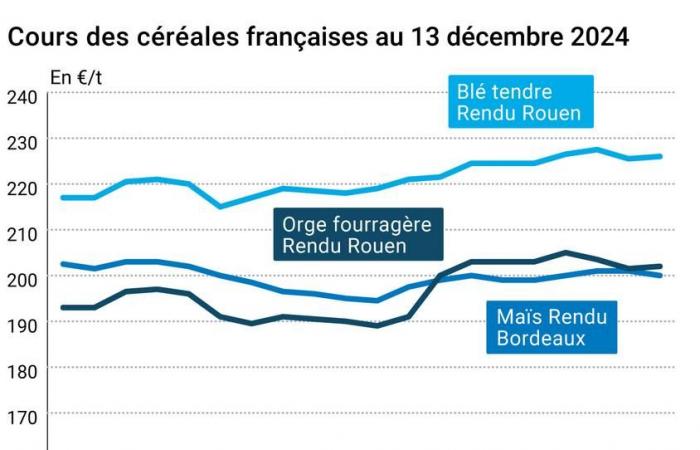

THE prix wheat bowed on the CBOT between December 12 and 13, as well as those of American corn in Chicago and corn on Euronext. Only European wheat fared well, closing slightly higher. On the walk physical French, the quotations of wheat and barley gained 0.5 €/t (rendered Rouen) while those of corn lost 1 €/t (rendered Bordeaux).

The question of the Chinese request in cereals weighed on world prices of wheat and corn, while the government announced harvests up respectively 2.6% in wheat and 2.1% in corn from one year to the next. The figures ofexports disappointing weekly UNITED STATES as well as the rise of the dollar against competing currencies, under pressure from inflation in the country, also had a downward impact on the prices of wheat and corn on the CBOT.

To find out everything about agricultural market news, click here

In the main markets in wheatnote the upward revision of the harvest estimate in the west of theAustralia by the Grain Industry Association of Western Australia (Giwa). The degradation of the quality of Australian wheat by rain at the end of the cycle weighs on local export prices. The ports are currently occupied by exports of canola and the focus is currently not on wheat.

To UNITED STATESrains in the SRW wheat growing area also pushed prices down in Chicago.

Canadian wheat exports were down from one week to the next, for a cumulative decline in the 2024-2025 campaign compared to the previous year.

Deliveries of Russian wheat to the Syria were suspended due to uncertainty over the new government and payment delays, Russian and Syrian sources said on Friday, reported by Zone Bourse. The data relating to transport maritime showed that two ships transporting Russian wheat destined for Syria had not reached their destination.

In Europewheat prices on Euronext found support in thetender Saudi launched for 595,000 t. The Russian export tax and the recent price increase in Black Sea make Russian wheat uncompetitive, and this could open up some prospects for French wheat.

The SovEcon firm also forecasts a 17% drop in Russian wheat exports in December compared to November, and the Ukrainian producers' association expected a rise in prices in December.

On the side ofUkraineprecipitation has increased soil moisture, but the situation remains worrying. Exports are going well in cereals and marked an increase of 32% year-on-year on the cumulative figure as of December 13. In wheat, 57% of the exportable surplus has already been shipped outside the country, according to the Ministry of Agriculture.

On the side of importers, theEgypt concluded an agreement with the United Arab Emirates to finance soft wheat imports. Algeria plans to impose a ban on durum wheat imports in 2025 to reduce its dependence.

Complicated navigation on the Moselle due to a damaged lock in Germany also supported European prices.

In butthe upward revision of the Ukrainian grain harvest by the Ministry of Agriculture weighed on European prices. Attention was mainly focused on theArgentinewhere plantings are now 55% complete, according to the Buenos Aires Stock Exchange. If the growing conditions estimates remain good for the moment, the Cordoba region would be prey to a water deficit which could prove worrying if it continues.

To find out everything about the latest news from professionals in the grain sector, click here

Fundamentals:

- China, wheat, production : 140.1 Mt in 2024 compared to 136.6 Mt in 2023 (source: Chinese government);

- China, corn, production : 294.9 Mt in 2024 compared to 288.8 Mt in 2023 (source: Chinese government);

- Australia, wheat, production : 10.8 Mt in Western Australia compared to 10.3 Mt previously (source: Western Australian Grain Industry Association);

- Ukraine, cereals, production : 55 Mt against 54 Mt previously (source: Ministry of Agriculture);

- Argentina, corn, sowing : 55% of surfaces and 98% in “good to very good” conditions (source: Buenos Aires Stock Exchange);

Commerce international :

- Ukraine, wheat, exports : 9.175 Mt as of December 13 for an exportable surplus estimated at 16.2 Mt (source: Ukrainian Ministry of Agriculture);

- Ukraine, corn, exports : 7.969 Mt as of December 13 for an exportable surplus estimated at 20.5 Mt (source: Ukrainian Ministry of Agriculture);

- Canada, wheat, exports : 360,200 t the week ending December 8 compared to 478,500 t the previous week, 7.271 Mt since the start of the campaign compared to 7.543 Mt in 2023-2024 (source: Canadian Grain Commission).

French physical markets from December 13, 2024 (July base for cereals)

| Soft wheat | Specifications | Due date | euro/t | | Variation |

| Dunkirk rendering | 220/11 miller Harvest 2024 | Jan-Mar | 227,00 | N | 0,50 |

| Rendering La Pallice | 76/220/11 Harvest 2024 | Jan-Mar | 227,00 | N | 0,50 |

| Rendering Rouen | 76/220/11 Harvest 2024 | Jan-Mar | 226,00 | N | 0,50 |

| Pontivy/Guingamp rendering | forage 74 kg/hl base, 72 kg/hl mini Harvest 2024 | Dec-Mar | 222,00 | N | 0,50 |

| Fob Moselle | miller Harvest 2024 | Dec-Mar | 232,00 | N | 0,50 |

| Fob Rouen | FCW Superior A2 class 1 major. included Harvest 2024 | dec. | 234,85 | | 0,00 |

| | FCW Medium A3 class 2 majo. included Harvest 2024 | dec. | inc. | | |

| Fob La Pallice | FAW Superior A2 class 1 major. included Harvest 2024 | dec. | 236,05 | | 0,00 |

| Departure from Marne | BPMF 220 Hagberg Harvest 2024 | Jan-Mar | 227,00 | N | 0,50 |

| Departure from Eure/Eure-et-Loir | BPMF 76 kg/hl Harvest 2024 | Jan-Mar | 221,00 | N | 0,50 |

| Departure South-East | miller Harvest 2024 | Jan-Mar | 235,00 | N | 0,00 |

| Durum wheat | Specifications | Due date | euro/t | | Variation |

| Rendering Port-la-Nouvelle | semolina standards Harvest 2024 | Dec-Mar | 295,00 | N | 0,00 |

| Departure from Eure/Eure-et-Loir | semolina standards Harvest 2024 | Dec-Mar | 285,00 | N | 0,00 |

| Departure South-East | semolina standards Harvest 2024 | Dec-Mar | 285,00 | N | 0,00 |

| But | Specifications | Due date | euro/t | | Variation |

| Bordeaux rendering | Harvest 2024 | Dec-Mar | 200,00 | N | -1,00 |

| Rendering La Pallice | Harvest 2024 | Jan-Mar | 200,00 | N | -1,00 |

| Pontivy/Guingamp rendering | Harvest 2024 | Dec-Mar | 206,00 | N | -1,00 |

| Fob Bordeaux | Harvest 2024 | Dec-Mar | 204,00 | N | -1,00 |

| Fob Rhin | Harvest 2024 | dec. | inc. | | |

| | Harvest 2024 | Dec-June | 218,00 | N | -1,00 |

| Departure South-East | Harvest 2024 | Dec-Mar | 209,00 | N | -1,00 |

| Feed barley | Specifications | Due date | euro/t | | Variation |

| Rendering Rouen | 62-63 kg/hl Harvest 2024 | Jan-Mar | 202,00 | N | 0,50 |

| Pontivy/Guingamp rendering | Harvest 2024 | Dec-Mar | 205,00 | N | 0,50 |

| Fob Moselle | without limit. orgettes Harvest 2024 | Jan-Mar | 193,50 | N | 0,50 |

| Departure from Eure/Eure-et-Loir | Harvest 2024 | Jan-Mar | 192,00 | N | 0,50 |

| Departure South-East | 62/63 kg/hl Harvest 2024 | Jan-Mar | 213,50 | N | 0,50 |

| Malting barley – Winter 6 rows | Specifications | Due date | euro/t | | Variation |

| Fob Creil | Faro 11.5% max Port 500 t Harvest 2024 | Jan-June | 222,00 | N | 0,00 |

| Malting barley – Spring | Specifications | Due date | euro/t | | Variation |

| Fob Creil | Planet 11.5% max Port 500 t Harvest 2024 | Jan-June | 238,00 | N | 0,00 |

Quotations of milling products from December 10, 2024

| Its fine soft wheat | Specifications | Due date | euro/t | | Variation |

| Departure from Ile-de-France | | available. | 139,00-141,00 | T | |

| | pellets | available. | 151,00-153,00 | T | |

| Half-white remolding | Specifications | Due date | euro/t | | Variation |

| Departure from Ile-de-France | | available. | 169,00-171,00 | T | |

| Low flour | Specifications | Due date | euro/t | | Variation |

| Departure from Ile-de-France | | available. | 169,00-171,00 | T | |

Commercial quotes for dairy products from December 12, 2024

| Milk powder | Specifications | Due date | euro/t | | Variation |

| | NBPL departure at 30 days 5% H BT bulk | available. | 2520,00 | T | |

| Whey powder | Specifications | Due date | euro/t | | Variation |

| | NBPL departure at 30 days, BILA pH 6 bulk | available. | 865,00 | T | |

Dollar/euro evolution of December 13, 2024

| Devise | Closing value |

| 1 dollar US | 0,9508 euro |

| 1 euro | 1,0518 dollar |

Chicago Futures Market Closes December 13, 2024

| Raw materials | Fence | Chicago |

| Wheat | 552,25 | cents/wood. |

| But | 442,00 | cents/wood. |

| Ethanol | 2,161 | $/gallon |

Closing of the Euronext futures market on December 13, 2024

| Milling wheat (Euronext) |

| Echéance | Fence |

| Mars 2025 | 229,50 |

| May 2025 | 233,25 |

| Sept. 2025 | 223,00 |

| Volume | 49332 |

| Corn (Euronext) |

| Echéance | Fence |

| Mars 2025 | 206,75 |

| June 2025 | 213,75 |

| August 2025 | 217,50 |

| Volume | 2950 |

International market quotes from December 13, 2024

| Energy | Echéance | Closing value |

| Oil (Nymex) | Jan. 2025 | 71,29 $ |

| Ocean freight indices | from December 13 | Variation |

| Baltic Dry Index (BDI) | 1051 | -4,00 |

| Baltic Panamax Index (BPI) | 995 | -26,00 |

| Baltic Capesize Index (BCI) | 1263 | 11,00 |

| Baltic Supramax Index (BSI) | 959 | -2,00 |

| Baltic Handysize Index (BHSI) | 618 | -8,00 |